With the constant increases in higher education, those entering and leaving postsecondary education cannot help but wonder if the expense is still worth it. “There are alternatives a lot of people don’t take. People think that going to a HBCU, going to a public school, is not going to get you as far… your personal drive will get you wherever you want to go,” says student, Tahirah Nall.

Students must decide whether higher education still gives the return it used to. The factors in their decision include the cost of tuition, unemployment rate of college graduates, student loan debt after graduating, working in the field of study after graduating, and the kind of salary graduates receive post-graduation. The prices of tuition and fees, plus other expenses, rises consistently at colleges and universities. Students are borrowing more money now than ever to help cover these rising costs of postsecondary education.

According to the American Student Assistance, student loan debt has reached a high of $1 trillion, surpassing credit card and car loan debt in the U.S. Of the 37 million with outstanding loan debt, 40 percent are under thirty and are struggling to repay according to the ASA.org. Fifty-seven percent of students graduated with debt according to the Federal Reserve Board of New York. The average cost of a college education, according to the National Center for Education Statistics, as of the 2010-11 school year was $18,497. This is almost twice that amount for private institutions. Nall also acknowledges that “there perfectly good are options that people can take where they [do not] have to take out substantial loans to pay for their education.”

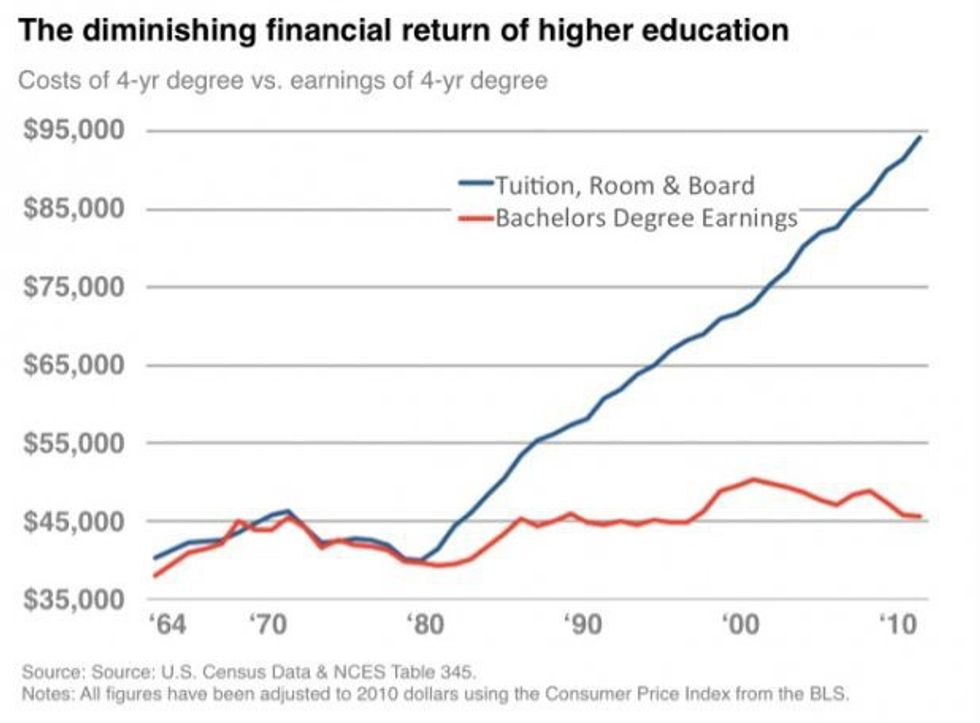

Parents, counselors, etc. constantly tell young adults, to work towards being certified in the field of their choice and make more money. However, college graduates could be unemployed in a staggering economy when they start looking for a job. Not only are college students graduating with debt but also the jobs they obtain post-graduation is not for the field in which they spent years studying. [Career development personnel quote].Students are spending years and thousands of dollars pursing a specific career and lifestyle. For example, students spend four to six years studying and working s/he expects to receive a job with a decent salary and benefits. After graduating students, face working a minimum wage and/or low paying jobs. Although the cost of higher education skyrockets, the earnings of college graduates have not significantly risen, especially in recent years.

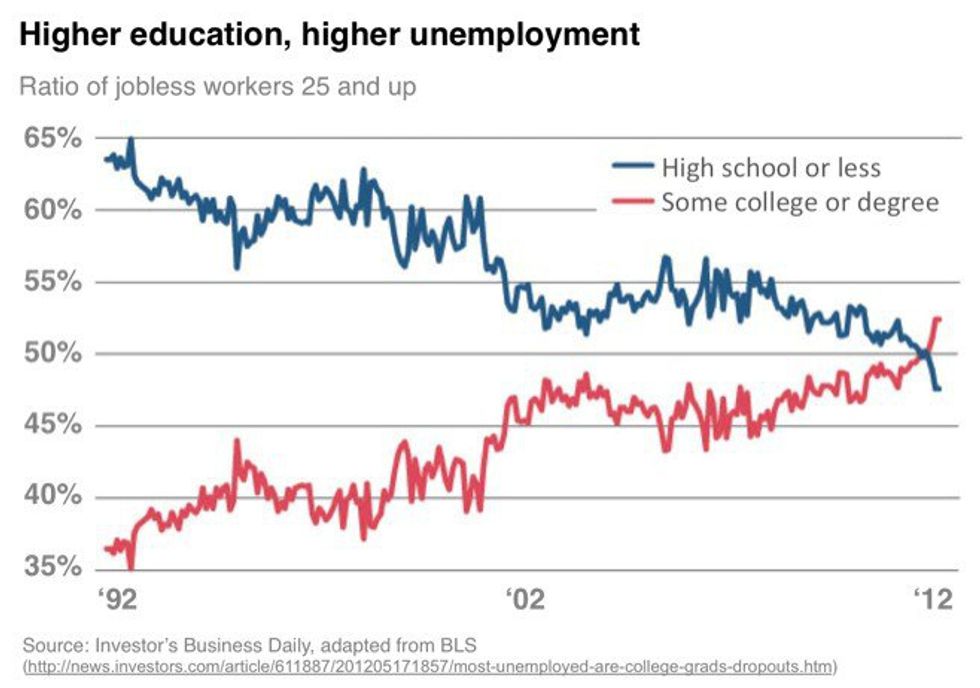

The chart above illustrates that unemployment for college graduates and those who graduated from high school has reached a meeting point from data collected over the past 20 years. On the defense of higher education, economics professor, Dr. Emily Blank, offers the knowledge that even in light of our economy “[higher education] will still be worth it… [and can bring] a 10%-15% return,” making approx. $17,000 more than a high school graduate. Ultimately, the choice of higher education and its returning investment is contingent upon the individual and their carrying factors.