You probably don’t go a day without thinking about your dining dollars. I know I don’t. When I am waiting in line to buy something, I keep a close eye on other people’s dining dollars as they come up to see where I stack up. However, that probably isn't the best way to budget. I view dining dollars as my own little mini game of self-control and budgeting. I would even say I am more frugal with my dining dollars at times than I am with my real money. I think it is because dining dollars is a set unchanging amount of money and I know by spending it now I am giving something up in the future that is unreplaceable.

I think it is very important to practice safe spending habits in college. When you start spending dining dollars like monopoly money, you can get in a habit of carelessly spending. When you leave college and suddenly don’t have that $760 cushion of spending and Starbucks money, you may be in for a rude awakening. The Average American household spends $151/week on food according to the Bureau of Labor Statistics. That comes out to $21 daily, and according to the US census ,the average household is 2.58 people, which makes the average daily food spending of an individual about $8. On a regular meal plan with dining dollars alone, you have close to $7 to spend a day-- and that’s not even including Dhall. Add in the price of the regular meal play daily and students spend about $28/day on food. And guess what? You already paid for it with your meal plan. There is no shortage of food on campus. Getting used to $28/day is not sustainable for a recent grad--better get used to saving.

I think saving gets a bad rep. Many people think frugality is boring and allowing money to build up in a bank about is pointless. But saving can actually be pretty sexy. Money breeds money. Benjamin Franklin was really on to something when he said, “a penny saved is a penny earned.” With the money I have saved throughout my working years, I have been able to invest and make substantial returns. The world of investing is certainly not boring, yet in order to invest, one must save. I will detail this further in a future article: “ How To Be An Investor. ”

Studies have even shown that saving might actually be sexy. New York Times money columnist Ron Lieber once asked the dating site eHarmony to dig through its 30 million matches made in July 2010, and found that users who labeled themselves as savers rather than spenders were contacted 25 percent more by potential mates. You want to attract that girl or boy behind you in line? Just flash you big dining dollar balance.

So how do I save my dining dollars? Here are a few tips:

1. Dhall is FREEhall.

Although you may sacrifice convenience, and to some people (not me), Dhall may get a little repetitive, it is unlimited on a meal plan. My advice is to get into a habit of going to Dhall regularly and treat yourself with Lou's and Tyler's. If you’re not on a meal plan, make use of your 40 swipes. As a fellow Odyssey writer told me, “if you haven’t taken bags and containers into Dhall, you’re doing it wrong.”

2. Do the math on your coffee.

I love coffee and I will pay up for a good cup of coffee any day. I am not even going to tell you to drink the Dhall coffee because it sucks and I swear there is not a milligram of caffeine in it. But what I will tell you is the best place to get coffee is ETC. ETC, Passport, and Lou’s all use local Blanchard's coffee (which is actually more expensive by the bag than Starbucks). ETC offers the best value as it is $1.95 for a large cup of coffee and comes fully customizable with all types of sugars and creams. The average drink at 8:15, which serves Starbucks, is about $3.25. If you are a coffee nut like me and get coffee 4-5 times a week your coffee bill goes down from ~$240 a semester to ~$150 by switching over from 8:15. That’s big.

3. Know where you can get a better deal.

I love ETC, but it’s expensive. The university certainly takes advantage of pricing power on campus. If you are picking up drinks for your weekend, $1.79 for a 16oz soda or $2.50 for other drinks is a lot. I got a package of Fig Newtons for $6.89. That’s nuts. If you have access to swinging by the grocery store to pick up snacks or 2-liter bottles, do it. You are looking at 30%-40% savings in many cases.

4. Utilize this chart.

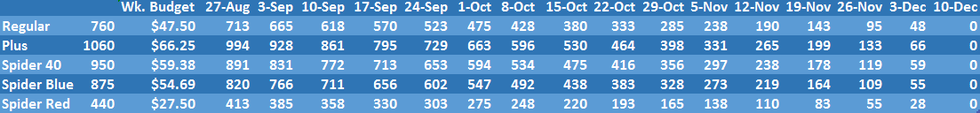

This may be the most useful thing I can show you. This chart references how much money you should have by the end of every week if you are spending it evenly. You can use it to see I can you spend a little more or need to start thinking about saving

Or you can reference this public Google spreadsheet that I will update.

What are your favorite ways to save? Let me know in the comments!

Happy saving.