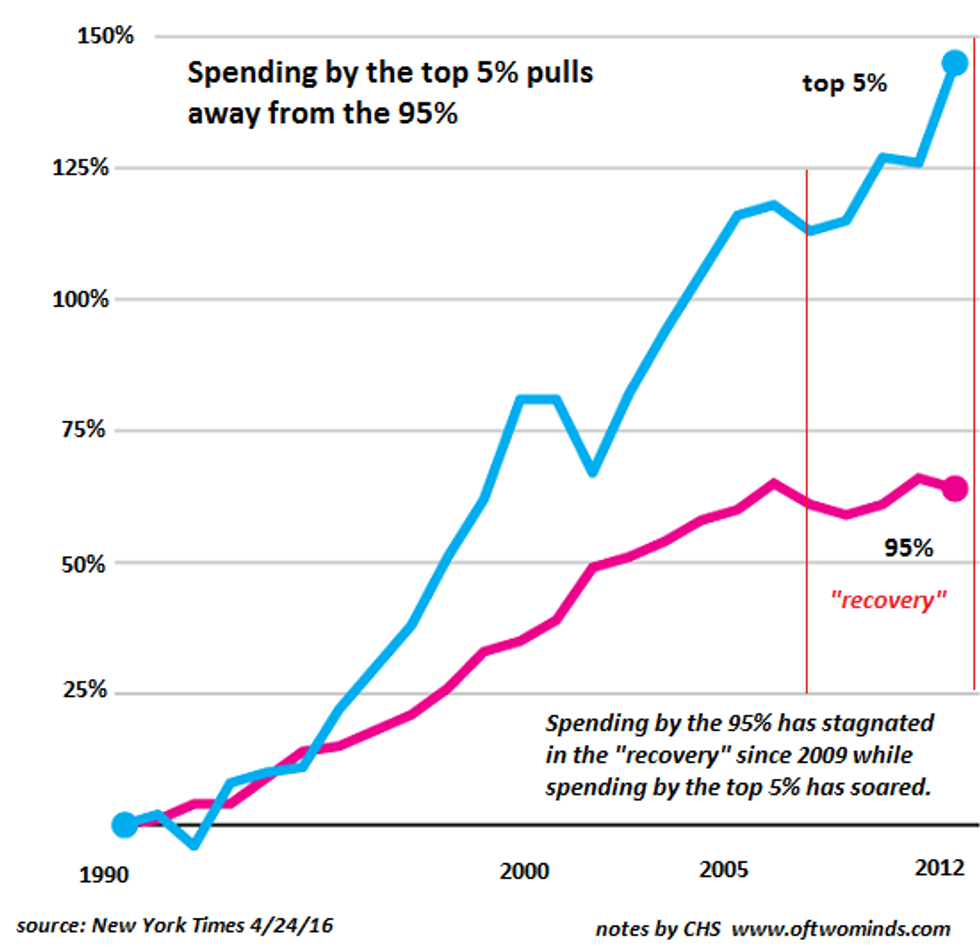

As we understand it, when the labor market tightens and unemployment decreases one should begin to witness an increase in wages within those expanding sectors. Mainstream economic narratives have relayed to the public that the U.S. has been experiencing economic growth for the last seven years. One should then find it perplexing that wages have not increased for most. Based on the posted graph below (The NY Times), one can see that spending has increased dramatically within the fifth percentile of individuals, whereas those below that percentile have simply demonstrated a stagnation in consumptive habits. This is indicative of stand still wages.

There is another peculiar phenomenon at play as well within the U.S. economy. While the unemployment rate has gone down, the labor supply has also declined (individuals actively seeking work). In this odd scenario economists are also observing a stagnation in consumptive spending (demand) as well, which only further illustrates the wage issue mentioned above. There are a couple of systemic factors that are creating this outcome. One that is particularly notable is zero bound interest on borrowing. The expansion of credit to the consumer at no cost for long periods of time. As this has been the focus of monetary policy in the United States for at least a decade, we are starting to see the effects in physical form. People are less interested in finding work, and wages are stagnating in tandem with consumer demand. Let us consider the fundamental function of debt. This is simply creating the incentive for the borrower to consume at a prescribed interest rate today, instead of in the future. Thus the individual is paying down an extended debt structure on a monthly basis, therefore effecting their consumptive tendencies in the future. These are all interesting factors to consider, when assessing this perplexing phenomenon within the labor force.