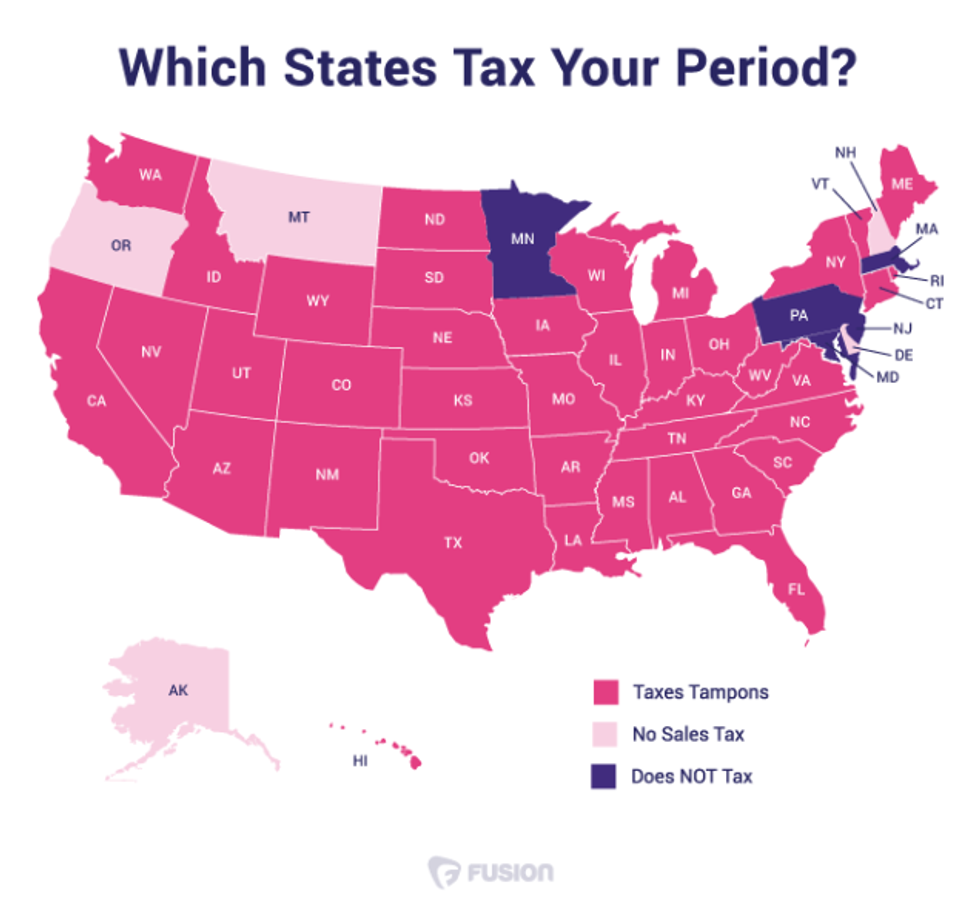

Chapstick, dandruff shampoo, and Viagra are three of thousands of items that are exempt from sales tax in many states in the United States. But noticeably missing from the list: menstrual products. This phenomenon is known as the "pink tax."

Why does the Tampon Tax matter?

Periods have been taxed since 1973. In the United States, nine states have exempted menstrual products from their sales tax, and legislation has been introduced in seven states with an attempt to do the same. Three of the seven — Nebraska, Virginia and Arizona — introduced their legislation this year.

What are women doing about it?

Jennifer Weiss-Wolf writes about what she calls a lack of "period equity" in her recently published book, "Periods Gone Public." Weiss teamed up with Laura Strausfeld, a lawyer looking to combat the tampon tax, and started an organization called Period Equity, that works on legal cases and legislation across the country meant to combat the tampon tax.

Period Equity's most recent undertaking was a public service ad starring celebrity Amber Rose, which was released on YouTube. She opens the charm on a diamond necklace to reveal a single tampon. "Where else would you keep something 36 states tax as a luxury?"

Notably, some states don't tax items such as pregnancy tests (Colorado), disposable heating pads (Vermont), or incontinence pads for bladder dysfunction (North Dakota, Connecticut)— but still tax tampons. Other states, such as Alabama, even have "tax holidays" in the summer when everyday items normally subject to sales tax (clothes, computers, art supplies, and books) are duty-free for a day or weekend—yet feminine hygiene products are still taxed.

Do other countries have the Period Tax?

INDIA- 0% Tampon Tax rate

India has scrapped its 12% sales tax on all sanitary products following months of intense campaigning from activists.

Campaigners argue that the tax would make them even more unaffordable in a country where approximately four out of every five women and girls already have no or limited access to necessary items, such as menstrual products.

Periods are one of the leading reasons why girls drop out of school in India, while many are forced to stay home and miss crucial education due to a lack of sanitary products. Some women use cloths or rags, which if dirty, can increase the risk of infection for many women and girls.

AUSTRALIA – 10% Tampon Tax rate

CANADA – 0% Tampon Tax rate

Canada's government said it would support the motion to remove its Goods and Services Tax (GST) from feminine hygiene products.

FRANCE – 5.5% Tampon Tax rate

The French government has recently reduced sanitary tax from 20% to 5.5%

GERMANY – 19% Tampon Tax rate

ITALY – 21% Tampon Tax rate

UNITED KINGDOM – 5% Tampon Tax rate

In the UK, women began paying 17.5% tax on sanitary products such as tampons and pads because the government deemed them "non-essential" items. After a lot of campaigning, that same 'period tax' was dropped to five percent in 2001. For any given product, the "women's" version costs an average of 7 percent more than similar products for men. Personal care products topped the list at an average of 13 percent more for women. Even something as universal as a bike helmet at Target costs $14.99 with sharks on it and $27.99 with unicorns on it.

Where menstruation is a healthy and natural part of a woman's life, menstrual products are subject to a tax, as they are deemed "luxury items." A lifetime supply of these products -- approximately 17,000 tampons and pads per person -- will cost thousands of dollars.