What is the perfect tax rate? Most people won't give you a quantifiable answer, just a vague statement that fits their political beliefs. Something along the lines of the rich not paying their "fair share," especially if they don't understand economics.

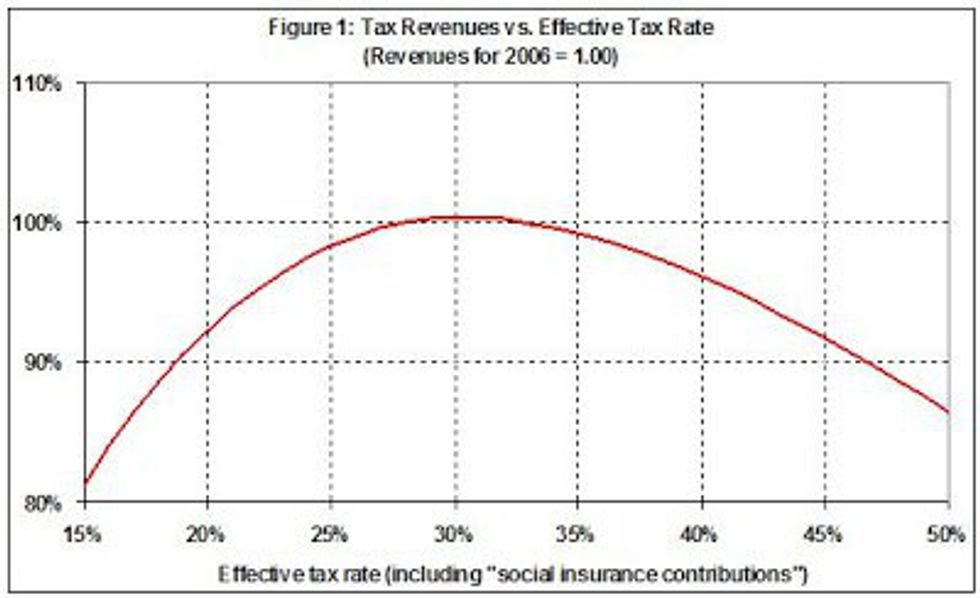

Thankfully, this question has a relatively simple answer, and all of the credit is due to one of Barack Obama's economic advisers. Dr. Christina Romer, an economics professor at the University of California Berkley, published a study pertaining to a common economic model known as the Laffer Curve. The Laffer curve is a parabolic equation that shows precisely what tax rate maximizes the tax revenue of the United States government, and stimulates maximal economic growth at the same time. The apex of the curve is right at 33 percent.

As you can tell by the graph above any tax rate above 33 percent lowers revenue. According to Romer each 1 percent tax increase above 33 percent lowers a country's gross domestic product (GDP) by as much as 3 percent. This study was published in the "American Economic Review," a peer reviewed journal widely considered to be the most rigorously scrutinized journal in the field of economics.

For the sake of simplicity, the curve only considers Federal taxes since state taxes can vary greatly. In reality, state taxes must be added to the overall tax rate in forty-four of the fifty states. State taxes can be as high as 13.3 percent in California.

If our entire nation had state taxes this high then our GDP would drop about forty percent. No matter what you consider to be an individuals "fair share" increasing taxes above 33 percent is detrimental to our country as it substantially shrinks our economy .

A majority of our GDP comes from wealthy individuals who own large businesses and drive most of our country's economy. When their businesses are taxed they have less capital to grow their companies, stimulate our economy, and create jobs.

The current progressive tax system works quite well until we reach the top earners. Most people cannot afford to pay taxes at 33 percent. Lower taxes for lower earners makes sense, but outrageous taxes for high earners hurts everyone.

Next time you hear about the "The One Percent" think of their businesses that employ millions of Americans and allow our economy to prosper. Instead of jealousy or contempt try to imitate the success of these "Captains of Industry" who power our economy. Owners and operators of large business cannot grow their businesses and in turn our economy if the profits of these businesses is almost halfway gone before they or their shareholders get paid.