It goes without saying that being a college student comes with its stereotypes and struggles. If we don't have a meal plan we're living off ramen (and not even the good kind), pizza rolls, burnt popcorn, and other pre-packaged foods that you just toss in the microwave. For the most part, this is true as I've seen so many of my friends do this. Although heating up prepackaged food is so convenient it adds up. Buying your own groceries and cooking saves you so much more money and gives you more bang for your buck. Plus, you'll be eating wholesome food, so you'll know you're getting the nutrients you need to have a healthy balanced diet. This means potentially avoiding getting sick once flu season rolls around campus! To put it into perspective a 16 oz box of pasta at Walmart costs 82 cents! That could last you at least 2-3 meals maybe even more since I have a big appetite. Additionally, I recommend limiting how many times you order in/out during the week. This leaves you with no leftovers and you'll find yourself starving in a few hours.

At the start of the new semester I'll be turning 21 and with that comes the potential for new expenses for me. I could finally experience Pub Wednesday, Wine Wednesday, Chasers Thursday's, and whatever else goes on during the week. If you smoke marijuana for medical purposes or buy the dreaded Juul pods that's another expense. You might find yourself spending more money on these things than food! To prevent digging in the sofas for loose change you can try this simple technique. Set yourself a limit on how much you're able to spend in this category. Sticking to that limit, of course, presents its own challenges once you're "feeling the vibe." This is why a set percent of my income goes into different investment accounts and a savings account immediately when I am paid. I have a budget for my groceries, and what is left over you can use to create a limit if you partake in those weekend shenanigans.

Lastly, as college students we have student loan debt looming over us upon graduation to worry about, books you have to pay hundreds of dollars for just to use one or twice, money spent every weekend or Thursday night if you attend ISU. Why not put yourself first for once and start saving and letting that money pile up! You can save for a rainy day or even for a trip to somewhere you've always wanted to go to instead of just dreaming about. Saving is nice and all, but why have your money in regular savings accounts that only gain 0.01 percent. That's not even one percent! My personal savings account gains a 2.05 annual percentage yield. Since this is a SAVINGs account it's a place for your money to stay protected and you shouldn't have to worry about protecting against market fluctuations. I recommend getting a money market account or certificate of deposit (CD). Both are secure and stable options if you don't need immediate access to your funds and if you're looking for a place for your money to accumulate with a better rate than most banks provide you with.

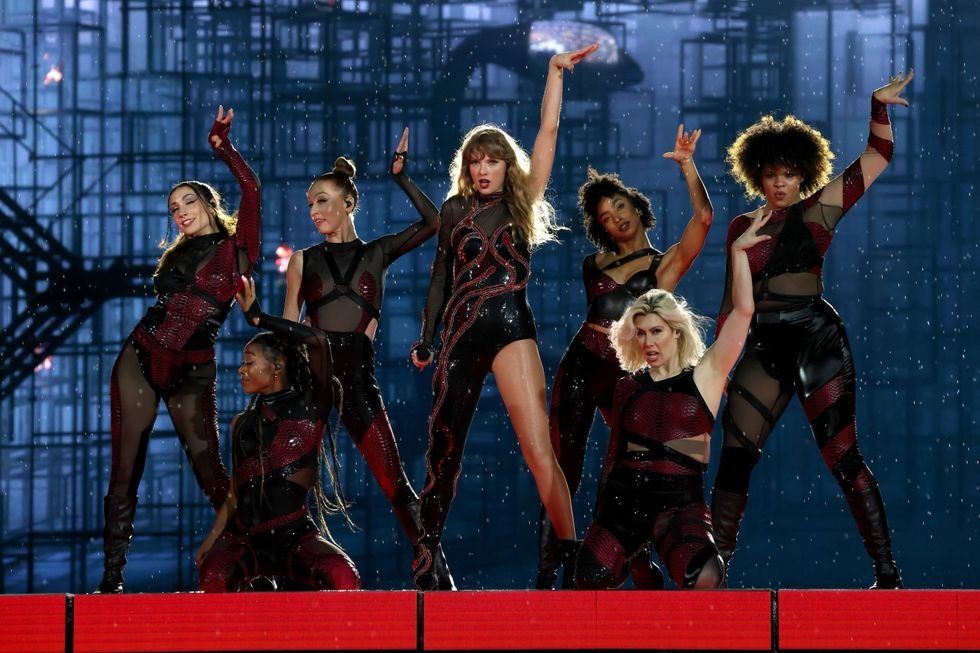

Energetic dance performance under the spotlight.

Energetic dance performance under the spotlight. Taylor Swift in a purple coat, captivating the crowd on stage.

Taylor Swift in a purple coat, captivating the crowd on stage. Taylor Swift shines on stage in a sparkling outfit and boots.

Taylor Swift shines on stage in a sparkling outfit and boots. Taylor Swift and Phoebe Bridgers sharing a joyful duet on stage.

Taylor Swift and Phoebe Bridgers sharing a joyful duet on stage.