So, you're a full-time student. You might even have a job to get you by, even with an array of assignments in front of you. With so much going on, you still need to manage your GPA. But the question is, how are you actually managing your finances?Your personal everyday purchases.

If you're a work-a-holic and a go-getter, you understand the principle behind discipline. Making flash cards, getting ahead of the game, clocking-in early...

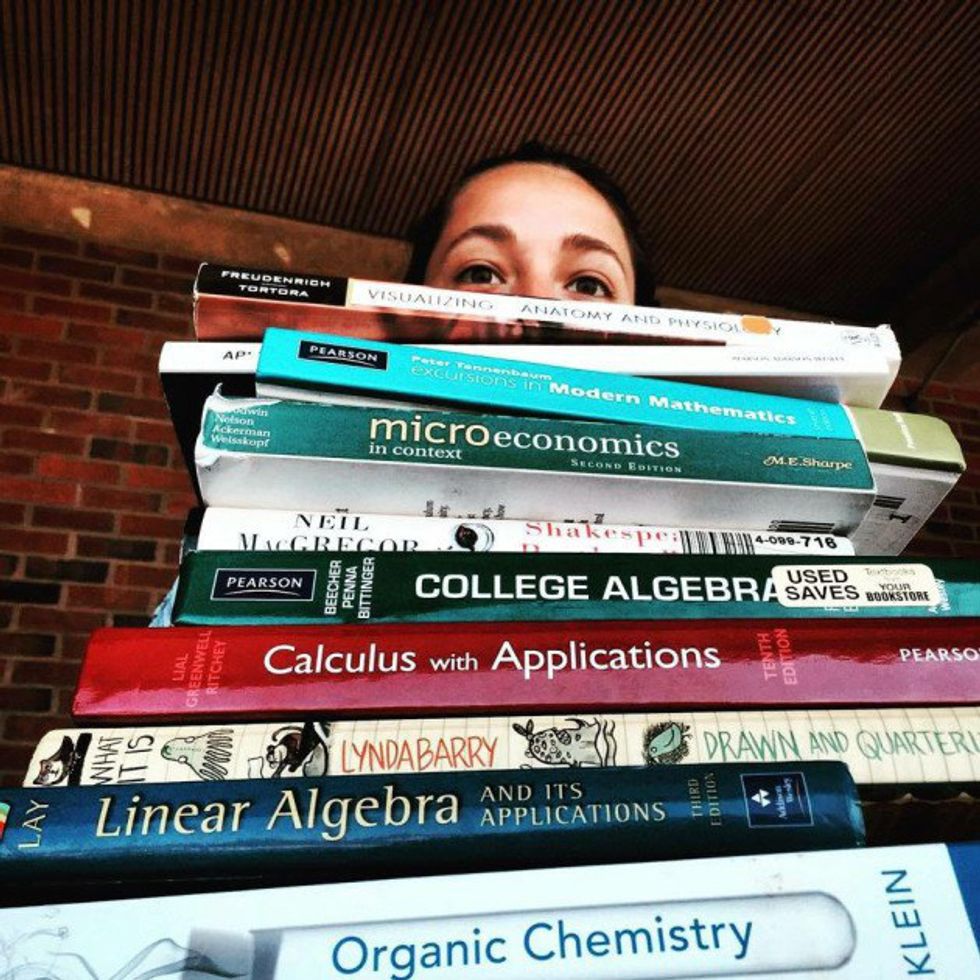

If you're not finishing up an online assignment, you're in the library cramming, and if you're not already stressed enough, your boss calls you in. Sound familiar? Your eyes may feel detached at times because they've been latched on to a computer screen or a text book for what may seem like forever.

Because of your crazy-busy schedule, you're health, social life, and emotional life may get tangled at times. Being twenty-something years old in this day and age, you're considered lucky getting a nice, full night of sleep.

The good news is, you can develop and form patterns. Here are some simple, effective ways to save you time, money and stress, in college. All it takes is a couple of personal investments here and there:

1. Place Limitations:

That means, no buying the same coffee every day for your 8:00 a.m. lecture, that is if you don't have a meal-plan. Brew your own cup, in your dorm or at home, and bring it to class. You'll save the trip, the tip, and will give yourself a pat on the back. If waking up 15 minutes earlier to brew your coffee, pack a lunch, and bring a water bottle to class saves you some cash, that's what I'm talkin' about.

Pack. Pack. Pack.

Never over do it.

2. Buy Used:

Helpful websites and sources are out there, people! There are even resource centers on campus that will help students get books, for free! Yes. Research your professors, their teaching style and books, ahead of time. You will be thankful you did later.

Here are three helpful websites:

http://www.chegg.com/books?gclid=CMSHvOy08tECFYtXD...

http://www.textbooks.com/?kenshu=bc4d7e02-091c-4d6...

https://www.amazon.com/b/?ie=UTF8&node=465600&tag=...

3. Be careful:

When having a credit card, it's not just swipe, swipe, swipe. And when having cash on you, don't just throw bills away. Watch what you spend. Be wise. Play it safe. If you can't afford the cost later, what makes you think you can afford it now? Why purchase expensive when you're purchasing eduction?

Prioritize. School is always first, everything else, materialistic, is second.

Remember, you can do anything, but not everything.