Within the past week, I’ve reached a couple milestones and I don’t know which one is more overwhelming -- I finished my first year of college and activated my first credit card. Both of these events have been a long time coming and symbolize my slow but sure transition into the so-called real world. Finishing this school year wasn’t so much a surprise as it was a relief. On the other hand, getting this credit card was quite the experience.

I went into college with no intention of getting a credit card anytime soon. To me, it was an avoidable foe that I wouldn’t have to worry about until I was a lot older. I told myself I didn’t need to be making huge purchases, and I certainly didn’t need an excuse to make lots of small purchases.

Signing up for my first credit card first became a reality during my second semester, when my funds began to run low. I basically blew through my summer savings during first semester. I wasn’t necessarily hurting for cash, and I continued to be my frugal self. It wasn’t until I switched my meal plan to get rid of my weekend allowance did money become a slight problem. Of course my parents were willing to help, but it became annoying for both ends to have to play the cat-and-mouse money transfer game. About a month into the new meal plan, my stepdad recommended I start looking for a credit card.

He assured me that he would pay off my balance every month as long as I was only spending money on food during the weekends. This deal sounded too good to be true, so of course I jumped on it. Alas, it was too good to be true.

Turns out, I had a lot of misconceptions about credit cards. First off, I naively assumed getting the card was a given. I thought it would be like when I got my debit card. Wrong, of course.

My second assumption was that everyone started off with perfect credit, and somehow you got bad credit. Wrong again. I used Credit Karma to look at my credit score and was horrified by how low my score was a 47.

I was terrified and assumed I had done something wrong. Wrong yet again. A decent panic attack later, I came to realize that everyone starts off with below average credit - thus why getting the card in the first place is a hassle.

Assumption four was that all credit cards are created equal. That afternoon was quite the eye-opener.

I spent the next week searching for a card that I supposedly had a good shot of getting. After doing a decent amount of research, my stepdad and I decided on a card. I applied for it, excited to finally get a credit card - and was immediately denied. I was flabbergasted, and so was my stepdad. This card was literally made for college kids and I didn’t qualify for it.

In a huff, I did some more general research into college credit cards and found some not so good news. Credit companies just weren’t giving cards to college kids anymore - even the ones catering to them. There was an expectation for college kids to have better credit, yet didn’t have many opportunities to make it any better. I was instantly reminded of those entry-level job applications that require five years of experience.

Defeated, I gave up on the credit card hunt for a while and took to stocking up on Uncrustables, Hawaiian rolls, and cheese from the student market to eat during the weekends.

My hunt was revisited during a trip to my bank’s physical branch after experiencing a couple unfortunate bouts of fraud. I was just in there to get a temporary debit card when the banker noticed that I was legally an adult, and had been for awhile. She suggested I sign up for their credit card.

My stepdad and I had considered it briefly in the past, but the benefits of the card were lacking and the APR was pretty high (another thing I discovered about credit card). Yet sitting there alone in the branch, stressed, and highly gullible in professional situations, I found myself signing up for that credit card on the spot with basically no parental guidance.

Following the uncomfortable and exhilarating experience of applying, I secretly hoped I would be denied, considering I signed up on a whim. Yet my banker immediately received a notification after submitting the application that I had been accepted. Whether I liked it or not, I had a credit card.

I had them send it to my home address in fear of it arriving to my dorm after I had moved out. When I came home last week, it was sitting waiting for me in my room. I took my time activating it, hoping to delay the whole process.

Truth be told, I was not ready to have that credit card. Not because I’m not responsible enough, but because it symbolizes such a huge moment. Having a credit card means spending money you might not have at the moment, and having a month to either get that money and pay off the bill, or not get the money and start charging interest. Having a credit card means building credit to buy a couch, or a car, or a house in the future. Having a credit card means being responsible for myself in a way I’ve never had to deal with before.

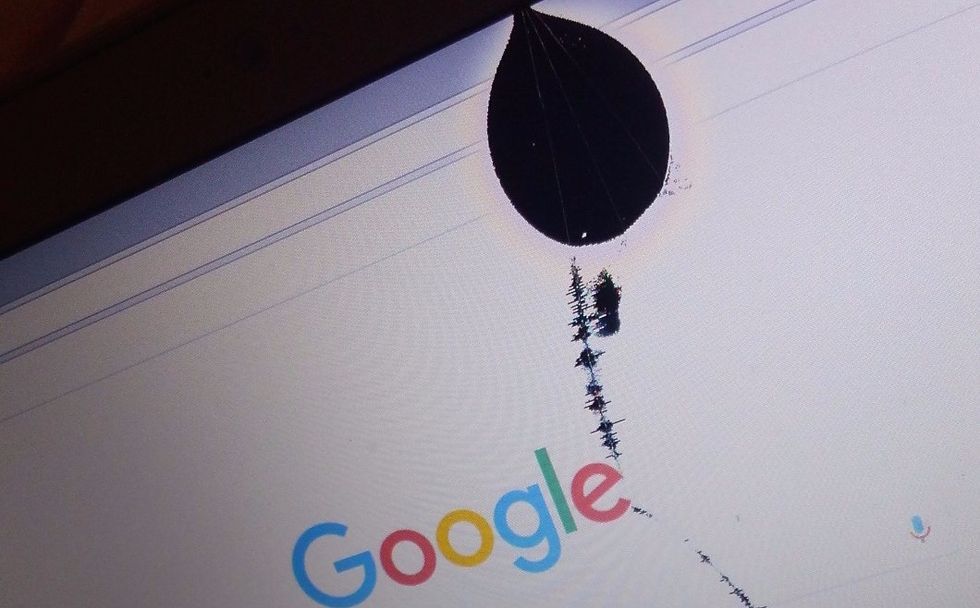

Yet when I opened my relatively new laptop to discover it had a giant crack on the screen and would probably die very soon, I didn’t have to panic quite as much as I would have a couple weeks ago. While I didn’t have the money to buy a new laptop at the moment, I knew I would in about a week. So, I made my first relatively large purchase on my credit card and the whole crisis was averted in less than twenty-four hours.

As a very frugal penny-pincher, spending money I don’t necessarily have makes me wildly uncomfortable and leaves me miles out of my comfort zone. Yet it's also exciting to have the new challenge of paying off this bill every month and the seeing my credit rise. I’m not worried about maxing out my cards on clothes or other novelty items, but I am worried about how accessible sushi is now.