The subprime crisis of 2007 and 2008 is often debated as the most crippling disaster the economy has ever seen. While this argument is fair and valid, it is incomplete and as such must be compared with the holy grail of macroeconomic thinking, the Great Depression. The two instances have many similarities and differences as far as crises go and it is worth looking at them both to understand the severity of these crises.

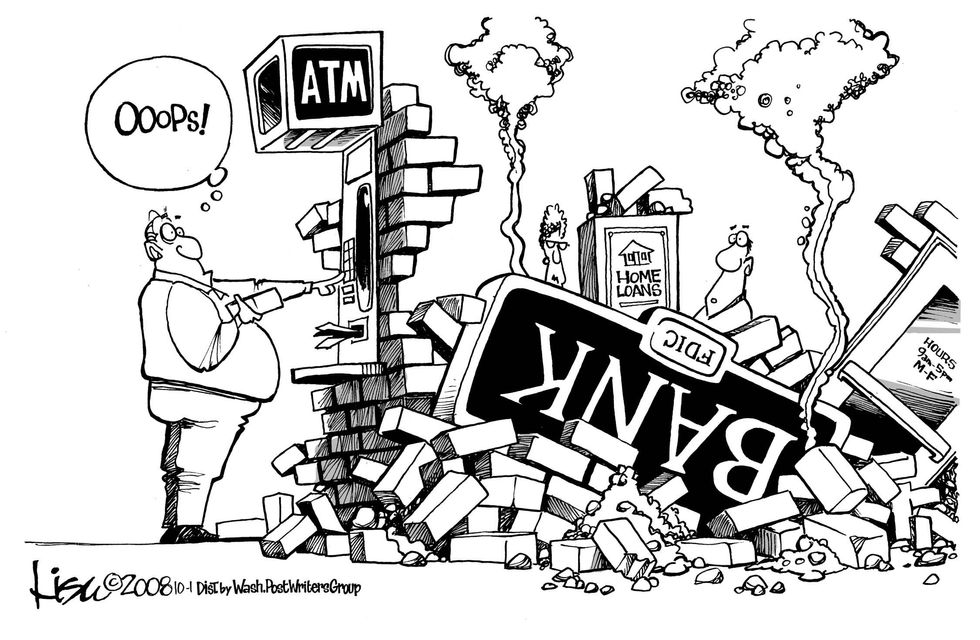

To begin, the biggest striking similarity between the two crises is that they began ultimately as banking panics. The original shocks to the system were different, however, they were both caused by speculative bubbles in different markets that created a shock in the system that drove a run on banks. The information asymmetries resulting from this shock as to which banks held which assets and to which banks were exposed to these assets led to a run on all of the banks in the system. This created a banking crisis that quickly evolved into a financial crisis. The onset of the crises began because banks did not have enough liquid assets in order to cover the depositors' money.

This similarity leads to one of the key differences that arguably kept the 2008 crisis from becoming a Great Depression: the monetary policy under the Federal Reserve. The Great Depression was marked by hesitation from a heavily restricted Federal Reserve in injecting liquidity into illiquid banks to keep them from failing and to keep the economy stable. However, in the 2008 crisis, the Federal Reserve was not infringed upon by the gold standard and was able to intervene easily to save illiquid banks, which is what prevented another Depression scale event from happening.

One overlooked similarity between the two crises is the fact that there was significant shadow banking involved in both. Shadow banking simply means that there is a lot of financial transactions occurring through a market or platform that is severely unregulated. As a result, this unregulated market created problems for the financial system in aggressive risk-taking and adverse leverage ratios. Shadow banking was prevalent in the 2008 crisis and contrary to popular belief was also involved in the Panic of 1929. Shadow banking has been around for so long that it caused another financial crisis in Amsterdam in 1776.

One key difference between the two banking crises was the environment of banking itself. In the Great Depression banking was standard in that a bank would wait until a loan matured and collected the money form that loan. In the years prior to the 2007-2008 crisis, banks underwent a policy of "originate and distribute" where they packaged loans (in this case mortgages) into securities and sold them off. This environment was much different than before as it exposed more parties to risk.

The financial crisis and the Great Depression both have very pertinent similarities and differences. At the end of the day no crisis is exactly the same, however these similarities are what is key to helping us understand how to mitigate and prevent future crises.