Sunday July 5, while Americans around the world recovered from their Independence Day hangovers, a major breakthrough in the future of international currency was underway in Europe. Across the pond in Greece, the senescent nation shocked the world when a bailout proposed by international banks was rejected after the Athenian government placed the vote in the hands of its people.

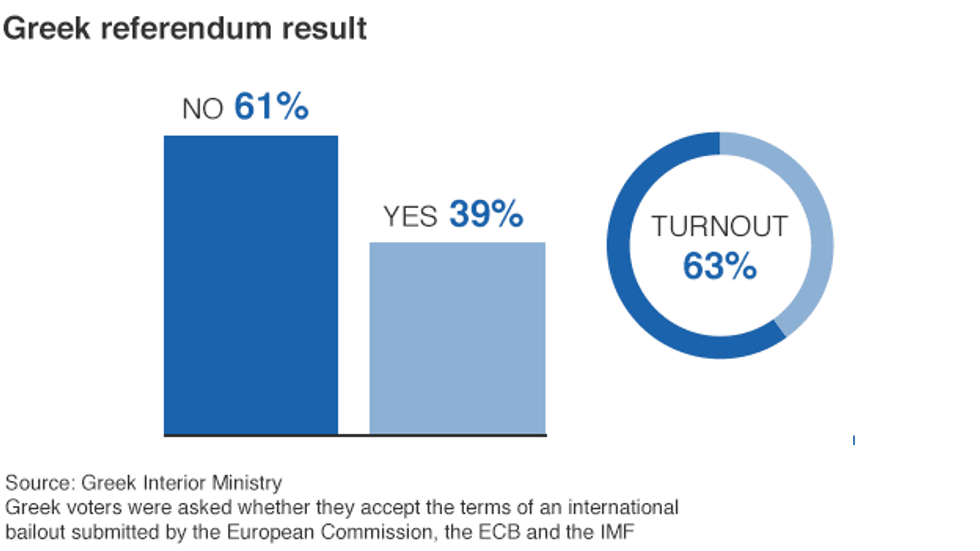

The referendum, which as I type is continuing to undergo official counting, was published by the interior ministry unofficially as 61.3 percent "No," against 38.7 percent who voted "Yes." The results of the referendum reflect a nation polarized by a stagnant economy, which over five years ago sought a bailout from other eurozone banks.

Greece’s government is spearheaded by the Syriza party, which has been characterized as anti-establishment.

While many spell this decision as a death sentence for the Greeks in terms of rebuilding a functioning economy, Prime Minister Alexis Tsipras said late on Sunday that Greeks had voted for a "Europe of solidarity and democracy."

The people may have voted "no" on this particular referendum but Greece is not out of the woods yet. Despite some European officials' claims that a "no" would be seen as an outright rejection of talks with creditors, Athens prepares to reinstate discussion of a deal that would better benefit the Greek people.

Such national bravery, when the future of the nation is at stake, is motivation for other countries to seek a fairer deal in the fight for stability. It is clear that the Greek debt requires a long-term contingency plan: However, after five years of empty promises the Greek people have made clear their intentions to establish their future upon pro-Greek terms.

On the other end of the controversy sits the conglomerate of nations and private banks which control the influx and regulation of wealth among the European nations. Leading finance ministers claim this referendum result was "very regrettable for the future of Greece." Germany's Deputy Chancellor Sigmar Gabriel went so far as to say that future resolution of the situation is "difficult to imagine." To me this is little more than a bluff.

I say, where else but the birthplace of democracy would a people unite in an adamant stand against a multinational bully as powerful as the European Union?

Aside from the clear positivity this act brings to Greece, there is still concern for the large percent of Greeks deeply unhappy with what has happened. The government is now tasked with uniting a divided country.

Moreover, if Greece wishes to move forward, its government must turn back and strike a new deal with the association of both national and private banks vying for control of the helpless nation.

To stimulate the economy, Greek banks will need another injection of emergency funds, which are already described as being extremely low. This will need to come from the European Central Bank, a bank Greece just publicly defied. Many look to this noble act as a spark for other failing european countries to follow suit. Countries such as Spain and Ireland also face similar economic crises brought on by eurozone regulations. Greek bravery may just lead to a domino effect that could change the course of European history in a manner not seen since the removal of the Berlin Wall.

After declining to give Greece more emergency funding last Monday, the European Central Bank has effectively forced Greek banks to shut down. BBC reports: “Withdrawals at cash machines have been limited to €60 per day.Greece's latest bailout expired on Tuesday and Greece missed a €1.6bn (£1.1bn) payment to the IMF.”

Worldwide, officials theorize that these acts may be the precursor to Greece leaving the eurozone.

The fate of the world economy may just hinge upon how Greece negotiates this crisis. If they choose to finally leave the Euro, they risk not only personal bankruptcy, but also threaten to unravel the European Union as Europe itself faces weak economy and lack of growth. Only time will tell how pivotal of a role this referendum will play in the fate of international commerce.