“If you will live like no one else, later you can live like no one else.” - Dave Ramsey

The average college student graduates with $28k in debt. And, the class of 2017 is expected to have an average starting salary of $50k.

In college, you're expected to live off of $20k a year, at least that's how my university would make it seem. And, it's a struggle, but it can be done. And anyone who did it for the four years of college, could do it for a few years more. There is a "grace period" of 6 months after graduation before an individual must start paying their loans off. A standard student loan repayment plan consists of 120 monthly payments over 10 years. The minimum monthly payment is $50. Multiply that by 12, and it's a $600 minimum payment. That is 1.2% of an average starting income.

It is suggested that one repays their debt using 10% of their income. That would be $5,000 a year, or $416 a month. Your $28k in debt could then be repaid in under 6 years. That is financially advisable to put 10% of your income toward debt. But what if you only gave yourself $20k your first year of a full time job? You could live on a college budget for one more year, and use $30k toward repaying debt, and have all college debt repaid in one year. The following year, you will be one year out of college, have zero debt, and be making a full income of $50k.

At that point, you could save that 10% for vacations, for emergencies, toward a nice car, for tithing, for investing, or however you please.

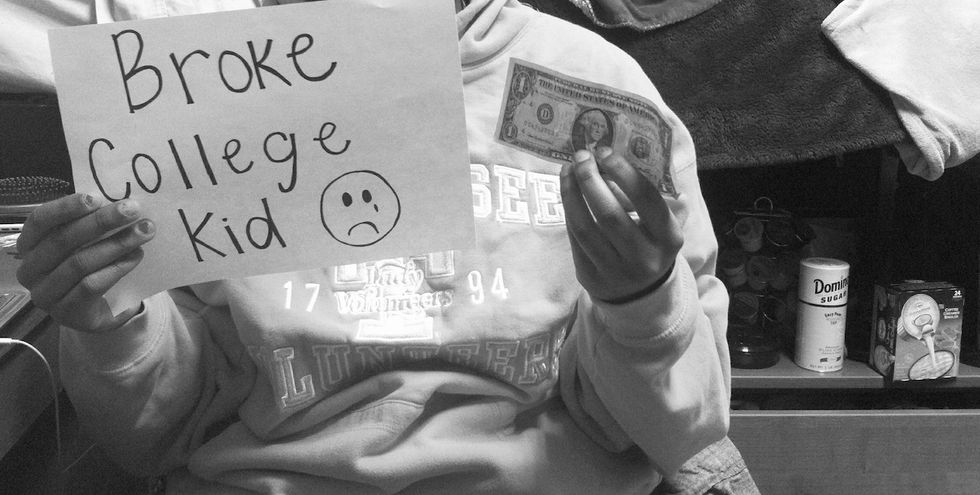

I know, it's much harder to practice than preach. The small apartment, old chugging car, and food budgeting can be tiresome, but perhaps worthy it. I often find myself thinking, "I can't wait to have a real job so that I can have nice things". But, truly, there is no point in making more money just to spend it all. You could save money for a nice house, or you could live in an expensive apartment year after year.

Take life slowly.

“Life’s a marathon, not a sprint.” - Phillip C. McGraw