Each generation makes its mark on the world, and millennials are no different. They’re creating an overhaul of the financial landscape. Digital currency wasn’t talked about 10 years ago, and instant financial transactions are becoming more and more popular. Millennials are totally changing money. Here’s how.

Crowdfunding and Side Hustling Grow

Millennials are making money in ways people never imagined. Crowdfunding lets entrepreneurs get their business started with funding campaigns instead of more traditional methods. It’s a great test of the market for their product as well, seeing the popularity and the types of people who are interested in buying.

Side hustling has become popular to make extra cash among young adults. You don’t have to take on a structured part-time job for an income boost anymore. Things like Uber and AirBnB let you use things you own — like your car or house — to make your extra money. There are jobs where all you need is a smartphone or computer. There are almost limitless opportunities to make some money on the side.

Money Comes Instantly

Millennials aren’t patient when it comes to getting their money. Services like Venmo and PayPal send and receive money instantly. Whether it’s a friend who owes you money or you’re buying something off of eBay, the transaction can be completed in an instant. While it’s mainly domestic at the moment, there are sure to be more and more international features soon enough.

Digital Currency Is Real Currency

People laughed at Bitcoin in the early days, but recently hit a three-year high, being valued at $1,000 in trading. Bitcoin also launched the starts of a ton of imitators and competitors. You can spend cryptocurrency wherever it’s accepted, making it actual currency that’s used largely by young adults. And it’s still in its infancy.

Recently, Pavel Bains wrote a piece for CoinDesk saying he believes individual cities will soon create their own digital currencies. He argues many cities would strengthen by having a currency that meets their own interests rather than the national ones. In fact, Liverpool, England just introduced its own digital currency in early February. It uses an app-based service that records transactions on the Bitcoin blockchain network.

Because millennials are partial to it, digital currency could get even more widespread with these implementations. Though it might not ever replace credit cards or cash, it could establish itself as a popular form of money.

The Relationship With Banks Is Changing

Most millennials have grown up with computers all of their lives. Therefore, it makes sense they want digital services from their banks. They don’t want to have to walk into a brick-and-mortar bank branch to make a deposit. Therefore mobile depositing and banking apps have been growing more widespread. Even small local banks are getting in on it.

Banks are also trying to satisfy the instant money desire by introducing real-time payment services. Virtual wallets and cardless ATMs are on the horizon, too, if they aren’t already in place at institutions. With millennials’ desire for digital, banks are adapting to keep attracting new customers.

Coupon Clipping Is In the Past

Millennials don’t want to waste their time clipping coupons to take to the store. They’re all about quickness and efficiency. Therefore, rebates are becoming super popular. Instead of saving money upfront, they get cash back after shopping.

Some apps link to your loyalty cards, while others work by submitting a picture of your receipt or scanning the code. You can get straight up cash or use the rebates you earn toward various gift cards.

While utilizing both coupons and rebates could save the most money, millennials choose the less-time-consuming option. They value their time more than they value getting an extra 50 cents off of a carton of orange juice. Not to mention, this generation will travel in order to pay less at a different store, having done their complete research beforehand.

Less Haggling, More Fixed Prices

The dreaded days of spending your whole day at a car dealership trying to agree on a price for a vehicle are hopefully coming to an end. Millennials are used to researching and buying everything online. They do their research before they get to a dealership and usually have their mind made before they get there. They aren’t looking for a salesman. Sometimes they don’t even want to go into the dealership.

It’s tricky to eliminate all the negotiating, like when trade-in values come into play, but car dealerships are molding to the demands of millennials. Tesla has already been selling cars at fixed prices, and General Motors and other brands are starting to follow.

Money is changing, and that’s a fact. The world is shifting to accommodate the demands of a new generation. Who knows what’ll come next?

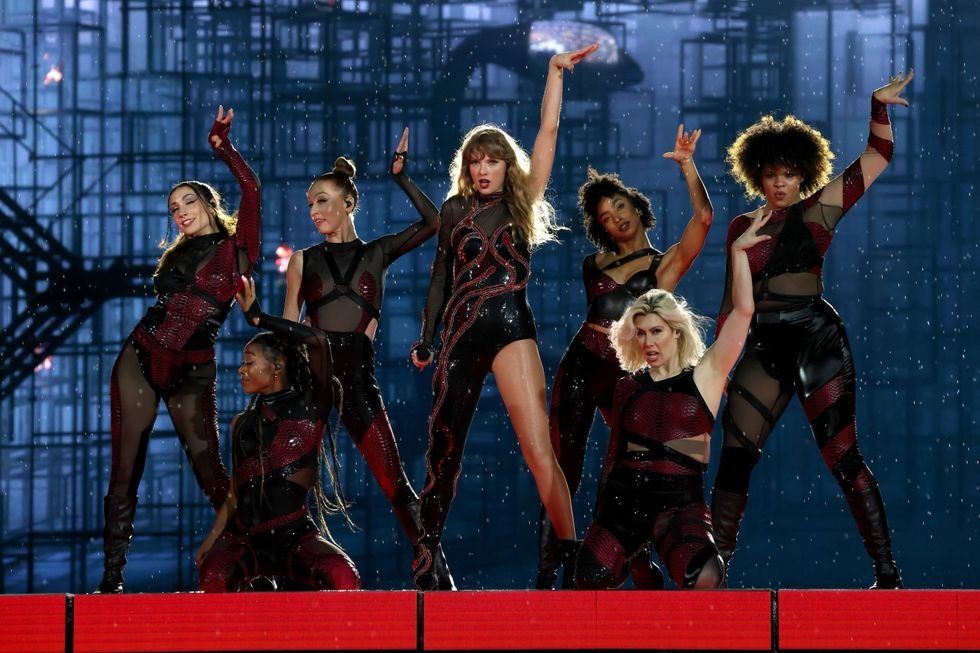

Energetic dance performance under the spotlight.

Energetic dance performance under the spotlight. Taylor Swift in a purple coat, captivating the crowd on stage.

Taylor Swift in a purple coat, captivating the crowd on stage. Taylor Swift shines on stage in a sparkling outfit and boots.

Taylor Swift shines on stage in a sparkling outfit and boots. Taylor Swift and Phoebe Bridgers sharing a joyful duet on stage.

Taylor Swift and Phoebe Bridgers sharing a joyful duet on stage.