As a first generation and low income student, pursuing higher education was a barrier in more ways than one. My biggest fear was drowning in debt for the rest of my life, knowing that I had to put myself through my entire college career. Like many others in my situation, I had to be smart and most of all - realistic - about my financial circumstances as I took my first important steps down an unknown and uncertain path. I decided to attend community college. Thanks to this decision, I am one of the few that can proudly say I am free from student debt.

Community college is a smart move

Community college is not a second class education. It’s a first class opportunity. Many people underestimate community college but thanks to it I have $0 in debt. When I enrolled in junior college I took my lower division prerequisites that were needed to transfer to universities and it saved me a fortune.

I had to endure uncomfortable questions and silent judgements while attending community college because of the stigma that came along with it. People make comments such as “community college is a joke.” It’s discouraging to me (although not surprising) that people believe statements like these. Everyone’s story is different and we don’t all have the same opportunities or privileges. No one chooses the circumstance they are born into. I chose to enroll into community college with hope. Hope to transfer, hope to be free from debt, and hope to better my life. This hope soon turned into reality when I got accepted to UC Berkeley. Today I receive a world class education among the brightest in the world with $0 in student debt.

Not only was the tuition of$46 dollars a unit what saved me from debt but also the unique financial opportunities. My community college had a scholarship office with many different scholarships available for community college students only. This meant the chances of winning were much higher. These scholarships were only offered to students who were transferring into a 4 year institution and designed specifically to support you when you transfer for the rest of your undergraduate career. I applied to 10 different scholarships and won 4 of them. These scholarships are used to pay my tuition at UC Berkeley leaving me free from debt. Although I was skeptical about enrolling in community college I am forever happy with my decision and wouldn’t take it back for the world. I left community college with scholarships, an associate's degree, and $0 in student debt.

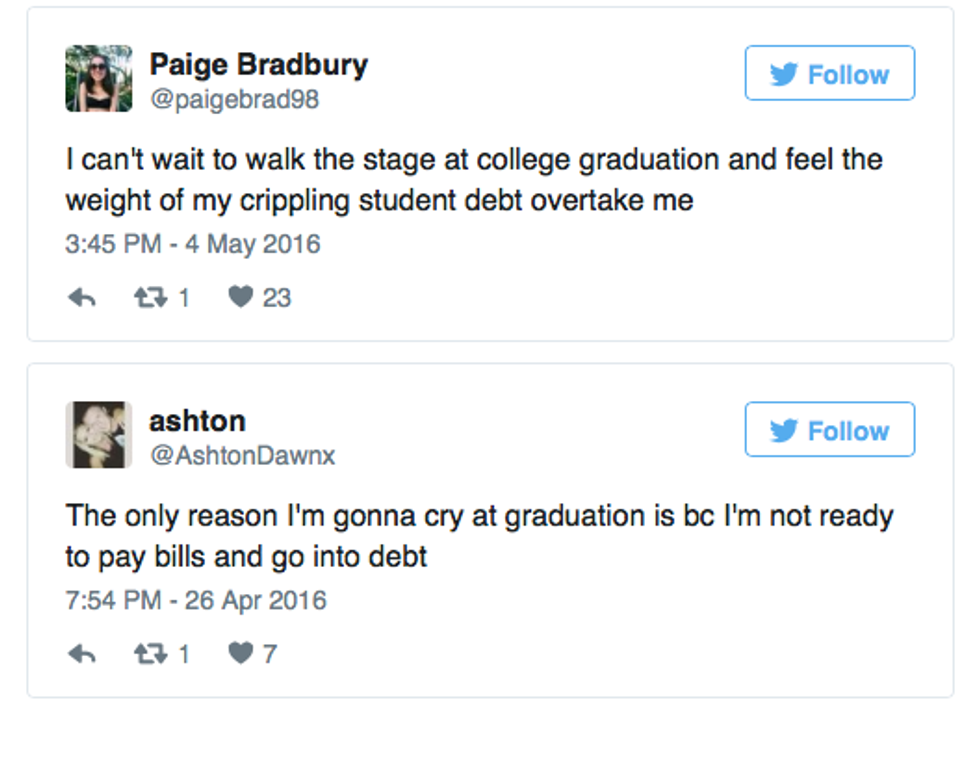

The struggle is real for millennials

Student financial aid expert Mark Kantrowitz recently calculated that students in the class of 2016 are set to have the highest level of debt yet, at $37,172. Making it come out to a total of $1.2 trillion in student loan debt. Students have taken Twitter to mourn over their debt and how they don’t look forward to dealing with this burden.

This debt crisis makes a lasting impact on students lives. Studies show that students who graduate with debt are 10% more likely to say that it causes delays in major live events such as: buying a home, getting married, and having children. Indeed, this is a crisis and it is frightening as millennials are in fact delaying adulthood.

Thanks to community college I don’t have to deal with this dilemma. Ever since transferring to UC Berkeley with four scholarships I am able to focus on my grades, internships, and extracurricular activities. College isn’t only about academics. What you learn outside of the classroom gives you a cultural and enriching experience. However, due to debt some students do not have the opportunity to gain hands on experience such as: interning, taking a leadership role, or getting involved on campus. They are condemned to paying bills and they miss out on opportunities such as creating a vital network and the developing skills, which ultimately delays them from finding jobs after graduation.

Advice I have for students to avoid debt

1. Consider community college: Community college shouldn’t been seen as an understatement. It’s a smart choice especially if you’re dealing with financial difficulties. Keep in the mind that the school does not define the student. It is up to YOU to be successful. Having an Ivy league education does not mean you’re going to have a better job than someone who attends community college and transfers to public universities like Berkeley, Davis, or Los Angeles.Success comes to those who work hard and take advantage of opportunities. How are you going to take advantage of opportunities if you can't afford to? Even if you decide to go the four-year route, I would suggest taking summer courses at community college to get rid of those lower division prerequisites. Not only does this allow you to save thousands of dollars but it might help you graduate early!

2. Apply to A LOT of scholarships: I can’t emphasize on this enough. There are millions of scholarships out there waiting for students. Take advantage of these opportunities. Sure it takes time and effort but it’s worth it in the long run because it saves you from debt. I never thought I would win any of the scholarships I applied to and I ended up winning four! Also, once you're in a four-year institution there are many opportunities for scholarships as well. If you’re a member of a fraternity or sorority, they offer scholarships to members of the chapter making your chances of winning higher. Try to look for scholarships that are less competitive such as nationwide because you’re competing with people from all over the world. Focus on the scholarships that are affiliated with your college and make sure you meet the qualifications, this will give you a higher chance of winning.

3. Take advantage of your school's resources: Make sure you know what your college has to offer. Going to a university like UC Berkeley, sometimes I feel like a small fish in a huge pond. I never knew all the free things that were available to students such as the food pantry. UC Berkeley’s food pantry is an emergency relief food supply for ALL UC Berkeley undergraduate and graduate students. Students can visit the pantry twice per month, each visit provides supplemental nutrition for 8-10 days. If you’re struggling financially take advantage of these resources that your University provides. Believe it or not, free food twice a month can make the biggest difference and it will save you a lot of money.

4. Have a game plan: Make sure you know what you want to study. It’s okay to change your mind but make sure you prepare yourself because not only does it waste time. It wastes MONEY. Have a game plan and make sure you don’t only consider the prestige of the school if you are facing financial difficulties. It is not worth having to carry the debt after graduation. Remember the school does NOT define the student. Be strategic in your game plan. Sometimes we get carried away with the excitement of college and forget everything else. However, debt is real and you’re making an investment in the next four years of your life. Therefore, you must think ahead and have a game plan before taking out a $28,000 loan.

Parting Thoughts

College is a serious sacrifice, an investment, and it determines the rest of your life. The student debt crisis is real and is it affecting the millennial generation. With presidential elections coming this November we don’t know where the future of higher education is going. When you make the big decision of where you want to spend the next four years of your life. Please keep in mind that just because it is an Ivy league school doesn’t mean you are going to get a better job. Consider your options because college is expensive and if you’re facing financial difficulties, the debt is simply not worth it.