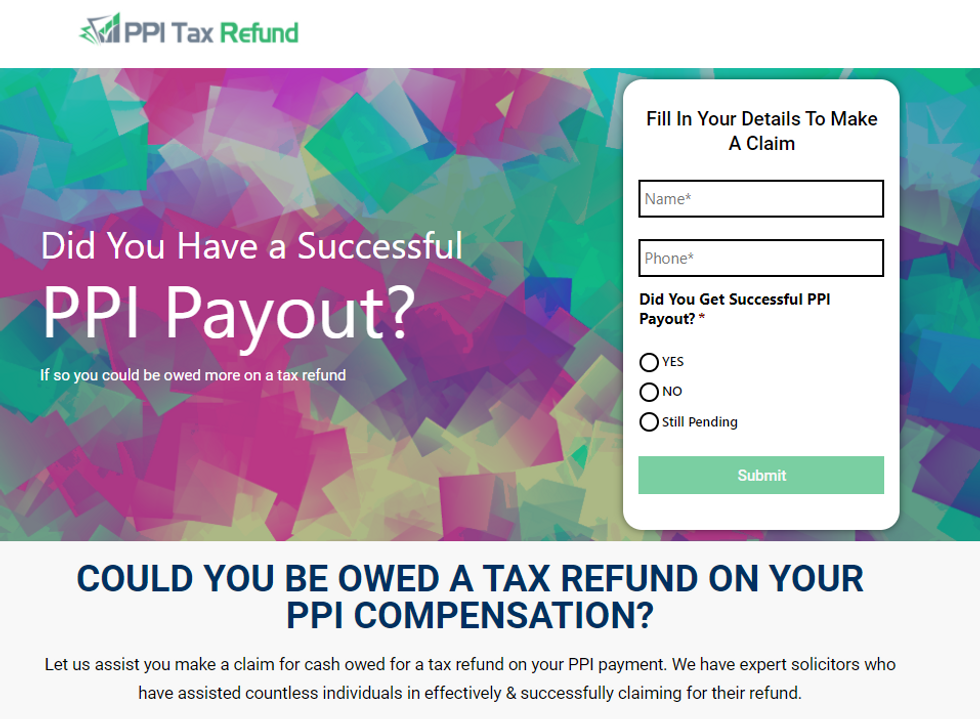

In this guide, we take an appearance at how much money you might be able to declare back from HMRC.

Why can I claim back PPI tax?

On 6 April 2016, the government introduced the Personal Cost savings Allowance, which permits customers to earn approximately ₤ 1,000 interest every year on their savings, tax-free. Nevertheless, due to guidelines introduced by HMRC, 20% tax has still been automatically deducted from all PPI statutory interest payments.

So, as PPI is taxed at the time of payment, if you have actually received any PPI pay-outs since 2016, a tax refund may be due to you.

PPI tax refund estimation

So, just how much PPI tax refund might I be entitled to?

Generally, the statutory interest component of the PPI compensation pay-out that you got was taxed at the base rate of 20%. So, for each ₤ 1000 refund of the statutory interest that you were paid, ₤ 200 was deducted in tax.

Nevertheless, the amount of tax that consumers are entitled to recover differs on a number of things, and the form-filling that's needed to make a claim can be somewhat challenging.

Because of that, we recommend that you let us help you to navigate the minefield of all those complex forms. You can begin the procedure to recover the cash that you're owed by contacting us by means of our online website today. The protected, paper-free service takes simply a number of minutes to finish, it's totally no win, no fee, and we could get you're the refund you deserve in as little as six weeks. It's a no-brainer!

Tax recover entitlement

Because the Personal Savings Allowance wasn't presented up until 6 April 2016, any PPI refunds that were paid out prior to that date are not eligible for a tax refund.

Nevertheless, even if you took out a PPI policy as far back as 1980, supplied that you received the refund after 5 April 2016, you may have the ability to reclaim the tax that was automatically deducted on the statutory interest that you were granted.

I wasn't a taxpayer. Can I still declare?

If you weren't a taxpayer in the year that you received the PPI pay-out, unless the statutory interest payment that you got pressed you over the tax threshold, you are entitled to declare all of the tax back.

I'm a greater rate taxpayer, can I make a claim?

No, unfortunately, those making in excess of ₤ 150,000 are not entitled to the Personal Cost Savings Allowance. Therefore, you can't claim the tax back that you paid on your statutory interest payment.

If you were in the higher-rate tax bracket when you received your PPI refund pay-out, the tax rate you need to have paid was 40%, which you ought to have done through self-assessment. If you didn't do that, you need to notify HMRC.

The clock is ticking!

Presently, you are just entitled to reclaim PPI tax four years retrospectively, consisting of the present year. For the year 2020/21, you can't go back any even more than the 2016/2017 tax year. If you do not act then there's an opportunity you might lose any excess tax paid forever!

Do not wait till next year!

Start our online reclaim procedure today to check if you can make a claim. Don't run out of time to get the tax back that you are owed!

StableDiffusion

StableDiffusion StableDiffusion

StableDiffusion StableDiffusion

StableDiffusion Photo by

Photo by  Photo by

Photo by  Photo by

Photo by

Photo by

Photo by  Photo by

Photo by  Photo by

Photo by  Photo by

Photo by  Photo by

Photo by