FTX was revolutionary. Its rise was as meteoric as its downfall, seemingly shattering the very ethos of cryptocurrency in the process. But one key stakeholder group is noticeably missing in the emergent post-FTX discourse: university students. That needs to change.

According to College Finance, 20% of college students have used student loans to pay for crypto investments in 2021, with the number of them trading and investing leaping by 500% at the top exchanges. Their rationale is twofold – profit and accessibility. Crypto offers a myriad of ways to make money, and as the average college student takes on $32,880 in student loan debt, money is always welcome. Crypto trading has also become a faster and simpler process characterized by easy transactions and low fees. In short, an excellent option for university students looking for opportunities to outsize their earnings.

But what does this mean following FTX’s collapse?

The problem boils down to the fact that, up until last week, FTX was perceived as a “blue chip” crypto company, one that held the line as its competitors crashed in the volatile crypto space. In fact, FTX’s stability appeared so indubitable that it was bailing out other crypto companies. Investors didn’t see FTX as a company to worry about.

That blithe belief unraveled quickly. FTX faces a class action lawsuit by its holders for causing billions of dollars in losses on the crypto exchange and for essentially gambling with customers’ accounts. Millions of FTX account holders lost money as a result. Given that FTX was also the fifth largest crypto exchange by volume before its downfall, it’s likely that college students invested in it.

This means that even crypto companies vetted as safe and secure can crash just as easily as the volatile ones, putting even pragmatic student investors at risk of losses. With more and more college students investing in crypto, it’s important for them to be validated as stakeholders in crypto space discourse. College aged investors often have less money and less market expertise going into the process, so including their interests and needs in the post-FTX crypto conversation is critical in leveling the playing field. Since the goal of crypto is democratizing access to financial services, a good step forward is intentionally making space for student investors.

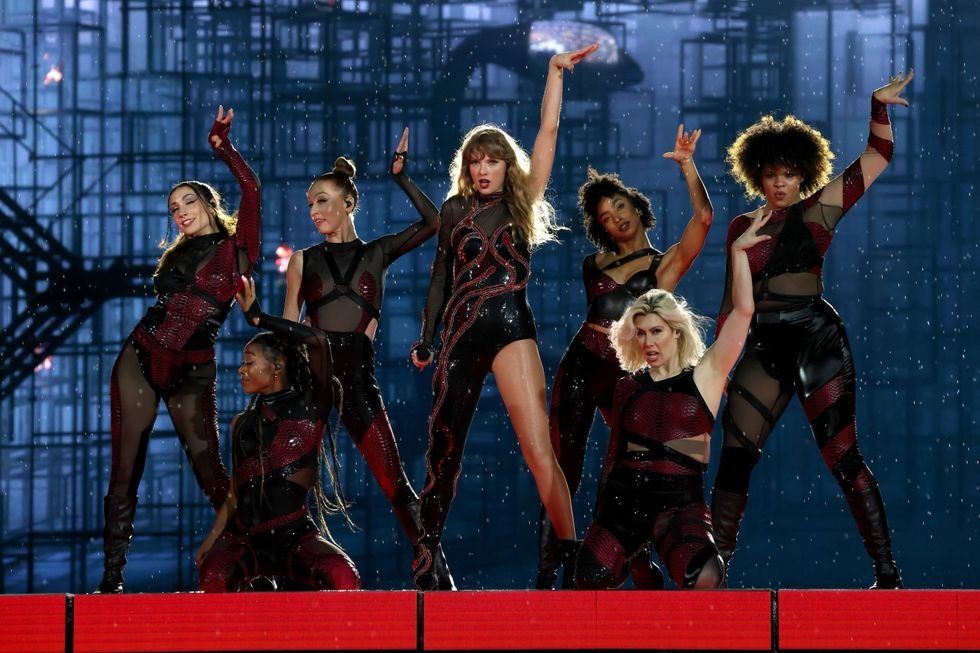

Energetic dance performance under the spotlight.

Energetic dance performance under the spotlight. Taylor Swift in a purple coat, captivating the crowd on stage.

Taylor Swift in a purple coat, captivating the crowd on stage. Taylor Swift shines on stage in a sparkling outfit and boots.

Taylor Swift shines on stage in a sparkling outfit and boots. Taylor Swift and Phoebe Bridgers sharing a joyful duet on stage.

Taylor Swift and Phoebe Bridgers sharing a joyful duet on stage.