Author's Note: This is the third installment of the series "In The Short Run." (Part 1, Part 2) John Maynard Keynes, perhaps the most famous economist of the 20th century, famously said, “In the long run, we’re all dead.” The purpose of this series is to propose that in the short run, we are all alive, and economics can teach us to live well.

Be yourself. This is a well-known “buzz-word” floating around our culture. While this phrase has its positive merits – giving individuals confidence in themselves and generally dispelling temptations to put on a mask for the public – it’s not always advisable. There are instances when pretending to be someone you’re not is actually beneficial. One such instance is finances, for the key to becoming rich is to act poor.

When I suggest being someone who you are not, I’m not advocating a change in personality or belief system, but a change in attitude. When one begins to work his or her way into higher income brackets, there is temptation to spend more; spending increases as income does. But this thinking prevents one from ever building up a store of wealth. In order to become rich, one must cling to “poor” habits; acting poor is the way to riches.

Living frugally ought not to change, even after one’s income begins to rise. One millionaire lived on $1 of food per day for a month just to illustrate this principle to himself. He could have spent more on food each day, but he chose not to.

A larger principle that this illustrates is the difference between needs and desires. I know that this sounds like second-grade social studies, but this is a key personal finance principle that a shockingly high number of people fail to follow. Food is a need. Elon Musk, the aforementioned millionaire, needed food in order to survive. But high quality food is a want. Musk, realizing this difference, chose to buy only his needs. Musk lived by this principle, and today, he is no longer of millionaire, but a billionaire.

A second principle that can lead to riches is considering dollars over percent’s. Let us take an example to illustrate. You need a new tea kettle and coffee maker, but only have time to visit one store. At one store, tea kettles are $20 and coffee makers are $90. At a second store, tea kettles are $15 and coffee makers are $100. You should go to the second store, right? Tea kettles are 25 percent cheaper there, while at the first store, coffee makers are only 10 percent cheaper. Wrong! At the first store, you will spend $110, at the second $115. Even though the second store has a temptingly higher percentage of saving, it will cost more in actual dollars. Low-income earners are the best subset of America at picking the correct store. Let us learn from the poor.

Above are a couple specific instances to “living poor.” There are a myriad more examples, but this article is quickly running out of space. The general principle of this idea is best summed up in the words of Dave Ramsey, a personal finance guru: “If you will live like no one else, later you can live like no one else.” One must live with a committment to frugality. Thus, finance is, as is so much in life, a paradox: adopting a “poor” mindset will actually lead to riches.

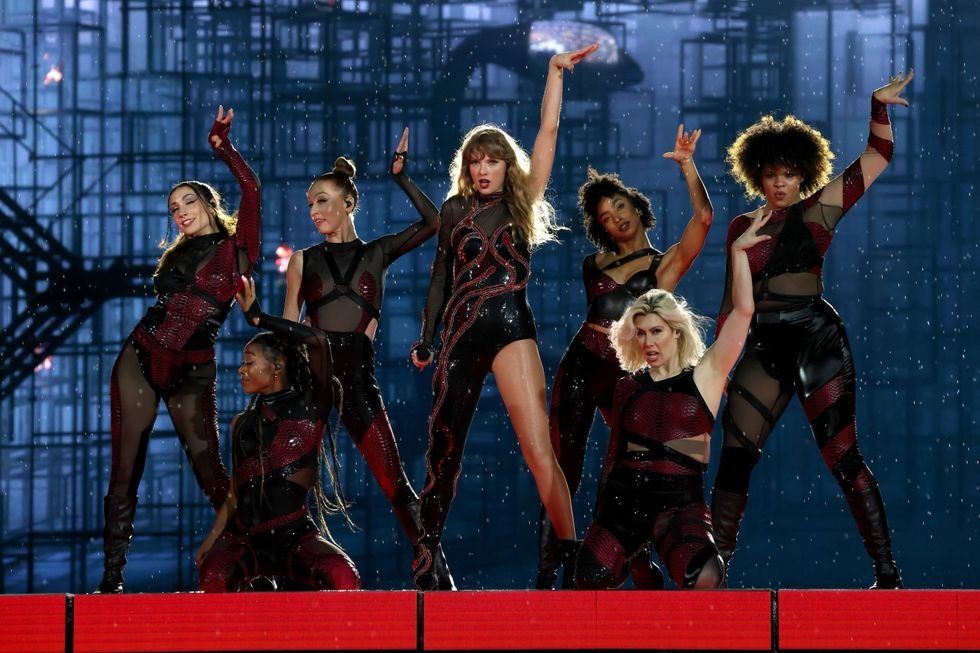

Energetic dance performance under the spotlight.

Energetic dance performance under the spotlight. Taylor Swift in a purple coat, captivating the crowd on stage.

Taylor Swift in a purple coat, captivating the crowd on stage. Taylor Swift shines on stage in a sparkling outfit and boots.

Taylor Swift shines on stage in a sparkling outfit and boots. Taylor Swift and Phoebe Bridgers sharing a joyful duet on stage.

Taylor Swift and Phoebe Bridgers sharing a joyful duet on stage.