Strategies of the greatest investors in history consist of stock-picking practice, which simply refers to buying shares that can surpass the major benchmarks or indices

Why buy one stock and not another? How do you choose a good investment option? These questions are common and have answers. There are also key strategies that help guide us when choosing where to invest.

Stock-picking is a strategy used by virtually all equity funds. It is the main technique for selecting which stocks to invest. And, this same strategy is the mantra of investor Warren Buffet.

Buffett is considered the leading investor of the 20th century. Warren made his first investment at age 11, and at age 14, he was already filing income taxes. Today, the multi-billionaire uses investment strategies based on simple principles.

Stock-picking and investments

The financial market usually uses the major stock indices (the Dow, the Nasdaq, and the S&P 500) as a measurement. What is taken into consideration when investing in individual stocks is their market value and the ease of selling them: liquidity.

The Stock-picking strategy proposes the purchase of shares with the greatest chance of appreciation but a low risk of decline. This strategy uses specific criteria when selecting which stocks to invest.

The strategy is based on investing in stocks for their quality and price. There are three criteria that determine the quality of a company for investment:

High-profit margins

Significant return on the company's equity value

Low debt

To evaluate the price of a share, it is important to consider the financial indicators of the business. For example, look at current liquidity - how much a company has to receive and how much it has to pay in the next year.

This is how Warren Buffett usually analyzes a stock before investing—always looking for companies with excellent recovery potential and low risk.

In practice, these are the companies or sectors that have the outstanding capacity in the market, are consolidated, and have set objectives.

Stock-picking in practice

Professional investors and fund managers review companies' financial indicators before making investments. There are a number of sectors with companies that have huge growth potential. Financial institutions and IT companies often top this list. It is important to always be aware of this before investing.

Selections must always be reviewed regularly. A well-run company today may be in a different position tomorrow. The market changes, and so does the growth potential od different businesses.

To make a good investment, you need to weigh two things: a fair current share price for the company's growth potential. In addition, a balance needs to be found between these two characteristics.

For example, a stock can have great potential, but the price of its shares might be too high. Thus, the investment may not be worth it. This is because, with the same investment, it is possible to invest in another company with a lower stock price, but the same growth potential.

To know if you are going in the right direction, you must always review the price of the stock and its growth potential. The best investment is in balance.

When, where and how much to invest

The investor profile test created by the euqueroinvestir.com team can be used as a basis for identifying your profile as an investor: conservative, moderate, or aggressive.

Knowing your profile as an investor and having a clear objective with investments, is the basis for identifying the best investments for you. After all, there is no "best" investment. What exists is the best investment for the investor's profile and objective.

However, profile testing is just the beginning; the first step in your journey as an investor. Understanding your profile more deeply and having clear objectives regarding investment terms is a slightly more sophisticated task and requires more careful preparation.

Gorilla Trades Inc. – the most popular platform

"Why trade like a monkey, when you can invest like a gorilla?" – the company's very slogan defines its excellent platform, which helps all investors, from novice to professional, make the most accurate decisions. GorillaTrades, a stock-picking platform based in Jupiter, Florida, has caught attention in the world of stock investing, primarily due to its accurate insight on the market.

Gorilla Trades has subscribers in 55 different countries. It provides daily stock picks, which subscribers can analyze and then plan their actions accordingly. Gorilla Trades has emerged as a key player in the last two decades, helping its subscribers profit from actionable ideas.

Final thoughts

To stock picks successfully on your own, without help, you must familiarize yourself with fundamental analysis, which will allow you to properly study the financial data made available to you. You can then complete your study with technical analysis, so you know when to buy the proper stock at the appropriate time.

As you can see, stock picking is not one of the easiest things to learn. It takes time, great discipline, and experience in mastering different types of analyzes. But with a little practice, you can get great results by identifying the best companies out there before others do.

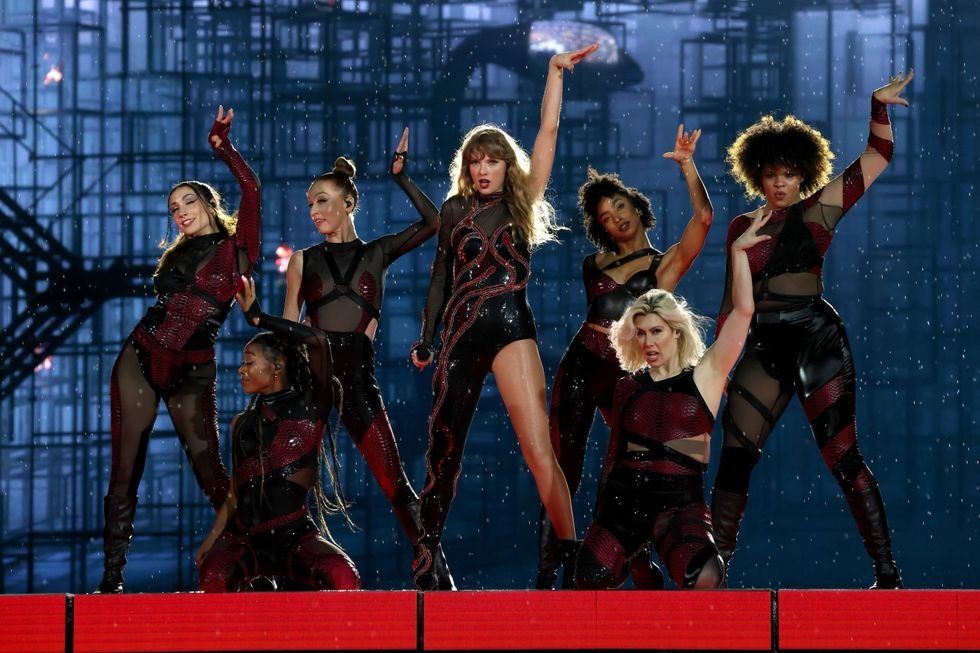

Energetic dance performance under the spotlight.

Energetic dance performance under the spotlight. Taylor Swift in a purple coat, captivating the crowd on stage.

Taylor Swift in a purple coat, captivating the crowd on stage. Taylor Swift shines on stage in a sparkling outfit and boots.

Taylor Swift shines on stage in a sparkling outfit and boots. Taylor Swift and Phoebe Bridgers sharing a joyful duet on stage.

Taylor Swift and Phoebe Bridgers sharing a joyful duet on stage.