President-elect Donald Trump will face a world in transition when he is inaugurated in January. There are a series of issues in every geopolitical theater across the world that the U.S. has strategic interests in. From the hell that is Syria and the battle for Mosul in Iraq; from the foundational crises that Europe faces to the geopolitical chess game in the East Asian seas, the United States faces issues that will affect the world for decades. As the future President, Donald Trump will be at the helm of many of these decisions. Over the next few articles, I will attempt to illuminate these issues and explain their significance and what interests the U.S. has. Last week, we talked about Grexit. This week, we’ll stay in Europe and talk about Brexit.

Brexit refers to the referendum held in England in June in which the British electorate voted to exit the European Union (EU). Following the results, British Prime Minister David Cameron of the Conservative Party resigned, replaced by Theresa May. PM May then confirmed that she would pursue Article 50 of the EU founding treaty to commence the two-year long process of withdrawing from the union. She also made clear that there would be no recount effort or an attempt at another referendum to change the result. In doing so, Theresa May is honoring the results of a wholly democratic process, no matter the consequences.

The EU is a political union of 28 European countries with a combined population of over 500 million. It is the largest free trading zone in the world, in which goods, services, capital, and people can move seamlessly from one country to the other with very few legal hoops to jump through. The right to freedom of movement allows citizens of one EU country to move to, work, and live in any other EU country, while free trade allows commerce to flow without barriers. These two rights under the EU have economically and politically integrated Europe to a level that no other continent enjoys. The EU has also provided stability. European history is violent as hell. I only half joke when I liken European history to interrelated royal families waging war against each other, before invading the rest of the world. The EU emerged in part as a social experiment to integrate the continent so that the specter of war would never haunt Europe again.

Britain has just elected to leave this social experiment. As my favorite red herring protagonist would say,

GoT references ftw

By invoking Article 50, which PM Theresa May has yet to do, Britain will have two years to formulate an exit plan. During this time, Britain will negotiate with other EU countries to retain free trade rights and special access to the EU market, outside of the EU framework. Without such agreements, Britain may have to pay tariffs and other barriers to trade for doing business with other EU countries. As a global financial capital, London often serves as the gateway for companies looking to launch into the rest of Europe. London is also a big start-up capital, with thriving finance and real estate sectors. If Britain were to lose all or even part of its free trade status, however, many of those companies may look to relocate to places where doing business will be easier. Losing free trade status may also make consumer goods more expensive for all British citizens, as imports from the EU will face more taxes that are just passed onto the consumer.

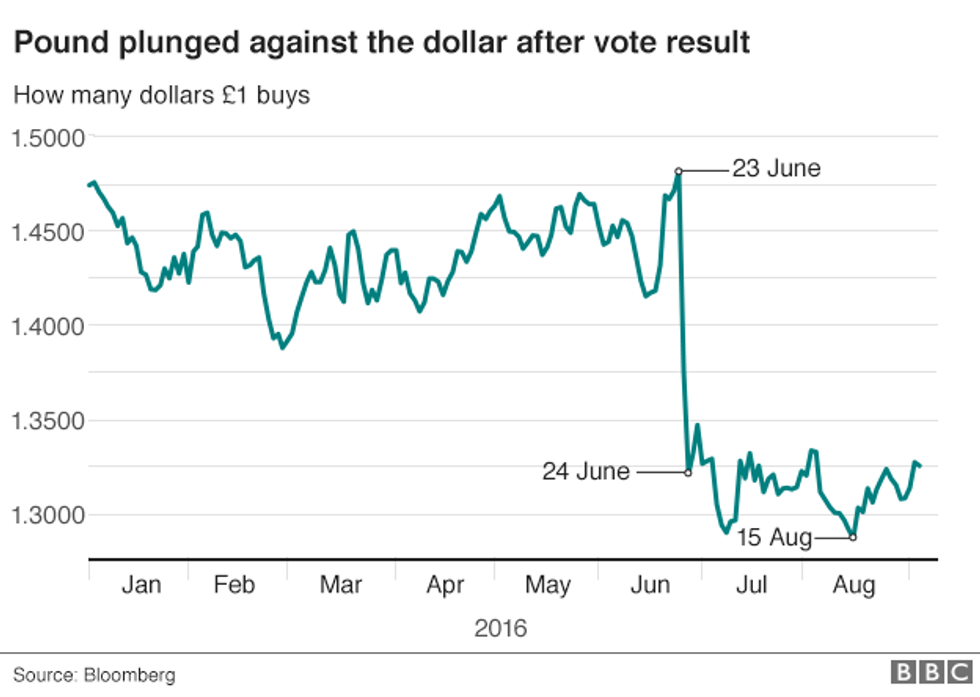

Leaving the EU will also have unforeseen consequences. The British pound is a freely traded currency. As such, the financial market freely determines its value relative to other currencies around the world. The sterling pound has traditionally been the most highly valued currency in the world, even higher than the dollar. Yet that measurement can and does change on the fly for a shit load of reasons, and global investors are notoriously fickle in the valuation of currencies. After the June referendum, the pound fell to its lowest levels in years, nearly falling to an even £1:$1 parity. It’s regained some value since, but such a shock can easily happen again if the British government fails to come up with worthy free trade agreements that will compensate for stepping out of the EU.

Before and after

that kind of drop is great for a roller coaster- not so much for a currency

EU migrants living in Britain also face an uncertain future. It was by the sanctity of the EU that European migrants were allowed to work and live in Britain without being British citizens. Now these rights are being called into question. This is also where the language of a “hard” and “soft” Brexit fit in. A so-called “hard” Brexit is a deal with the EU that rejects the right to freedom of movement of people between the EU and Britain. While many Britons who are anti-immigrants may support this position, it comes with the lack of access to the EU markets. So, goodbye immigrants and hello higher prices. A “soft” Brexit, on the other hand, refers to the continuation of the freedom of movement of people in exchange for free trade access to EU markets. This is seen as more of a compromise and is similar to Norway’s current relationship with the EU. A “soft” Brexit is now the best hope for those who favored remaining in the EU, while Eurosceptics are pushing for a “hard” Brexit.

Brexit is another foundational crisis for the EU. While Britain is not a founding member of the EU and was not part of the Eurozone, its withdrawal from the Union is a nonetheless a punch to the gut. With the ongoing refugee crisis, overt aggression from a resurgent Russia to the east, and the specter of a potential Grexit, this development could not have come at a worse time.