Okay, ya'll. I am here to tell you that I am going to challenge myself to what seems like an impossible feat this day in age. I have asked around at lunches with friends, strangers on the street and even at my new job at the bank.

The one question that burns in everyone's mind.

How do you become a super saver?

It seems like such a tedious task. Attempting to save for a vacation, working towards paying off a credit card debt. Heck, even saving a little extra cheddar for a rainy day can sometimes feel like its disappearing into thin air. It can all pile on so quickly and the weight can be overwhelming.

That's why I've decided to dive head first into "super saving" and let you know how it goes from here on out! I've compiled a short list of ways to start saving that may seem like a small, even silly start, but when you really think about it, it adds up quickly.

Savings Account

I have honestly never utilized a savings account up until the past two months. I didn't see the point. I thought that I could just set aside some money on my own, but I soon found out that I'd quickly burn through that. But I am here to tell you that there are many ways to help yourself save and opening a savings account, although obvious, is one of them. I am an "out of sight, out of mind" kind of girl, so I have set up an account where a small portion of each paycheck moves directly into this separate account, so I never have to actually see the money moving from one account to another. I honestly rarely check my savings account because I want to keep it as an "out of sight, out of mind" thing. Example: If you put aside just ten dollars each paycheck and say, you are on a weekly pay cycle. Ten dollars each paycheck adds up to 520 a year! And if you have it automatically transfer to your account, you never have to even see yourself save! It's magical!

Bonus: Having a savings account can help you protect your finances! God forbid anything happens to your checking account, you still have the peace of mind of a separate entity that is your savings account.

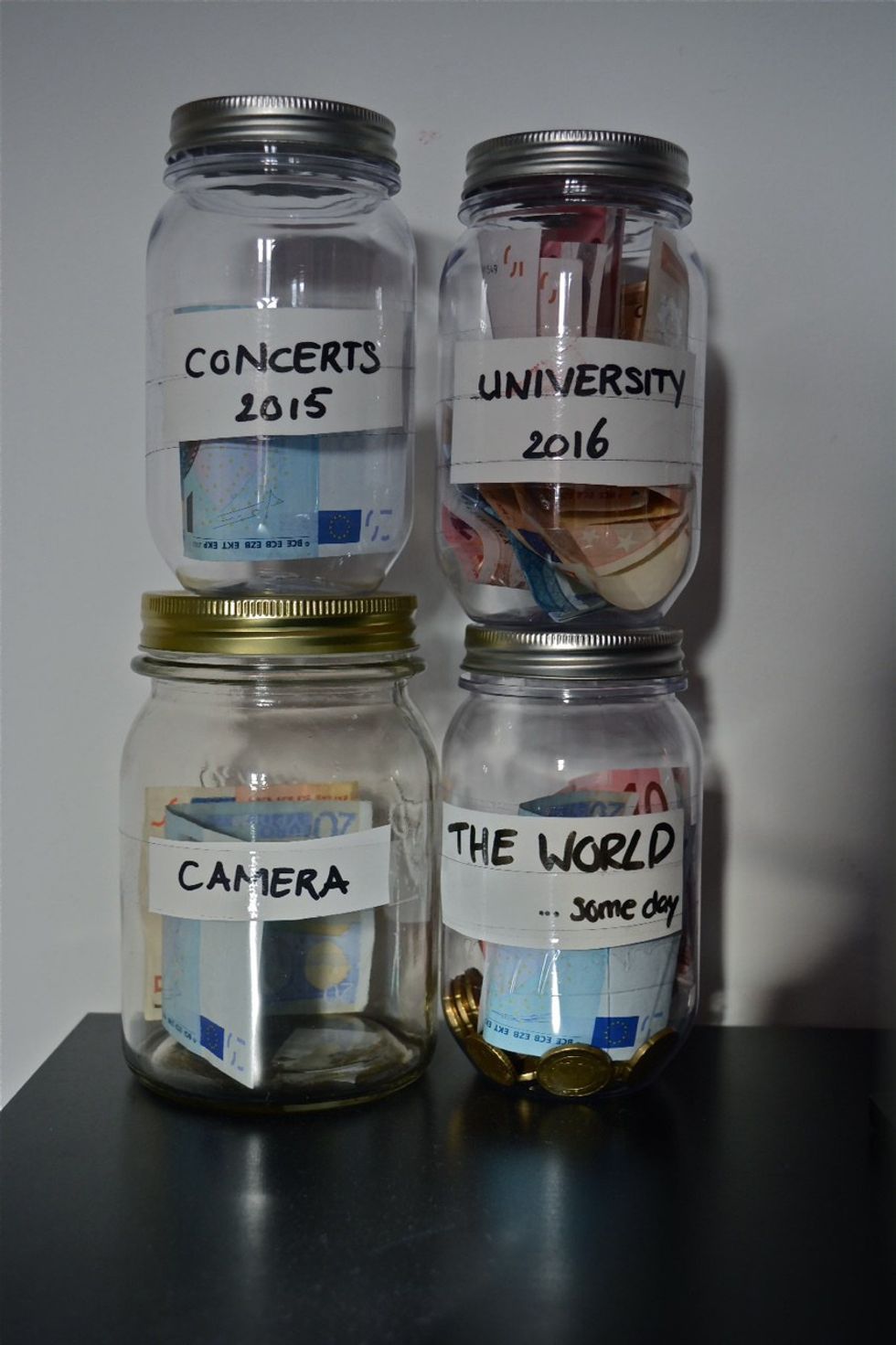

Change Jars.

This one I actually learned from my Aunt. We went to lunch one day and she was telling me about all the quirky ways her family used to save when she was younger. Her big thing was change jars. She has paid for at least two vacations that I know of just by utilizing a huge jar to collect dollar bills and change. She and my Uncle save up all year, then she gets all of the change out and counts it out, rolls the coins up, and takes it to be converted. Voila, plane tickets!

My version: I have two small change jars, as I am now becoming more of a cash person. I have been obsessed with my card for far too long. Any change that I have goes into either pennies or silver. If you really want to become a smart saver and if you have the space, create a jar for each of the coins! That way you can roll them up and not have to sift through the various coins to get the right amount for a full roll!

Have as many jars as you need to! It will all add up to the bigger picture!

The Five Dollar Bill Game.

Now this one I have actually been wanting to try. I have just begun implementing it and I have actually heard great reviews on this little game. I originally heard about it when I was grabbing a bite to eat with a friend. She saw that I was going to pay for my meal with a five dollar bill and she insisted that I save it and put it away. "It's how I save for vacations," she said. I shook my head, putting the bill back into my wallet and selecting a ten. She opened up her wallet to show off her collection of five dollar bills that were ready to get put away into a savings jar. She saves them all month, then puts them into her savings account at her bank. And depending on how much you utilize cash and are willing to pack away, you could be saving a lot of money in the future.

The Splurge Saver.

So, this one I also learned from my friend. I love my Starbucks iced coffee (with caramel and coconut milk.) and on average it costs around $3.13. So I put aside at least the minimum aside each week. Just one cup of coffee each week away into a savings account. $3.13 x 52 weeks in a year = $162.76 a year in your pocket. Now, if you wanna be a bold daredevil and save two coffee drink prices a week that is $6.26 x 52 = $325.52 a year!

Now, I'm not saying that you need to jump head first into the savings world, because trust me I know how hard it can be on those millennial streets. But even starting just one of these saving techniques can really put you in a much better spot. What if you have a family emergency? Or you lose your job? Smart savers have on average three to six months salary. It was a statistic I learned on the job and I was blown away. I feel so far behind!

But I know it is possible to become a super saver. And I know you can do it too!

Here's to the happy savings and the many awesome vacations overseas, the house on the lake, or the credit card paid off! You can do it! Just start small and let yourself get comfortable, then challenge yourself to save even more!