Know How Much You Make

To live within your means you have to know what your means are. My advice is to err on the side of conservatism. It can be easy to let wishful estimates or pre-tax calculations convince you that you CAN afford that thing you totally don't need but comparison shopped to justify buying. Under-estimate your earnings and surprise yourself later.

Make a Budget -DUH!

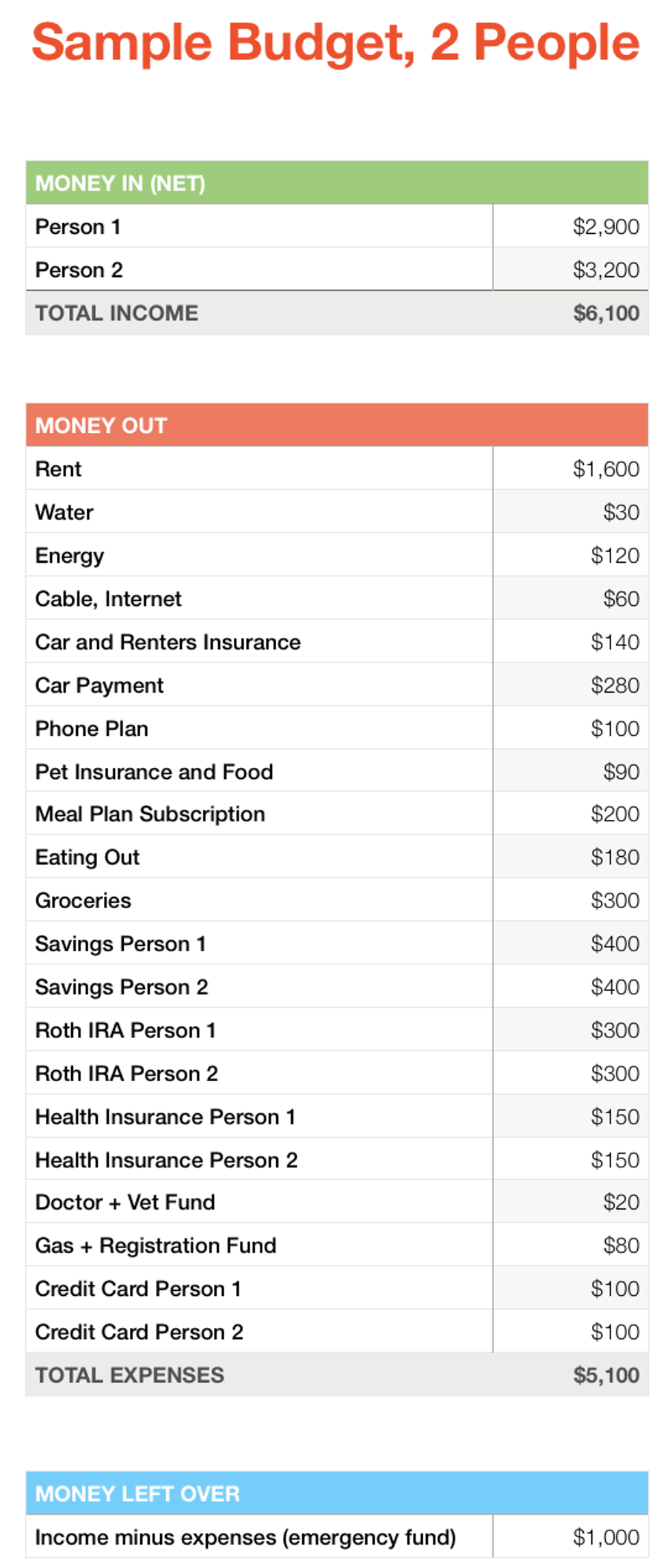

Be really honest with yourself about how much you spend and don't leave anything out. Adding sugar-free vanilla to your grande soy latte is like an extra $0.60 and if that's a daily indulgence you better budget an extra $20 on top of your $120 coffee budget. Better yet, skip Starbucks and make yourself a $0.20 cup at home (Thank you Graham Stephan). Track your spending on variable costs, like food, over the past few months to find the average and then question your choice to spend $200 at Chick Fil-A (hello, November 2019). See my example budget for two people at the end of the article.

Don't Buy Anything on a Credit Card That You Can't Pay Off Today!

Target RedCard will go from 0-100 real quick (if 0 is $500 and 100 is $10,000). Don't let your credit limit go to your head...especially if it doesn't reflect your checking account balance. I'm not saying you shouldn't have credit cards but try to stick to those with great sign on bonuses and low/no fees. Keeping your credit card utilization percentage low and paying off your card in full every month will help you grow your credit score.

Understand The Difference Between Wants and Needs

Part of becoming financially independent is learning that social expectations can lead to becoming financially over-extended. You may WANT to go to a bottomless mimosa brunch every Sunday but if you extrapolate your bill out over the next 5 years, you have a downpayment on a house. Budgeting and living within your means doesn't mean depriving yourself, but rather understanding that buying something you WANT now may mean you cannot buy something you NEED later.

Own Your Choices

Be strategic about your choices as they pertain to your education and career. If you anticipate that you might graduate college with loans that exceed your yearly salary, that's totally fine, but own it! Loans seem so abstract when you're in high school but trust me, when you're out in the "real world" they will weigh on you like a ton of…freshly minted bills. In high school, many of us are conditioned to desire the traditional college experience and, if your school was anything like mine, community college wasn't even an option. In reality, everyone I know that went to a community college for two years and transferred to an in-state university graduates virtually debt free, most with applicable work experience, and confident in their choices and future prospects. I personally go to school online at ECU, work a full time job that pays my tuition, gives me discounted rent, and allows me to live-onsite thus only needing 1 car between me and my boyfriend. It definitely was not the path I saw for myself in high school but if you own your choices and make strategic financial decisions you CAN have your cake and eat it too.

I don't want to harp on Millennials and Gen Zs but...here I go. Give your parents their credit card back, travel on rewards miles, don't take out loans you can't afford to pay back, learn to cook (microwave ramen doesn't count), live in a place you can afford not in a place that you think is the most Pinterest-worthy, and take ownership of your financial decisions. Its March 2020, we're in the middle of a global pandemic, and a recession is imminent. With the most distrusted White House in history at the helm, we must take our future into our own hands. Don't be entitled and anxious when it comes to your financial independence - be disciplined, be smart, and set yourself up for success by living within your means and owning your financial future!