First, how are you doing? No seriously, how are you really doing? It is a different, weird, trying time for all of us. Some are laid off. Others are now homeschooling their kids. Extroverts are having to make meaningful conversations with curtains. Many are still risking their health and the health of their family to make sure we all have our basic needs met! If you are in the medical field, a first responder, a grocery store clerk, gas station attendant, or any other essential job that was not treated as such until this pandemic...THANK YOU!

Now onto how to make the best of this situation with your money.

Money management skills and understanding how to budget what little you may have is HARD! And now, it is harder than ever if you are furloughed, laid off, or awaiting unemployment. I have not been an adult during a recession or economic downfall. And it is scary. I do not have a life saving to live off of, because my adult life is younger than Billie Ellish, and let's face it, $5 shots sounds like a much better deal at 22 than it does at 27! Instead of beating ourselves up over what we could have done to prepare for the unthinkable, let's focus on what we can do now, realistically.

It is 2020, you need a budget. That's right, the "diet" word of finances. So if you have not begun budgeting, please pause in the reading of this article and go on over to The Financial Diet or Dave Ramsey (similar tools, and habit building traits to get you on the right track) or to understand big money words and concepts, Napkin Finance. Saving money and budgeting seem almost impossible if you are paycheck to paycheck. It is easy to believe that you need to be "ahead" to start handling finances. I thought that way for years! Recently, I began budgeting and it is now my favorite pass time. I even do it for my Nana! I realized how much money I was throwing away. Once I set down with my super colorful pens and markers to make a budget, I noticed small random transactions on both my credit cars and debit cards that were not necessary! I am a natural spender, I love to treat myself, my friends, family, and agree to processing fees while shopping on obscure online stores. But I noticed those small random transactions was essentially, past me, sabotaging future me's financial security and freedom. So I started small to make me appreciate the money that I work hard for a little more! Enough of me blabbing, here are 5 foolproof ways to save a few bucks!

1. Transit Money- Put What You Aren't Using During This Time Into Savings Or Allocate To A Different Bill.

How much money do you spend a month on transportation? No, for real! How much (BTW--if you had a budget, you would know off the top of your head). I drive to and from work and had a pretty active weekend life. I was spending about $100 a month on gas. Due to the recent shelter in place order, I go to work and come home. I hit the closest store to me on the weekend, for weekly groceries, and that is it! In the past month, I have spent $30 in gas. That is $70 I just saved for the month. That is my water bill...for 2 months.

If you were taking the subway or bus to and from work or social outing, how much were you usually spending to reload your transit card? Same for rideshares. How many times a month were you "responsibly" using uber? Find that average, and put that in a savings account or toward debt or a bill!

2. Create a New "Quarantine" Email To Take Advantage Of Services Offering Extended Free or Discounted Subscriptions. livingonaquarentinebudget@aol.com

Netflix, Tiger King

No, this isn't wrong. You are doing exactly what they want! You are providing yet another email to market to. You will fall in love with their service and talk to friends about it and then once life is back to normal certainty, you can keep your subscription. You do not have to give up your Netflix or Hulu. I mean, come on, Tiger King is the best thing to happen to us all of 2020, Desperate Housewives is on Hulu and It has created a bond between my boyfriend and me that can never be broken. I will suggest creating a NEW email and cancel your current subscriptions and take advantage of the extended free trails a lot of streaming and content services are offering. Head over to The Financialdiet and check out 22 services you can enjoy for free or discounted during this crazy time!

It may not seem like a lot, but saving $10/month can mean having $20 in your account after you pay your bills or $10.... you are literally having your cake and eating it too!

3. Switch To An Online Bank

Chime Bank

Banking has changed over the years. When is the last time you stepped foot inside your bank? Seems like something you would try to avoid at all cost right? Look into online banks that have perks, and auto-savings. A bank like Chime banking. You can get paid up to 2 days early via direct deposit and it rounds up to the next dollar putting the change into an easily accessible savings account. Here is a referral for Chime for you to potentially get $50... in FREE money! You are welcome!

There are several other online banking options that may fit your current or future needs. Head on over to Nerd Wallet to see what is the best for you!

4. Ditch Diet Culture!

You should NOT be going in and out of the store for fresh produce during this time. Meal plan with foods that are not perishable. Foods, that have versatility. You can still remain healthy with canned and frozen veggies. You can still have leftovers and lunches for work if you still have to report, that does not break the bank. This is a time that you can perfect a go-to dish for dinner parties or make yourself proud with a creative meal. Don't focus on organic. Focus on a budget-friendly grocery haul. Below is our menu for the week along with cost...

Grocery list:

Chicken breast (2) $4.56

Bacon $3.69

Eggs $.98

sourcream $1.05

Shredded Cheese $2.50

Canned Corn (already in my pantry) $0.49

Refried Beans (already in my pantry) $0.49

Canned fire-roasted tomatoes $0.49

Grits (already in my pantry) $1.29

pasta (already in my pantry) $0.89

Pesto $2.25

Tortillas $1.39

Tostadas: $0.99

Cauliflower Pizza $5.49

Salad kit (X2)-- $2.49 always grab the bags furthest in the back. they have the latest expiration date!

Monday: Shrimp and Cheesy Grits

Tuesday: Chicken Tostadas

Wednesday: Cauliflower pizza and salad kit

Thursday: Breakfast for dinner

Friday: Chicken pesto pasta

Saturday: Cesar Salad kit add buffalo chicken strips

Sunday: Cheese Quesadillas

This menu is just for dinner, with some creating leftovers, and we are at $30 for a week's worth of dinner--for 2 people! Now we buy more food for snacks and lunches, of course! But what we have listed above isn't junk food. It also isn't the healthiest. But we are able to really make these meals happen without breaking the bank! We do our shopping at Aldi with a little bit of Walmart to offset what we can't find at Aldi.

Oh!... and do not use this an excuse to stock up on Oreos and chips... they may not be as perishable, but don't lie to yourself. They will not last long!

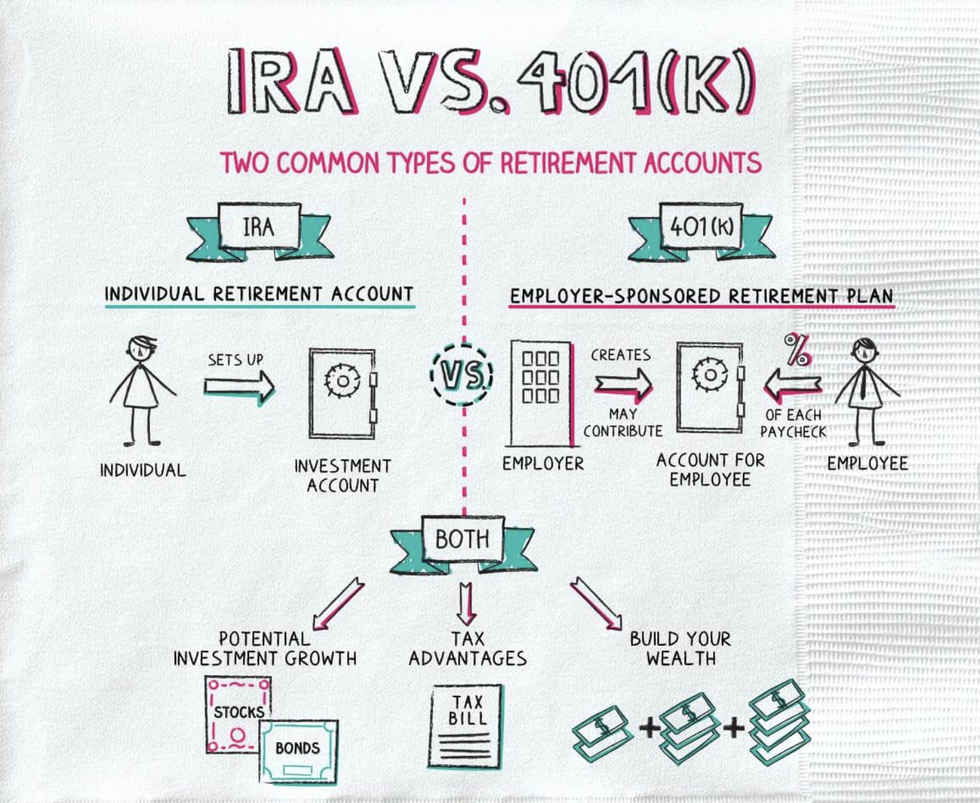

5. Stop investing in your 401k or IRA... relax and trust me (& Dave Ramsey)

https://napkinfinance.com/napkin/401k/

If you are fortunate enough to still have an income right now, and a job that offers a 401k count your blessings. If you are not young and have had the opportunity to have a 401k for some time now, count your blessings. DO NOT BORROW AGAINST YOUR 401k. Just stop investing. If you refer back to the top of this article you will see how I suggested The Financial Diet and Dave Ramsey as learning tools on how to budget and understand your money. These 2 experts want you to be debt-free! When you are trying to climb out of debt you need an emergency fund as a safety net...mainly for times like now!

If you are currently contributing to a 401k or a Roth IRA. Stop. Don't touch your money. Don't move it. Just take that money that you would normally invest and put in savings!

That could be an extra $100 a month at the minimum. If you make and contribute more, then you are looking at more money to put into savings every month. Stop contributing until you are in a place that offers more job security.

This way you can have that extra money to help you out so you can stop using your credit cards, pay off your debt, and then once you are debt-free... you can contribute 15% instead of the standard 3-6%. This time next year you could double your contribution to your 401k or Roth IRA. If you can barely make ends meet or if you are in mounds of debt, who cares if you are contributing $112 of your 45k salary a month if you are in 100k in debt. It's like adding water to a bucket with a slow leak! For now, you need to take care of yourself and your 4 walls (shelter, food, transportation. clothing)! 401ks and IRAs are wonderful investments that will be there ready for you to invest in once you are investing responsibly.

If you were not in a situation to do all of the 5 listed above you can at least do 1! It may not fix all your problems, but here is some tough love for you--fixing money problems isn't a quick process! You gotta work for it and sacrifice even when you think you can't give up anything else!

You can do it. You will make it through this crazy time. We will gain control of our finances. We will continue to share Tiger King memes.

Love you all for reading or skimming.

-P