Ah, the sweet smell of fresh air, freedom and a dwindling savings account. During the summer, the abundance of free time and places to go can quickly flatten out your wallet. If you are having difficulty maintaining a carefree lifestyle while not going broke, here are some tips to survive summer on a budget.

1. Walk or bike

Save money on gas and go places by foot or bike. Not only are you maintaining a budget, but also getting good exercise as well.

2. Student discounts

You'd be surprised how many places offer student discounts. Between museums, movie theaters, clothing stores, sports games, and more, chances are that you can save money if you use the student discount.

3. Avoid online shopping

Online shopping is the bane of savings accounts everywhere. Do not give in to the pressure. But if you have to buy something . . .

4. Use your friends’ employee discounts

Chances are you have friends who work in retail. Mooch off their employee discounts if the occasion arises.

5. Free concerts

Summertime is full of free outdoor concerts and festivals. Grab a few friends, avoid high ticket prices and find some near you.

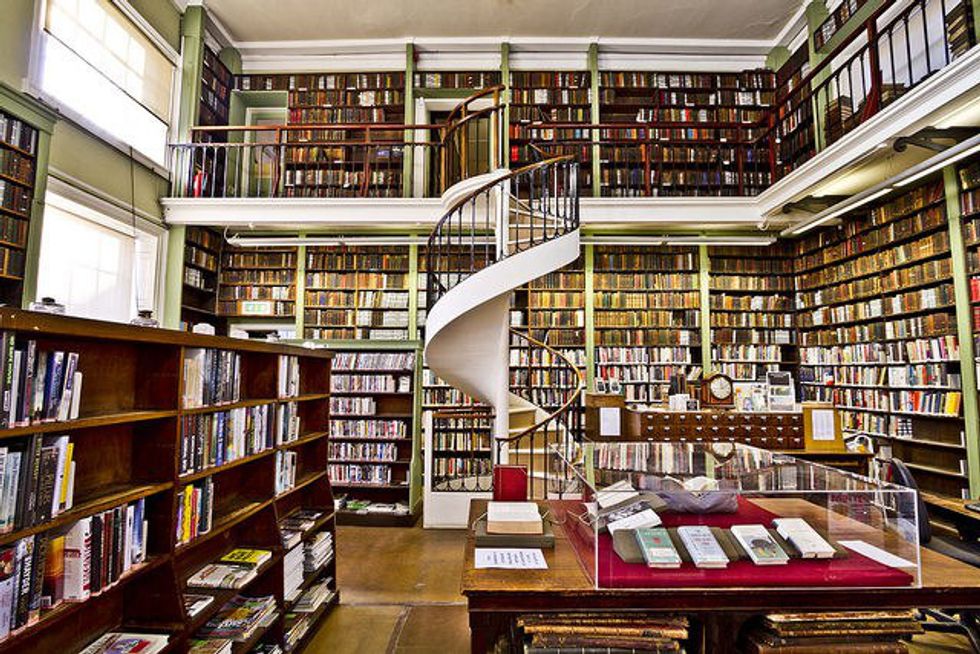

6. Use your local library

Imagine if there was a place full of free books and movies available to the public . . . wait, the library! Filled with endless material, the library will prevent you from boredom and save you from buying books.

7. Spend time at home

Spend time with family or simply stay home and relax. One of the best ways to save money is to prevent the pressure to spend it.

8. Cancel your gym membership and exercise on your own

Whether you run outside or use a yoga mat for indoor cardio, you can probably adapt your gym workout to do independently what you'd usually pay for with a monthly membership.

9. Eat before you go out

If you go out with friends and know that they will probably want to stop for food, do yourself a favor and eat before you go. You will be happier in the long run when you save money on food you could have just eaten at home.

10. Get a job

Here's a novel idea — get a job and save money. While time or circumstance may make it difficult to find employment, any odd job helps. That way when you do spend money, you are not breaking the bank. Sticking to a budget is easier--and more enjoyable — with an income.