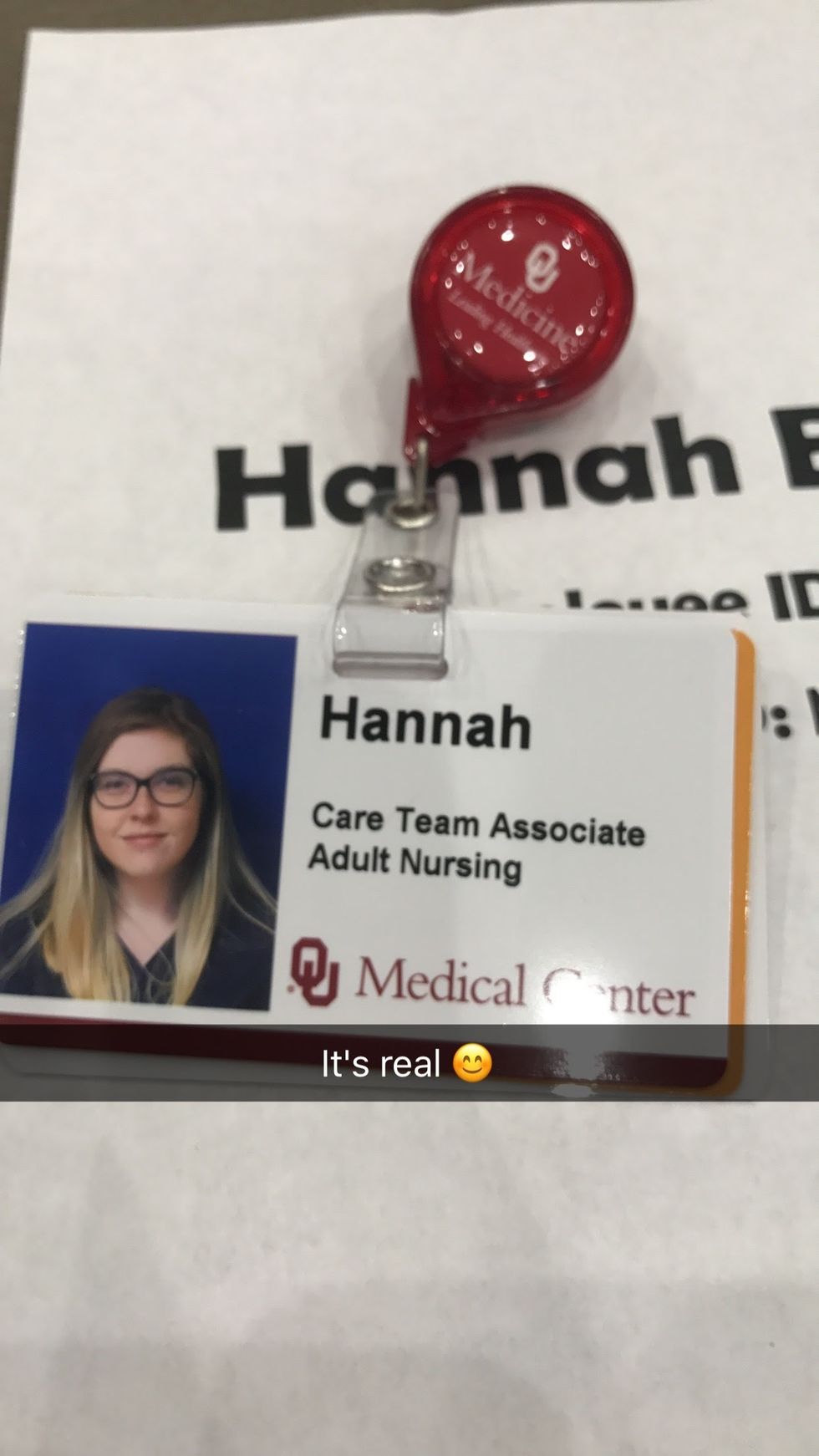

1. Get a job as quickly as you can

Authors photo

Authors photo

If you are really lucky and go to college after high school (and even if you are not), you will need a job.

Not only will it look great on resumes when you graduate, but it will also help you be more self-reliant and maybe help offset unexpected college costs that, let's face it, inevitably come up.

2. The more debt you take, the more it will haunt you

To this day, I still keep up with roughly how much a nurse makes in the state of Oklahoma. I look at least a few times a year because it helps me feel better about the debt I have.

Basically, by looking at my future and career prospects, it makes me feel better about the debt I have.

3. Get a subsidized loan

Most of the time, we will have to take out at least a small loan eventually, and this is one that doesn't accrue interest until after six months past graduation.

4. Having student loans made me realize the value of the dollar

Signing the promissory note made me understand that when I graduate, I will have bills beyond living expenses. It helped me realize that budgeting is a must, and just because we want doesn't mean we need.

5. Student loans won't cover everything

I think when we are young (at least when I was younger), we live in this world in which we look at everything to do with finances through the scope of privilege, which clouds our judgment.

I thought that the world magically took care of everything financially, but it was actually my dad. He made sure everything was taken care of. When we become college kids, we see that the responsibility becomes ours.

6. Apply for scholarships like it's a second job

Everything that leads to scholarships

Pell grants are great, but they wont cover everything, and if you can avoid loans in the first place, do it.

7. Only take what you genuinely need

Be honest with yourself about this number.

Just because you get $5,000 in subsidized and $5,000 in unsubsidized loans, plus private loans, doesn't mean you need all of it. You probably don't even need a tenth of it. Just understand your total finances before taking out any loans.

8. If possible, live at home for at least your first semester/year

One of the many Adventures of Andrew and Hannah

While dorm life sounds appealing (at least it did to me), understand the amount of money you spend on dorms plus a meal plan can very easily stack up to half, if not more, of your total tuition and fees.

A lot of schools require that if you live in a dorm, then you have to purchase a meal plan. While these are convenient, be honest with yourself on the type you think fits the best, and if possible, just avoid the dorm altogether. I saved thousands by moving back home, and I have been so much happier mentally, too.

9. It helped me put in perspective about how much bills are.

The nervous expression about the cost of life

When I signed up for the loan and signed the promissory note, it put things in perspective. I slowly started to realize that when I graduate, the repayment of the loan will have to come out of my monthly income, and the more I took out, the longer it will take to pay it off.

10. If possible, put money into your savings

Sometimes all it takes is pennies.

This will help pay back some of the loan debt as you are in school or if not possible during school years put back as little as $5 because when graduating I know that $5 will add up.

I still have debt. A lot of it. Even with working, in today's modern age it is virtually impossible to come out of college debt-free, and that is OK.

It still weighs on me, but I have learned valuable lessons from it--lessons I would rather know now than 20 years down the road. For that, I am thankful because it has made me much more mature, and I am no longer that naive child who thinks the world magically works. I know better know, and I'm a better person for it.

Incoming Freshmen: please understand bills are expensive, but dreams are bigger.

If you remember that, the debt won't feel like it is caving in on you, which will help your mental health tremendously.