In this day in time it is critical for one to shine a spotlight on those individuals who exemplify integrity, and whose moral and legal principles cannot be purchased. It was just announced this morning that an ex whistle blower who worked in risk analysis for Deutsche Bank during the financial crisis has rejected a $16.5 million reward from the SEC for his role in exposing fraudulent behavior within Deutsche Bank. In order to clarify the order of events on the matter let us start with the beginning. Like many large investment banks, during the crisis Deutsche had poor performing credit derivatives on their balance sheet, and for fear of bankruptcy they falsified the value of these assets to their shareholders and market participants. Some examples of a credit derivative include credit default swaps and collateralized debt obligations. These are essentially value producing financial securities that trade on domestic and foreign exchanges. They act as insurance policies against loan portfolios that have the potential to default (ex: mortgages, possibly student loans etc). In this case they were mortgage backed securities. These credit derivatives once gave high returns, however, with the financial crisis and the general recognition of the toxic nature of mortgage loans, the value of these securities plummeted and Deutsche panicked. As a result they inflated the value of these securities on their books by $3.3 billion in order to avoid a potential bailout. In 2012, two whistle blowers, one by the name of Eric Ben-Artzi, called attention to this fraudulent behavior. As a result there was an investigation by the SEC, however coincidentally, Deutsche's top lawyers had been vacillating in and out of positions at the SEC and also within Deutsche Bank. Naturally a conflict of interest and corrupt interpretation of legal precedent ensued as a result. Ultimately the bank was fined $55 million for their illegal activity, no one went to jail, and none of the managers who benefited from inflated portfolios lost any personal funds, whereas the shareholders were the ones to actually pay for the mistakes. It was just announced today that Eric has declined his $16.5 million compensation from Congress upon principle and to protest the corruption behind the punishment to Deutsche Bank. He did write a letter

stating his position.A Whistle Blower Calls Corruption At Deutsche

A principled individual sheds light on legal corruption.

Subscribe to our

Newsletter

Advice To Live By As Told By Bob's Burgers

The Belchers hold the key to a better life.

Bob's Burgers is arguably one of the best and most well-written shows on tv today. That, and it's just plain hilarious. From Louise's crazy antics to Tina's deadpan self-confidence, whether they are planning ways to take over school or craft better burgers, the Belchers know how to have fun. They may not be anywhere close to organized or put together, but they do offer up some wise words once and awhile.

1. "I'm no hero. I put my bra on one boob at a time like everyone else."

Tina reminds us that we are all merely human.

2. "If you believe you're beautiful, you will be."

But sometimes self-confidence is difficult to maintain. That's why it's important to have people are who remind you how wonderful you are.

3. Family is always there for a good bedroom dance party.

4. Or even a kitchen dance party. As long as you're together and having fun, it will all be alright.

5. Embrace love. Embrace having crushes.

6. And get creative with how you express your love.

7. It's OK to feel overwhelmed by life. It gets us all down sometimes

8. Linda knows how to live.

9. You don't have to know everything about something to enjoy it.

Especially wine

10. Rock your own look. Even if you seem ridiculous, you are being you.

11. Honesty is often the best policy, especially if you want flawless skin.

12. Don't let anyone keep you from celebrating to the fullest.

Eat all the cake.

13. No matter what, the Belchers always seem to be having a good time. So appreciate those around you and just keep groovin'.

8 Things That Make You Feel Like You Have Your Life Together

because none of us actually do have it all together

We're in college, none of us actually have anything together. In fact, not having anything together is one of our biggest stressors. However, there's a few little things that we do ever so often that actually make us feel like we have our lives together.

1. Making yourself dinner

And no this does not include ramen or Annie's Mac & Cheese. Making a decent meal for yourself is one of the most adult things you can do living on campus. And the food is much better than it would be at the dining hall.

2. Wearing real clothes to class

You didn't wear sweatpants? CONGRATS!

3. Steering clear of procrastination

It's really tricky to avoid procrastination when you have 20 assignments to do because all of your professors put their deadlines in the same week. But when you somehow accomplish this sorcery you feel like a boss ass bitch.

4. Doing your laundry

There's no better feeling than having clean clothes in your closet. Try to do your laundry before it all piles up and you're stuck struggling to find enough washers open to fit all of your clothes in.

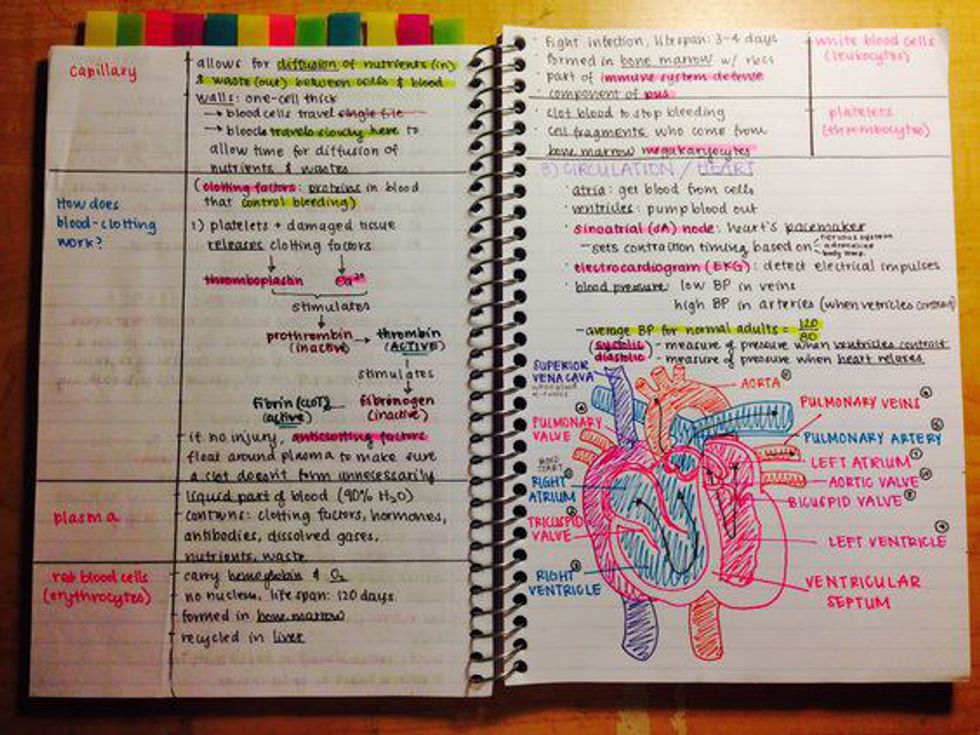

5. Keeping your notes organized

Nothing makes me happier than being able to clearly follow my notes after class. Your notes may not look quite like this beauty, but it's worth a shot!

6. Cleaning your room

Your bed is made, your sheets are clean, you vacuumed your floor. What is this magical world we have entered and can I stay here forever. It's a lot easier to have everything else in your life together when you wake up to this.

7. Going to the gym

The gym is (sorta) free right now, so you really should take advantage of it while you can. Exercise is awesome for you both physically and mentally.

8. Actually doing well in school

Success! You've actually done something that will benefit you in the future. Go you! It takes a lot of dedication and work, but your GPA will thank you kindly!

I think the hardest thing about going away to college is figuring out how to become an adult. Leaving a household where your parents took care of literally everything (thanks, Mom!) and suddenly becoming your own boss is overwhelming. I feel like I'm doing a pretty good job of being a grown-up, but once in awhile I do something that really makes me feel like I'm #adulting. Twenty-somethings know what I'm talking about.

1. Taking care of yourself when you're sick

When I was younger, my mom took such good of me if I got sick. Now, if I puke, I have to clean it up. Gross. I also have to make my own chicken noodle soup. I wish my mom could take of me forever.

2. Making a to-do list

To-do lists are so mom-ish, but I thrive off of them. Plus, they make me feel accomplished as heck.

3. Planning your activities around the weather

It never fails to make me feel old when I say, "There's a chance of snow on Thursday. How about we do Friday instead?"

4. Scheduling your own doctor’s appointments

Most twenty-somethings fear talking on the phone, myself included. I draw the line at going to the doctor alone, though.

5. Getting your own toilet paper

Nothing makes me feel like I'm officially #adulting like picking up a giant pack of toilet paper at Target...or smuggling some rolls in my backpack.

6. Making food without needing to ask your mom questions

"Yeah, Mom? Can you use canola oil instead of vegetable oil? Okay, thanks."..."Hey Mom, me again. This recipe wants two cups of sugar, but I only have one and a half. Should I just try it anyways?"

7. Holding your tongue

In high school, I was a lot more willing to comment on racist Facebook statuses and sexist Tweets. Now, I'd rather just avoid the conflict. It isn't worth it.

8. Saving your paycheck (or your tax refund) to pay your bills

I was excited to get money back from my tax refund, but it all went right back into my bank account. When you're 20 years old, responsibilities come before shopping sprees, unfortunately.

9. Balancing your checkbook

Do people in their twenties write checks, or is it just me? There's something so satisfying about getting a sum in your checkbook that equals the sum on your bank account.

10. Going places alone

In high school, I didn't do anything alone. Now, I enjoy my solitude a little more. I walk to class alone and eat lunch by myself. It makes me appreciate my friends so much more!

11. Packing your own lunches

I miss the days where my mom made my lunches for me. Now I just make a sandwich and wish someone had cut the crust off.

12. Actually eating your vegetables...on purpose

I never thought my fridge would have carrots, broccoli and celery in it. I still don't really like raw vegetables, but I know they're good for me, so I force myself to eat them.

13. Taking a multivitamin

I've got to make sure I'm getting all my vitamins so I can stay healthy. That way I don't have to call the doctor!

14. Planning a life after graduation

Resumes, cover letters and job applications are the worst part of #adulting because they remind me that, someday, I will be a full-time adult. Scary.

8 Things That Anyone Who Went To A Small School Knows

Sometimes bigger isn't always better.

I went to a small high school, like 120-people-in-my-graduating-class small. It definitely had some good and some bad, and if you also went to a small high school, I’m sure you’ll relate to the things that I went through.

1. If something happens, everyone knows about it

Who hooked up with whom at the party? Yeah, heard about that an hour after it happened. You failed a test? Sorry, saw on Twitter last period. Facebook fight or, God forbid, real fight? It was on half the class’ Snapchat story half an hour ago. No matter what you do, someone will know about it.

2. Never getting to be invisible

I like to stand out, but even I sometimes wish I could just blend in. Whether it be a bad hair day, or a sick day, or just a day where you don’t want to talk to anyone, there are some times when you just want to be another face in the crowd so you don’t have to deal with anyone. You do not get this luxury at a small school. If your hair looks bad or your jeans have a hole in them, you feel like everyone is staring at you. If you’re in a bad mood, someone will still say hi to you in the hallway and you still have to smile and wave back, because they will notice if you don’t. Standing out can be a good thing, but never getting the protection of a crowd sometimes really sucks.

3. Knowing every single thing about every single person in the town

You’ve gone to school with most of these people since you were eight years old (or younger), so you know everything. You could tell me the name of someone in my grade, and I could probably tell you what they want to study, what side of town they live on, if they have any siblings, and where they’re going to college.

4. New kids are a big deal

Most new kid stories are that they felt forgotten and lost in such a big, scary school. Not in small schools! Every couple years when there was a new kid, everyone would want to talk to them, because we had been stuck talking to the same people for the last 12 years of our lives!

5. It’s hard to make new friends

Your friend pool is so small that having more than 5 close friends is a rarity for most people. Once you weed out the mean people, the annoying people, the people you don’t really click with, and the people who have no interest in you, you’re down to a low number of potential best friends.

6. On that note ... the dating pool is even smaller!

Most people’s boyfriends come from out of town, because who wants to date the kid who knew you when you had braces or the girl who saw you pee your pants in 1st grade? Better to find someone who can know you for the person you are now and not the acne-covered tween you were then!

7. Teachers are weirdly close to their students

Not in a bad way, but I know a lot of people at my school who are really close to one teacher or another. Whether it's the advisor to a club or the teacher of your favorite subject, odds are that every student in a small school has a teacher that they can go to for anything.

8. It forced you to make friends out of school

Because your school was so small, you knew that going out of town was your only hope to make more than two friends! This forced you to get out of your comfort zone and find new people to hang out with, who might have later turned into your best friends.

10 Times We All Related To Chandler Bing On A Spiritual Level

"I'm hopeless and awkward and desperate for love"

I'm assuming that we've all heard of the hit 90's TV series, Friends, right? Who hasn't? Admittedly, I had pretty low expectations when I first started binge watching the show on Netflix, but I quickly became addicted.

Without a doubt, Chandler Bing is the most relatable character, and there isn't an episode where I don't find myself thinking, Yup, Iam definitely the Chandler of my friend group.

Here are 10 Chandler moments that made us all see the "Chan Chan Man" within all of us.

I mean, besides this obvious one:

1. That Time He Tested Out His Flirting Skills and This Happened

2. When He Was Willing to Do Anything to Avoid Confrontation

3. When He Couldn't Handle Awkward, Emotional Situations

But, hey, at least he owns up to it!

4. How He Reacted Whenever His Friends Ignored Him

5. All of the Times He Worried About His Failing Love Life

6. Whenever He Tried to Whip Himself Into Shape

He tried really hard.

7. How He Handled New People and New Experiences

8. Whenever His Friends Got Annoying, He Was Always the Voice of Reason

9. He Always Knew How to Jam

10. He Finds a Way to Make Any Situation More Fun

Sure, he may be awkward and desperate for love, but if you're the Chandler of the group, your flaws just make you even more adorable!