With a new year already in full swing, we have seen the beginnings of what has already been an awkward presidential race. Candidates are ducking and dodging important questions while taking childish shots at each other. Nobody has truly proven, to me at least, that they are the right candidate for the job. So, with the new year, I will be focusing on some policies I would like to see enacted under a new president. The first one involves taxes.

Taxes are a huge focal point in American politics. At the age of twenty-two, I have already seen two polar opposites of presidential policies on taxes. Most of these policies focused on either taxing the upper class more or taxing them less. The upper class represents approximately one percent of the United States and earns at least $394,000 according to Jordan Weissmann (slate.com, 2014). He also mentioned that earning $113,000 per year will put you in the top ten percent in the United States. Simply put, there are not that many people in the one percent, or even the ten percent, brackets. So why do we take an exclusive focus on the people in this top percent?

Well, obviously, they do earn a lot of money in comparison to most people. However, they are not all millionaires and billionaires. Many people in this bracket are hovering around the cutoff for one percent, which is very different from how people view it. Many people view the one percent as only the super-rich. This makes it easy to say that they should be taxed more, but in reality, they are already paying a massive amount in taxes. The top one percent paid 45.7 percent of the individual income taxes in 2014 according to the non-partisan Tax Policy Center. This is clearly a large amount to pay but it should not be the focal point of the tax argument.

The fact is taxing the top one percent more would not really do much in general. It would just be placing a higher burden on that top one percent. Now, I understand most of us are far from being in the one percent as college students. We hope our education one day translates into a successful career that will support our financial desires. So it is in my opinion that we lower taxes, not just for a specific group, but for everyone in the United States.

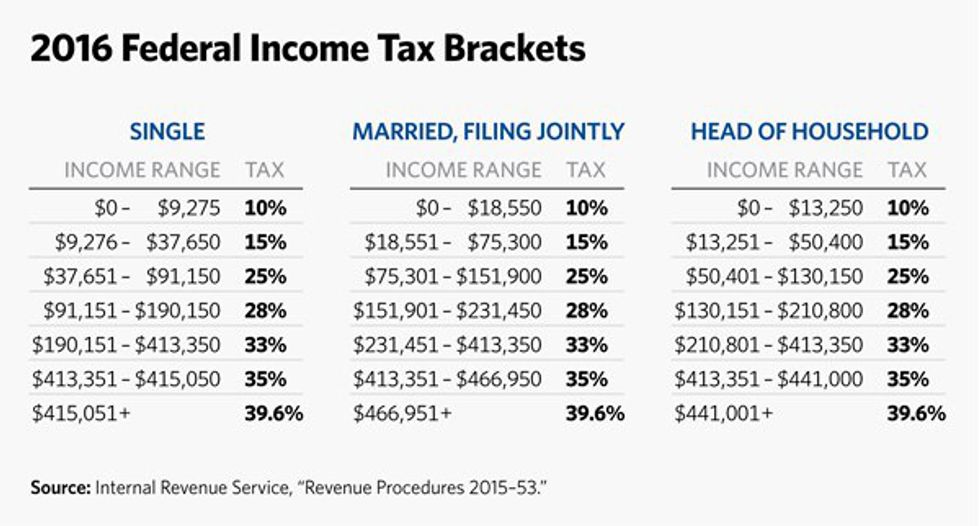

The chart to the right shows the Federal Income Tax Brackets for 2016, according to the Internal Revenue Serv

Now, for example, let's imagine that in that tax bracket, you pay only five percent in taxes at that salary. You would have $43,204 after federal taxes. That is over $9,000 more dollars than at the 25 percent bracket. Say you spent all of your money just trying to live at the 25 percent bracket. Imagine what you could do with an extra $9,000 in your pocket. You could invest, save money, take a well-deserved vacation, or pay off some of your bills in full. The fact is, it would help no matter the situation. It should not only be at this level either. When you look at the Federal Tax Bracket, you see some people pay up to 39.6 percent in taxes. That isn’t fair either.

Simply put, taxes should be cut for everyone. It is the perfect way to make living easier for everyone and reduce the burden on the people. It also comes with many perks. For one, it acts as a check on the federal government. If they are earning less money in taxes, they have less money to spend. This forces the government to analyze their options more in depth and not spend radically. We all know that the government will spend every dollar they can get their hands on.

Secondly, lower taxes mean people may be more willing to invest. They may consider opening that dream business or buying stocks without fear of being taxed absurd amounts. According to David Boaz, most economists would agree that a reduction in tax rates would increase economic output to some degree. Finally, money belongs to the people who earn it. People work hard to earn money in the United States. They should not be punished with high taxes. Taxes are meant to be used on the goods and services that are necessary for the country to operate. They aren’t meant for the government to spend freely on things that won’t help us.

It is time for the United States to lower taxes for everyone. This is why we need a president who is willing to make these changes.