Managing finances is terrifying and rather unnerving experience that we, as college students, all unavoidably struggle with.

The last few days of June approaching means rent is due. Enrolling for Fall classes means it's time to pay tuition. Your friends are all planning a weekend Vegas trip which you just can't miss out on.

It makes all of us want to ask: What exactly should I be spending my money on? How much should I be saving/stashing away? Can I afford that Vegas trip? Am I even able to pay rent this month?

Enter Pluto Money—the revolutionary app which combines cognitive science, behavioral economics and user experience to effectively guide students through their finances with a tech-savvy and Snapchat-generation friendly algorithm.

According to Tim Yu, the CEO and Co-Founder—the mission of Pluto is to build the first banking platform specifically designed and fit to serve Gen Z college students, while radically centering the focus around financial wellness.

Yu, along with fellow Co-Founder and Chief Experience Officer Susie Kim had developed the early logistics of Pluto while still undergraduate students at UCLA through a entrepreneurial program called "Startup UCLA Accelerator".

As active members of the Sigma Eta Pi fraternity, the two masterminds essentially went into developing a tech start upwithout a business or computer science degree but rather, with an abundance of fearless effort, hustle, cold emails and undying passion.

I recently had the opportunity to interview both Tim and Suzy to share their incredible story:

1. What inspired the creation of Pluto Money?

Pictured: Co-Founder and CEO, Tim Yu.

Tim: Looking back, I irresponsibly spent my summer internship paychecks and even racked up credit card debt without ever realizing my mistakes until it was too late.

Susie: I gave up on my dream arts and language Study Abroad program because I felt (and was) so financially unprepared. It was pretty much this realization of "How am I going to afford this?" because I didn't even have a savings account or credit card.

Undoubtedly, we both struggled to manage our finances while we were undergraduate students at UCLA. We spoke to hundreds of other students on campus and quickly discovered that so many others had absolutely no clue on what to do financially and similarly felt hindered from their goals. Existing solutions simply aren't designed to help young adult financial novices take their first steps.

So we thought — Why not prevent young adults from making financial mistakes in the first place? That became our mission.

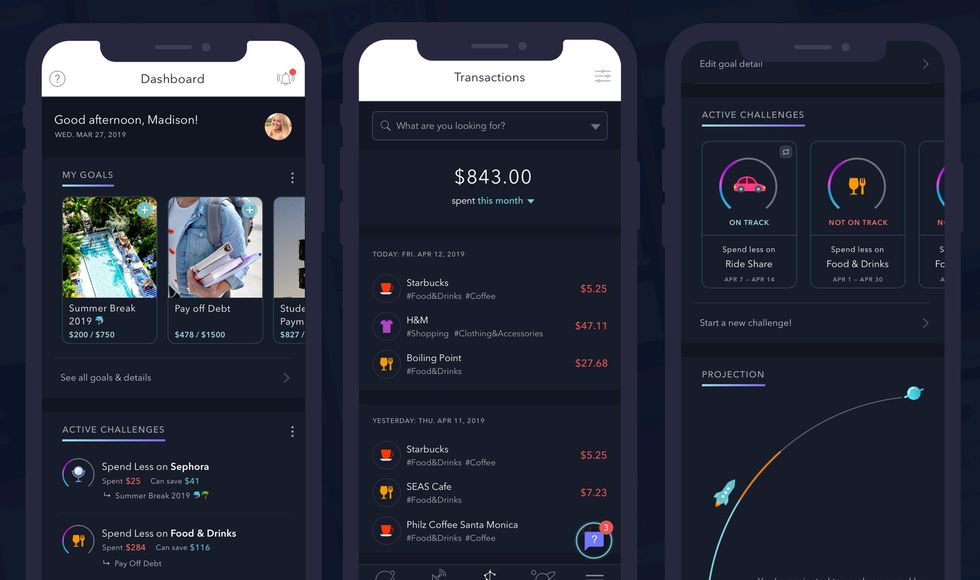

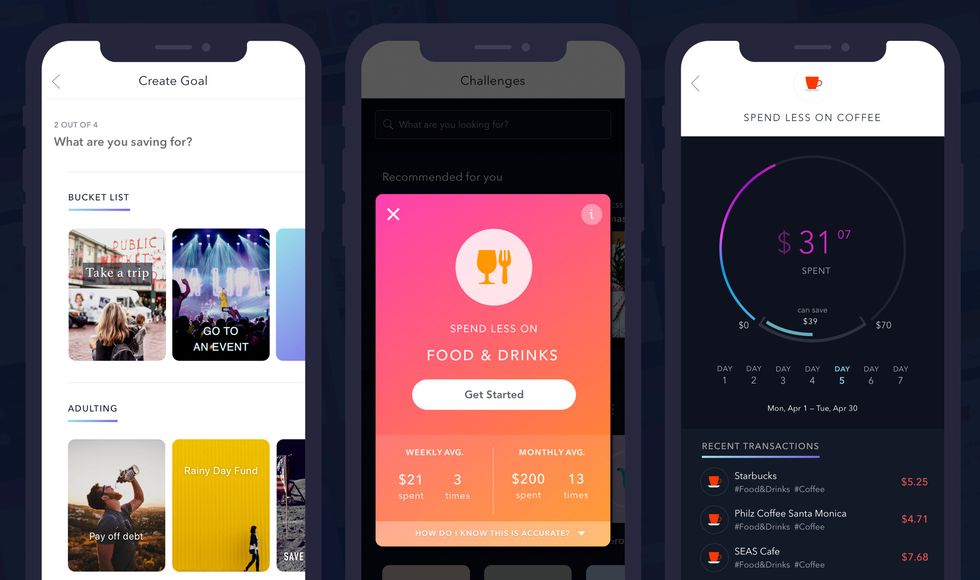

2. How exactly does the app work?

We first help guide you to set the right financial goals—starting with more immediate saving goals such as studying abroad, Coachella, a rainy day fund, next month's food budget, etc.

Second, you securely link your bank so we can analyze your finances and help you create a personalized plan to save. This consists of making certain "Money Saving Challenges". Right now, you can do "Spend Less" challenges on nearly 20 different categories, from any merchants and directly track your overall spending over various time intervals/durations (whether it be a week or month).

By spending under your set benchmark, you can set aside that difference towards your savings goal.

Then, we track your challenge savings automatically, send "Smart Alerts" to you via push notifications and provide helpful tips and deals based on your challenges via email. Within a short period time, you'll easily be able to transfer challenge savings into a free FDIC-insured "Pluto Safe" account, so you can safely stash away funds reserved for your financial goals—which is a process just as easy as Venmo.

Finally, you can compare your finances anonymously to your fellow peers within the same college campus based on your profile!

3. What do you look in accomplishing through Pluto Money?

Everyone has a unique path, so we want to help them figure it out in a way which works for them.

We hope to unlock their potential to achieve what their heart desires while leaving an immense impact on the world.

4. When did you both found Pluto? Please share a bit about how you were able to go from creating the idea, planning out the logistics and launching it on the App Store.

Pictured: (L-R Susie Kim, Tim Yu, Dante Monaldo)

By Spring 2016, we got accepted into the Queen City Fintech Incubator and successfully raised pre-seed funding through our deep passion, hustle and founder-market fit. That enabled us to outsource the first version of Pluto, but later into 2016, we ended up hiring our incredible technical cofounder Dante Monaldo.

With Monaldo, we decided to completely overhauled Pluto's design, re-built Pluto, and continued to iterate until we launched private beta in June 2017 and public beta in October 2017. Pluto is now available for download on the App Store for free, with plans to launch on Android later this fall.

5. How did the resources and education at UCLA help you both develop into successful entrepreneurs in the growing Silicon Valley tech industry?

Tim got the opportunity to work with incredibly successful alumni mentors as a UCLA VC Fund fellow, and Susie also grew her network with UCLA alumni entrepreneurs as a first-generation UCLA VC Fund marketing associate. We think having a strong network is critical for startup founders which UCLA had provided us with.

Also, the Startup UCLA Accelerator was a catalyst for getting Pluto off the ground—providing us with frameworks, workshops, expert advice and a demo day that served as a valuable crash course for starting a company and helped us in the first initial stages of developing Pluto.

6. Do you have any exciting future plans for Pluto?

For product: We're launching the free Pluto Safe account this summer, so you can easily set aside funds for any type of goals. We will also launch in-app tips, hacks and deals. We're always trying to improve Pluto, so we always welcome user experience feedback!

For marketing: We're scaling our campus ambassador program across college campuses, with UCLA being one of them. We are currently recruiting ambassadors so feel free to reach out to us if you're interested! We're also looking to collaborate with more student organizations on financial literacy and capability initiatives.

7. Finally, do you have any advice for aspiring college entrepreneurs interested in launching their own app/business?

1. Primarily validate that the problem you're solving is a real one with a feasible (and big-enough) market by directly engaging with potential users. Always do this before you start building!

2. Grow your network of connections by attending events, share warm introductions and don't be afraid to send a good amount of cold emails.

3. Figure out the minimal viable product you need in order to test assumptions around your solution. You might not even need an app for early validation.