.

When it comes to money, many things matter. And people often forget to work on the perfect ways to earn it, save it and reciprocate it. Money sure does many things. And every time, one focuses on growing and creating wonders. It has to help society and the fellow world to grow with us. Finance and taxes go hand in hand. People often forget to understand that taxes are not cruel. Taxes make society grow and are the route cause to form a good living for the whole set of people. And when you are living in a social setup, it is essential to contribute and work along with it. And its growth. Every product has a tax, and it goes to the government that money accounts for many welfare schemes. But there are many myths about the tax and tax credit company. One has to be clear about this. And as responsible citizens, everyone should be aware of the tax and get their myths cleared.

Why is Tax Essential, and How it Helps?

The state uses taxes to pay for a wide range of social programs, including employment initiatives. The government needs to cover the admin expenses for the hundreds of people in the different departments. The amount that the government obtains is known as income tax and is used for a lot of things, like creating additional infrastructure like roads, bridges, trains, and dams, as well as for defense and civil services.

Myths about Tax Credits

There are many unresolved myths about Tax Credits. People often confuse about these in a Tax credit process and misunderstand the taxing system of the country.

Tax is Optional

Although this may be the most glaring misunderstanding, a surprising number of individuals believe in that. It is because the Schedule instruction book alludes to the taxation system as optional, and they are not compelled by law to actually file. The phrase "optional" has nothing to do with whether or not paying taxes is genuinely a choice; instead, it refers to the idea of how each individual is accountable for determining the specific amount of tax they owe.

The deduction is allowed for home offices

A myth used to be partially true at one period of time. However, as home offices become increasingly commonplace, this once-factual assertion has turned into a lie. While there is more attention when a home office is declared, it is no more need to be hesitant to do so because it is a valid deduction.

Online earnings are tax-free

This idea is still just false. Since the majority of folks doing business online do not even file it and have their earnings disclosed to the Taxing system, it's easy to understand how a notion like this could have started. However, the Revenue sees money generated online in the same way as income generated offline.

My Consultant is Responsible

Regardless of whether you work with an accountant, any mistakes are eventually your responsibility. It's always best to spend some time. And double verify your returns before it's filed instead of assuming your financial adviser has it all done. If you are audited, your tax credit consultant will frequently guide you through the process.

Conclusion

Your tax myths have to be cleared. You need to work clearly with your tax benefits. And it is essential to understand this well ahead.

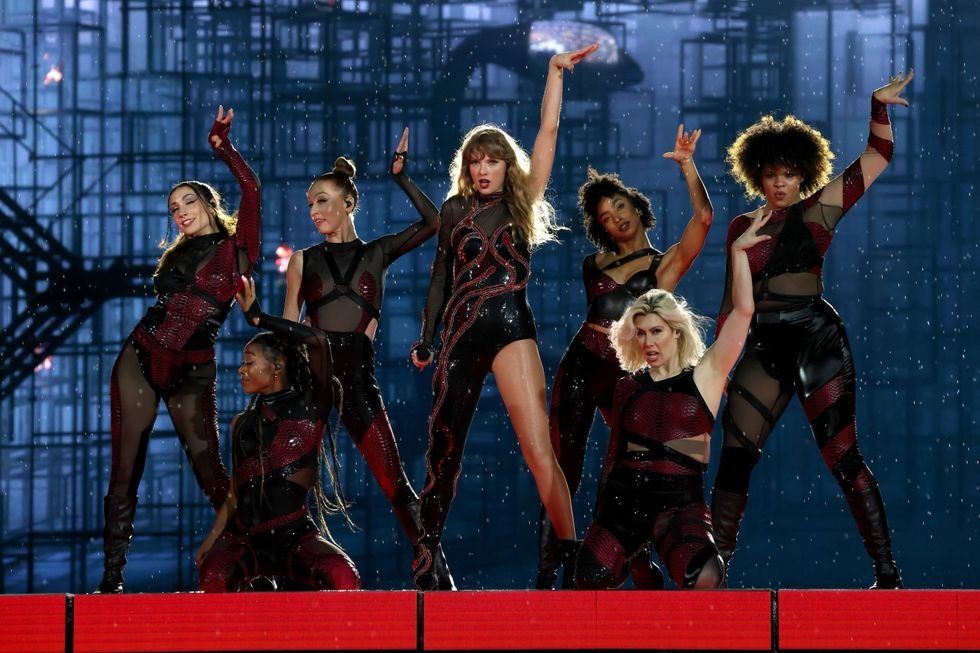

Energetic dance performance under the spotlight.

Energetic dance performance under the spotlight. Taylor Swift in a purple coat, captivating the crowd on stage.

Taylor Swift in a purple coat, captivating the crowd on stage. Taylor Swift shines on stage in a sparkling outfit and boots.

Taylor Swift shines on stage in a sparkling outfit and boots. Taylor Swift and Phoebe Bridgers sharing a joyful duet on stage.

Taylor Swift and Phoebe Bridgers sharing a joyful duet on stage.