"My parents made just enough money to disqualify me for financial aid, but not enough to help me pay for college."

"My parents made just enough money to disqualify me for financial aid, but not enough to help me pay for college."

Bloomberg Business reports that there has been a 1200 percent increase in college tuition in the past 3 decades, and it is steadily rising. With the already high tuition prices increasing as fast as they are, millennial students are struggling to stay in school and make ends meet.

New York University is experiencing a lot of heat after the Faculty Against the Sexton Plan protest when an anonymous student "Mandy" came forward and admitted to selling her body to afford the rising tuition prices. Although prostitution may be the most extreme case, how are other college students managing to afford tuition? And under what circumstances?

"As a first generation college student, I was determined not to let my circumstances prevent me from continuing my education. I didn't care what the cost was." -"Mandy", New York University

Tuition prices are rising and incomes are decreasing, college degrees are becoming out of reach for many. Studies show that with the increase in tuition there is a decrease in enrollment and graduation times, while an increase in students suffering academically, and an increase in the drop-out rate. Students are dropping out, transferring, and changing their majors just to save some extra money on their tuition bill. Students are working multiple jobs and taking out high- interest loans to help pay for their college. Many are entirely unable to start paying on their loan interest now, or they are going to extreme circumstances just to make that monthly payment.

"I went from 1 job sophomore year, to 2 jobs junior year, to 3 jobs senior year. I thought I could do it but I'm already finding it difficult to balance everything. Most days I don't get done until between 8:30-10pm and the only day I have off between my jobs and my full course load is Sunday which I spend doing homework and catching up on sleep." -Anna F., Montclair State University

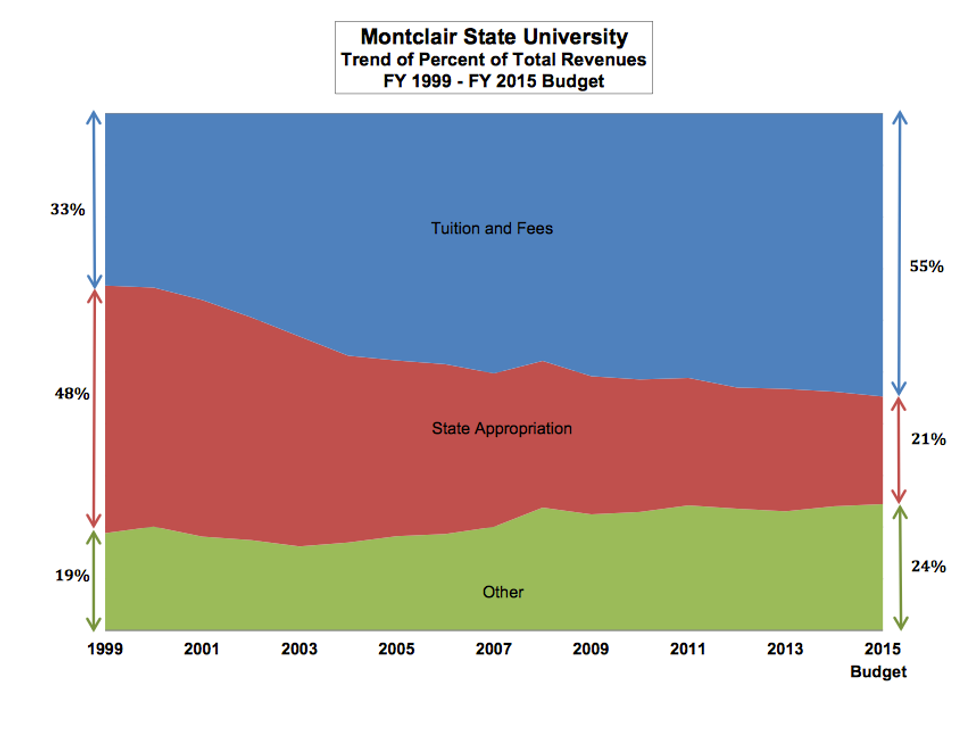

Montclair State University is a New Jersey senior public school, which receives funding from the state. Tuition at MSU is just under $12,000 a year for a full time undergraduate student. This price tag however does not include housing, a meal plan, textbooks, transportation, health insurance, and additional fees for special classes. Most students at MSU are paying more like $22,000 a year, most of which are funded through high interest loans. Even at one of the cheapest universities in the state, students are still struggling to pay on tuition, especially with the 5% increase each year. Enrollment in public NJ colleges has increased by 20%, but funding to these schools from the state has decreased by $37 million since the year 2006. If the enrollment rates are increasing at these institutions, then why is the funding on a steady decline? Each year less financial aid is awarded and less funding received from the state. Students and parents have had to take on the burden of paying that deficit via their tuition and fees.

"Working three jobs was a killer, but a girls gotta do what a girls gotta do when it's just her...there's times where people are all getting together and I wish I could just take off or not care about my job, or even take a day off! But I know if I do then it's going to affect my way through college...I had to take the semester off to work full time and be able to pay for school since I received less financial aid this year." -Jules S., Montclair State University

Looking at the spending for the past fiscal years, Montclair State University has experienced a huge increase in revenue from tuition and fees, while a decrease in state appropriation. As long as the state continues to cut spending on public state schools, and the universities continue to increase their spending, students are going to have to continue writing bigger checks each year.

"Every paycheck I get from now on is going toward my loans." -Briana H., Montclair State University

"If over the past three decades car prices had gone up as fast as tuition, the average new car would cost more than $80,000."

- The Real Reason College Tuition Costs So Much

Montclair State University experiences a 5% tuition increase each year, next year the tuition will be raised by at least $600. If a student takes 4 years to graduate on time (from the years 2015-2019) they can expect to see an increase in at least $2,500 from their freshman year to their senior year. This amount can really effect students who are paying their way through school, or who can only receive a minimal amount of financial aid. Each year students have to either find more ways to get financial aid, or they have to rework their budget to make up for that 5% increase. $600 for a struggling college student is a lot. $600 is a commuter parking pass for two years, a few text books, a few months of groceries, and endless school supplies.

"What people don't realize, especially when it comes to living in the city, is that it's so expensive. The average studio apartment is about $1400 per month with out utilities, $250 for food, and $200 for transportation. With a job that pays $15 an hour, which you're lucky if you find one, that leaves you working full time with no time to go out with your friends, let alone time to study." - Madeline L., Pace University

Montclair State University is not the only school experiencing a rise in tuition, in fact most schools are. New York University raises tuition by about 3% each year, and with tuition already above $60,000, that could mean a $2,000 increase next year. Most incoming freshmen are totally unaware that the tuition they are paying their first year is free to change at any point, and in fact it will. Riots, protests, and petitions are in place to combat the unfair price hike, but what choices do these schools have when they themselves are experiencing cuts?

"If tuition hiked for me at my master's program, I would need to find a new apartment and would struggle to buy food. For me, 600$ is more than two months of groceries. As a struggling student, I have put off investing in a domain name for a personal site, business cards, and art supplies, which I need as an art student trying to become a working artist. My financial struggle has also prevented me from attending to my mental health. I should treat my anxiety, which triggers panic attacks and migraines with a proactive approach, like regular therapy situations, but working three jobs and going to school full time, I can't afford the luxury. My mental health prevents me from performing in school - it becomes a vicious cycle." - Abby N., Massachusetts College of Art and Design

Students from all different backgrounds at all different schools are experiencing debt due to financial aid/lack of financial aid, and all the stress that comes with it. Many students seem to be in the income gap where their family is financially stable enough to survive- but do not have the funds to send their children to school.

"I’m the second of three children to go to college my brother is only 2 years older than I am and my sister is two years younger. My parents face the huge burden of having to send us to school back to back to back. At the time [my brother] was going into his freshman year at Monmouth University my parents were just starting to get on their feet again after some financial hardship, he was eligible to receive financial aid for some of his time in school and the university was able to give him rewards for his academic success. Unfortunately for me though my parents made "too much” money by the time I was going into freshman year, I was unable to receive any financial aid even though I only made $4,000 that year. I was able to take out loans for my freshman-junior years starting at $22,000 my freshman year and increasing a few thousand every year after. The only loans I was lucky enough to get were through HESAA NJ Class Loans, and I had to begin paying the interest off right away. My junior year I took a few thousand extra in my loan just so I could use it to make my payments for my freshman and sophomore year loans. It’s crazy and will end up costing me significantly more money in the end but I had no choice, if I can’t pay every month it affects my credit. I started thinking of ways that I could make money to pay some of the loans off but almost all of my thoughts were insane. For example, I looked into selling my eggs, a very long and sometimes painful/ dangerous process, but, I could walk away with upwards of $8,000. [My brother] broke his femur and had numerous surgeries and countless prescription painkillers, he didn’t like the way they made him feel so never took any of them, my mom filled them anyway just in case the pain was too unbearable and he needed them. I seriously considered selling them and I could have easily made a few hundred if not thousand on them. I feel restricted in what I can do and it has made choosing a career path even more stressful than it should be. I have always cared about people and wanted to go into something that I could serve others, but there isn’t a whole lot of money in those fields...How am I going to pay these loans off over the next thirty years if I'm barely making minimum wage myself?" - "Jessica", Montclair State University

"When I was 17 my dad had a severe stroke (he still hasn't recovered) which forced him to retire. He went from making upwards of $130,000 a year to surviving off of $13,000 a year. I lived with my mother who had no job and my step father who made more than enough to support his children, but not me. By law I had to put his information down on my FAFSA regardless of his lack of financial support, in result my aid was cut by 60%. Since day one I've had anywhere from 1-3 jobs and any other ways I could earn a quick dollar. With the small aid I've gotten and the jobs i've held, I'm still about $40,000 in debt." -Tim M., Montclair State University

The terms in which students need to file on independent status for financial aid are extremely strict. A lot of students are experiencing family issues in which they cannot get financial aid because they don't have access to the income that their parents make. This leaves students struggling to get financial aid on their own and also it is extremely hard to get a loan as a college student without a cosigner.

"My first semester was paid for by my father, he then decided I was not worth paying for. I had to make the tough decision of quitting the [field hockey] team and taking up work full time. I was working every day of the week in the theatre just to get by. Everything so far has put me in terrible academic standing. I have a 2.51 GPA and need a 3.0 to keep my scholarship, but I also need to work to keep paying for school, and keep studying to stay in school. It is one really large circle that will kill me one day...Tuition has increased by about $2,000 and I honestly do not know where I am going to get the money." -Kera A., Goucher College

To read more about Kera's story and support her education please click here.

"$600 is my rent for the month. That's literally costing me the price of my home. That is a huge difference. I don't know how students can afford to take unpaid internships at all when I struggle as it is." -Angelica D., Montclair State University

The fact that the interest rate on a college loan is typically more than the interest rate on a mortgage for a house is absolutely frightening. The scariest part about being in college is knowing that you will graduate and go into the real world with thousands of dollars against you. Our generation is suffering from student loan debt and it is only getting worse.

NYU student Nia Mirza started a petition to lower the tuition and cost of attendance, rather than raising it. If this is happening to you at your school, please reach out to your university administration and state officials.

To sign the NYU petition please visit their Change.Org website here.

"My parents made just enough money to disqualify me for financial aid, but not enough to help me pay for college."

"My parents made just enough money to disqualify me for financial aid, but not enough to help me pay for college."