The cat’s out of the bag…or so The New York Times alleges. In last week’s presidential debate, Hillary Clinton claimed that Donald Trump hadn’t released his taxes for a variety of reasons, including that “maybe…[Trump] ha[sn’t] paid any federal income tax for a lot of years.” Trump raised eyebrows when he simply cut off Clinton and stated, “That makes me smart.” Well, it now appears that this exact reality could have been confirmed by The Times.

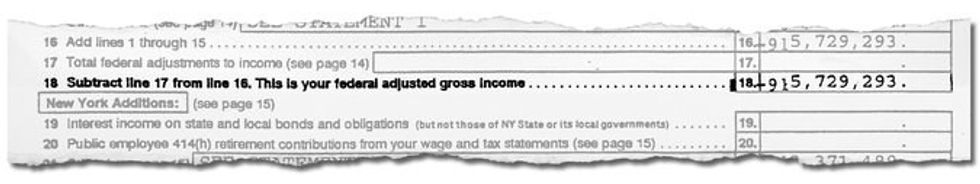

Trump's 1995 tax returns, obtained by The New York Times.

Donald Trump’s 1995 tax returns have apparently been obtained by The Times. The records suggest that, after poor management of casinos and failed purchases in the airline industry and of the Plaza Hotel in Manhattan in the early 1990s, Trump declared a windfall tax deduction of $916 million. This amount is so large that The Times’ tax experts found that it could be used to “cancel out an equivalent amount over an 18-year period.” Thus, in effect, Trump created $916 million for himself in 1995 by manipulating tax laws into denying the government 18 years’ worth of taxes. The Trump campaign’s response? “Mr. Trump knows the tax code far better than anyone who has ever run for President and he is the only one that knows how to fix it.” So, this entire allegation might very well be true. And the GOP’s response to it reeks highly of hypocrisy.

Warren Buffett in 2011 propelled himself to the national stage by claiming that his secretary paid more in taxes than he did. After repeatedly calling for increased taxes on the wealthy and the introduction of so-called “Buffett Rules” to tax legislation, Buffett found himself a prime target for Republican scrutiny. In one such spectacle, his company, Berkshire Hathaway, helped to finance a major tax inversion for Burger King. In this case, under Buffett’s advice, Burger King merged with Canadian donut chain Tim Hortons, and because of tax inversion laws in the U.S., was able to relocate its tax base into Canada. To be certain, this was deemed by both parties to be highly unpatriotic, as man who is championing “fair” tax rules for all just depleted the U.S. treasury of millions in tax revenue by sending a multinational company’s headquarters outside of the country. However, this “economic patriotism” that both the GOP and Democrats championed (albeit briefly) in admonishment of Buffett apparently does not transition to Donald Trump.

In the 2016 election season, defying federal taxes (so long as it’s a member of the GOP that does it) has suddenly become an admirable trait. To quote Mayor Rudy Giuliani on The Times’ Trump revelation, “The man’s a genius. He knows how to operate the tax code for the people that he’s serving.” Then, Governor Chris Christie, ever the Trump lapdog, proclaimed, “There’s no one who’s shown more genius in their way to maneuver around the tax code.” What the heck? Since when do we openly praise people who evade the tax code? Sure, Trump is probably adept at avoiding taxes. But what happened to the arguments against Buffett’s tax evasion on supporting our men and women in uniform? Our social services? What better way to support them then to literally financially contribute nothing at all…especially given the traditional Republican commitment toward supporting the armed services. So, apparently we’re supposed to vote for somebody that will fix our tax system because he personally knows how to pay nothing into it. Sounds like a fail-proof strategy if you ask me!