If you attend college, or even if you don't, chances are you know that tuition rates are constantly rising. It's no longer probable to save up for a few years, work a part time job, and be able to make it out of college debt-free. Now, over 70% of college students take out some sort of student loan, and the national student debt is up to $1.3 trillion. Students know that education is a big investment, but with the current price it is, many are wondering if it's possible to pay.

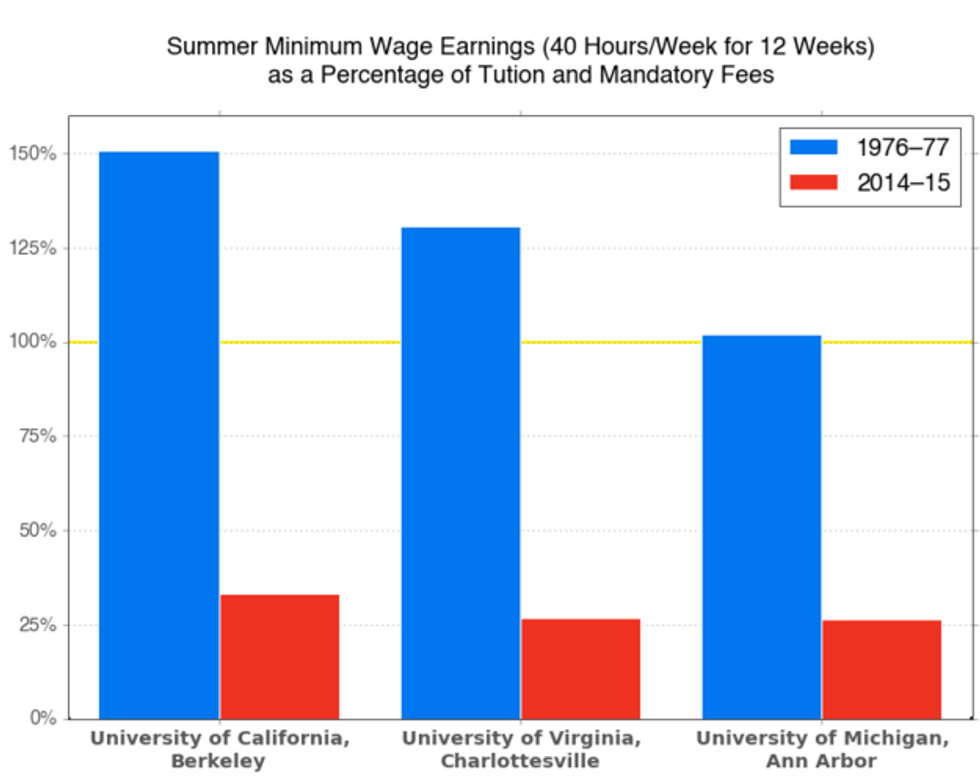

It used to be possible to pay for college without taking out loans. But because tuition rates have risen exponentially within the past 50 years, it takes more than working a few summers. This chart shows that working an average summer at minimum wage could pay for over 100% of the tuition and fees at these three colleges.

Compared to the statistics from 1976-1977, working an average summer at minimum wage nowadays could pay for about 20-25% of what it could pay for 30 years ago, depending on the college. To pay for college, it used to take some hard work and saving up. Now it takes some hard work, saving up, and 5x the hard work.

On top of the rising tuition rates, students can get stuck in debt that has the potential to follow them far into the future. While corporations can file for bankruptcy, students do not have that option. And our government is profiting off of the debt of college students. The federal government made $50 billion off of student loans in 2013 alone. (Huffingon Post)

In our more competitive job market, the demand of a college degree has gone up, raising the price of college and making it more difficult to obtain. And now many students think that a bachelor's degree just isn't enough. The student debt of graduate students has recently skyrocketed. Graduate students make up about 14% of college students, but now almost 40% of the student debt.

The side effects of the rising tuition rates and student debt can have detrimental consequences on college students and graduates. And with the increasing trend of graduate students with debt, it has the possibility to follow people well into their careers and further in life. Research shows that on average, it takes someone 21 years to pay off loans from a bachelor's degree alone. Recently, some have the proposed the increase of minimum wage, but I am skeptical in thinking whether that would help, or only raise tuition rates as an effect. Whatever the solution may be, it seems that something must be done in order to help students who cannot pay for college without student loans.