In the current mode of economic thinking, the major debate is between trickle up economics and trickle down economics, whose outcome will shape how our economy develops in the near future and may even address the underlying problems of the American economy--I alluded to in my 2017 economic outlook--such as diversification of labor and the growing crisis of inequality and the savings multiplier.

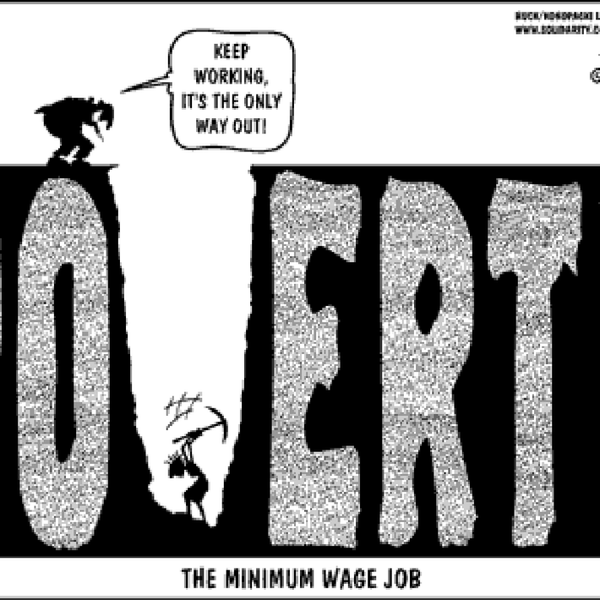

To begin, let's first take a look at what these two modes of economic thinking entail. Trickle-down economics, otherwise known as supply-side economics, is most commonly attributed to Reaganomics. The basic principle behind this system is that more money and tax breaks are given to the rich and therefore the money will flow to the bottom echelons of the economy. In theory, this sounds plausible given the way market forces operate and the nature of capitalism itself. History has, however, shown that its implementation has been flawed. More money went to the top echelons and stayed there rather than trickling to the bottom. This is primarily because of something called the propensity to save and consume. In economics, the propensity to consume is the amount of a person's disposable income they are likely to spend in the economy. Usually an average is taken, but there is a stark difference between that of the wealthiest Americans and the average of those at lower income levels. Those with less disposable income have a higher propensity to consume or spend and a lower propensity to save, meaning that the spending multiplier, or rather the rate at which the economy grows via spending, is greater in the lower levels than the higher incomes. Those who receive higher incomes save a greater portion of their income than spend it.

On the contrary, trickle-up economics is based on the principle of giving more tax breaks and compensation to those at the lower income levels, thereby bringing an increase in income to the upper levels as well. This would be in the form of subsidies, tax credits for small businesses and other means. It would also promote local job growth and development and reduce the dependence on large-scale corporations to create jobs. It might even reduce the influence of large-scale corporations in Congress by reducing their importance in the economy. Those at the top, however, do not lose in real economic terms while those at the bottom simultaneously gain and spend. More money will be spent and put into circulation, thereby greatly increasing the spending multiplier effect. This method would also significantly reduce inequality in the US, which would increase economic growth both on paper and off the record.

Although trickle-down economics would work well with proper implementation, our current legal system is ill-equipped to handle it. Trickle-down economics failed because of the propensity of those with higher incomes to save. In order for it to work; we, therefore, would need to legally compel the wealthy to spend more on investment and the lower classes. Instead of facing that legal battle, it would be more efficient to focus on trickle-up economics because the market forces governing propensity to spend and consume are much easier to work with at that level.