Credit cards are a major player in your credit score. This is why you need to have one and make sure you use it. Your credit score can be seriously damaged if you use your card in an unwise way. The good news is that the entire process can be completed with a little help from these guidelines.

Here are some things you need to know about building credit with a credit card

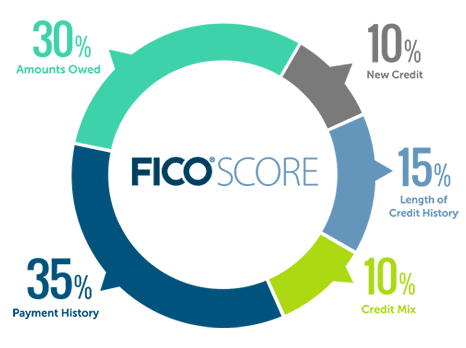

Your FICO credit score, is what you use to apply for credit. There are many factors that go into calculating your score. However, two are more important than others.

Your credit utilization ratio and payment history should be the most important. Your credit score will be determined by how proficiently you use your credit card.

Let's start with the first. It accounts for 35% your overall score. It's more than credit cards. It's also how you pay other credit accounts.

Next is your credit utilization ratio. This ratio accounts for 30% of your credit score. It relates to the amount of credit cards you actually use. It compares the total credit you have been offered to you and how much you carry over your cards each month. A lower balance is better for your score.

What is the Impact of How Many Cards You Have?

How many credit cards do you need? There is no perfect number, but at least one credit card will help you build your credit.

Research and credit scores both show that responsibly using your credit card is more important than having too many. This means that you should look at how much you use your credit and the history of your payments to see what your credit score really looks like.

Even though you don't necessarily need many credit cards, it could be beneficial to have a few. Instead of having one card and a higher balance, you could have smaller balances with each.

It is important to remember that credit utilization doesn't necessarily depend on the cards you have. It is possible to count a small amount on multiple cards as your total credit balance versus the amount you have available.

The best option is to keep your balances low and pay them off fully. Your payment history will continue to look excellent if you pay the full amount each month.

If you have multiple cards, you need to be careful about how much you spend and what you can afford. It's a problem if you spend too much on your cards and don't pay them off.

To ensure that your cards are paid on time, you must also monitor your due dates.

Tips and tricks to build your credit

Although credit building can seem like a lengthy process, it is possible to make it easier and faster if you take the right steps. These are the top rules that you need to keep in mind to help build credit efficiently and effectively.

1.Don't overspend

Your FICO score will be affected if you have a higher credit card balance. Even if you don't pay it off every month, keeping your credit card balance below 30% will make a big difference.

Your score will be affected if you have higher balances. It is important to remember this if you want your credit card help you and your score to improve.

2.Pay on Time

Some people fall into bad habits, such as paying late bills. However, you can change. It will count more if you miss a payment six-months ago than if it was three years ago. As you progress, your FICO scores will continue increasing and improving.

Your FICO score can be improved and you will be able to obtain better financial conditions.

3. Quality over Quantity

It is not necessary to have more than one credit card, regardless of whether they are general, store, or gas cards. Credit reports will reflect a worse credit score if you have more credit cards. Some people may find it difficult to decline discounts from store cards. Despite this, it is possible to opt out of these discounts.

A store card will usually have a high interest rate and most people don't pay their credit cards in full every month, so they expect to make a lot out of you.

It's hard to not spend money when you have something good. A better credit card will allow you to keep low interest rates, lower limits, and even zero fees. Bonus points can be earned if your card that does all of these things gives you cash back.

4.Start Secured

What if your credit score isn't good enough to get a credit card? You might be able to get a secured credit card.

First, consider how much money are you willing to deposit into your account to obtain your college student card. Secured cards require that you leave this money alone. It gives the card issuer something they can use in the event you default on your payments. The money will need to be in an account with the card issuer, or in an account that they have access. You may be eligible to earn interest on the deposit.

Your money will be taken if you don't pay your bill. The bank won't have any problems doing this. People with poor credit are expected to keep doing the same thing over and over again.

Secured card is great is a good option if you are trying to rebuild your credit but can't get a card.

5.Pay attention to your payments

Remember what we said about payment history? It's important that you use bank reminders, if offered by your institution.

It doesn't matter if it's email, texts, or any other, reminders, or even automatic payments, can make a big difference. Your credit score will improve dramatically if you keep your payments on schedule. Pay more than the minimum.

6.Request an increase in your credit limit

So you are making your payments on-time, your spending is lower, your debt is decreasing, and you're building your credit score. It's now time to think about an increase in your credit card. Your credit utilization is a measure of how much money you spend and how much cash you have.

You can improve your score by keeping your score below 30%. Your utilization rate is 20% if you have $10,000 credit and you have spent $2,000, which is a good score overall.

However, increasing your limit could make your ratio lower.

7.Paying your Credit Card Bills on Time

Are you aware of how important your payment history is? Your credit score is about 35% if you pay your credit cards on time. Your history is important, starting with the first six months and moving backwards.

It's important to have a history if you don't have one. You can pay a bill using your card. Don't go into debt if you are unable to pay the bill. This method should only be used if you are able to pay the card off each month. You don't need to worry about interest when you pay the bill every month.

What is the average time it takes to build credit?

You may be wondering how long it will take. It's not going be easy. Credit history is built over time. It will only increase if you do all the things we have discussed.

It can take a while to make your accounts current. Next, pay your bills on time. Then make sure that you don't spend too much of your account balance and use your cards as intended. You'll have better credit if you do.

StableDiffusion

StableDiffusion StableDiffusion

StableDiffusion StableDiffusion

StableDiffusion Photo by

Photo by  Photo by

Photo by  Photo by

Photo by

Photo by

Photo by  Photo by

Photo by  Photo by

Photo by  Photo by

Photo by  Photo by

Photo by