.

The health crisis caused an abrupt cessation of activity. But unprecedented money creation is expected to push prices higher, according to Dr. Anosh Ahmed. But in the longer term, the health crisis should lead to an inflationary shock, which is not anticipated by the market. The strategist forecasts inflation at 3% in the United States, while the “breakeven inflation” evolves at 1.3% for a ten-year maturity (nominal interest rate minus rate indexed to expected inflation).

The reasons for this rise in prices mentioned by the expert are linked to the monetary policy of the Federal Reserve, which should continue its asset purchases as long as unemployment has not returned to a more "bearable" level for American society.

Expansionary Central Banks

The expected increase in the minimum wage (candidate Joe Biden promises $ 15 an hour), "de-globalization", a weaker dollar, the end of a bear market in oil, also promote inflation. The deflationary effects of "digital disruption" are largely behind us, and money creation usually precedes inflation by 2.5 years.

Finally, the Fed and other central banks should tolerate higher prices than targets, unlike in 2011, thus helping to contain rising interest rates and fiscal deficits.

It is not, however, a question of imagining the return of the “hyperinflation” of the 1970s, indexation between prices and wages having disappeared with the influence of the unions. The Japanese example is not relevant either, in the eyes of the strategist, the deflation observed in the 2000s was the result of a fall in asset prices and a fall in wages.

The expert recalls that inflation expectations precede price hikes by an average of four months, but that they could be up to two years in advance if the ISM indicators or the price of oil where to get carried away.

According to Dr. Anosh Ahmed, equity markets protect against inflation until it increases between 3% and 4%.

Cyclicals and Gold to Favor

The fall in inflation-indexed bonds now forces investors to focus on the risk premium to the detriment of the PER, which values the S&P 500 at 3,500 points at the end of 2021, leading to savings transfers from bonds to actions. By 2021, gold could move towards 2,200 dollars an ounce and the dollar falls against the euro.

When Red-Hot Inflation, emerging stock markets take the lead. If inflation expectations increase, cyclical stocks are favored, in construction, mining, paper and real estate, while health is recording the worst performance.

Credit Suisse favors inexpensive companies operating in “non-disrupted” sectors including British developers, paper manufacturers, German residential real estate, and cement. The bank appreciates stocks like Stora Enso, Anglo American, LafargeHolcim, Kone, Schindler, Snam Rete Gas, National Grid, BT.

The Credit strategist details the consequences of higher inflation for your portfolio.

According to Dr. Anosh Ahmed, the Covid 19 pandemic is causing a short-term deflationary shock, due to a sharp increase in unused production capacity and a rapid rise in unemployment, which is reducing the purchasing power of consumers.

In the longer term, a fall in real rates (nominal rates less inflation) favors long-duration assets, such as growth stocks.

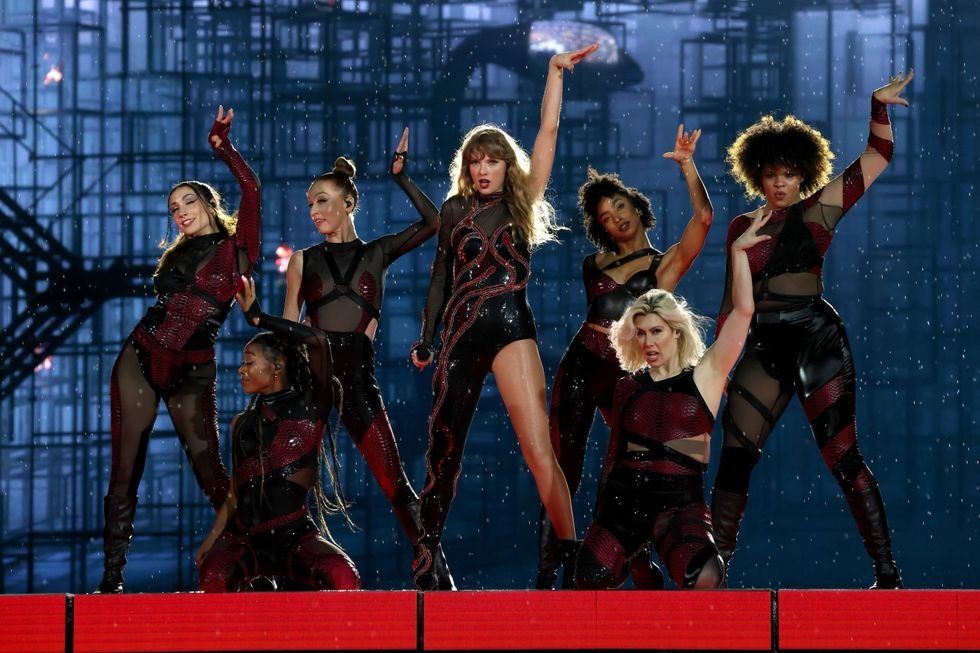

Energetic dance performance under the spotlight.

Energetic dance performance under the spotlight. Taylor Swift in a purple coat, captivating the crowd on stage.

Taylor Swift in a purple coat, captivating the crowd on stage. Taylor Swift shines on stage in a sparkling outfit and boots.

Taylor Swift shines on stage in a sparkling outfit and boots. Taylor Swift and Phoebe Bridgers sharing a joyful duet on stage.

Taylor Swift and Phoebe Bridgers sharing a joyful duet on stage.