If you have not yet heard of Bitcoins or other forms of cryptocurrency, prepare for your mind to be blown.

"Bitcoins" are virtual coins that hold actual monetary worth and can be used to make real-life purchases. They are the first decentralized forms of currency in the world, and they have endless valuable uses.

Bitcoins can be sent, received, and transferred through the internet via multiple exchange systems. In comparison to other forms of currency, Bitcoins do not have to go through a federal bank or clearinghouse. This means that Bitcoins have very low-interest fees. You can use them in every country without converting them into the respective standard, your account cannot be frozen, and there are no prerequisites or arbitrary limits.

Once Bitcoins are purchased with dollars, euros, yen, etc., they are kept in digital wallets on one's computer or mobile device. From the virtual wallet, a person can buy literally anything, from cars and electronic technology to food, real estate, and more.

Now, one might ask, "How is Bitcoin regulated?" and the answer is very simple.

The Bitcoin network is secured by workers called "miners". Miners are responsible for monitoring every Bitcoin transaction and making sure people are not stealing, hacking, or abusing the Bitcoin system, much like a virtual IRS. Miners are rewarded newly generated Bitcoins for monitoring these transactions, and they verify and record them in a transparent public ledger.

Bitcoin is a great way for businesses, entrepreneurs, and citizens to embark on new innovative quests. Bitcoin is changing the way finance can be used in global markets, and there are hundreds of ways to take advantage of this new platform.

So, now that you know the basics of Bitcoin, let's get into the interesting stuff.

If I told you Bitcoin investing could have turned you into a millionaire in just seven short years, would you believe me?

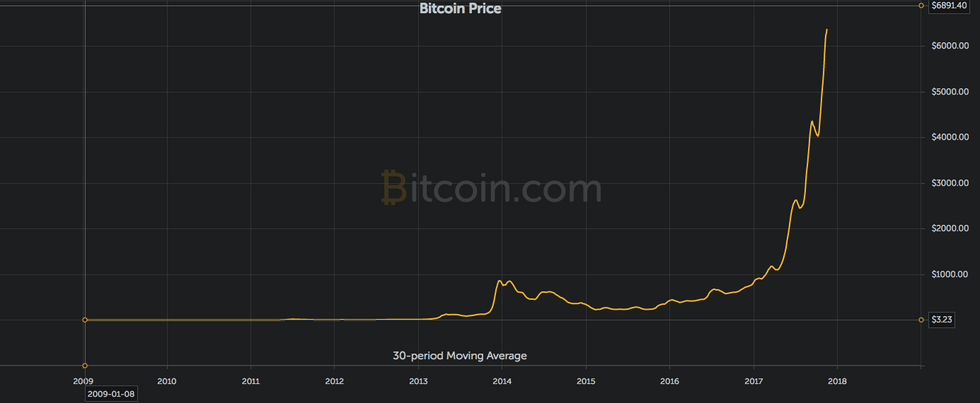

Since Bitcoin is a relatively new market that emerged in 2008, not many people know how valuable each coin is potentially worth. In May 2010, the average price of one Bitcoin was less than $0.01. In less than a decade, the average price of a Bitcoin in November 2017 is an outstanding $7,853.

Now put this into perspective: if a person bought 10,000 Bitcoin in 2010 for $30, they would be able to exchange those Bitcoins for actual United States dollars backed by the Federal Government. This results in a turnout that would make them exactly $78,524,200 richer.

In retrospective, a person could only say "Yes, go Bitcoin!" but the amazing part about stocks, innovation, and technology is that it is unpredictable. Only those that were willing to make that financial leap of faith in the early part of the decade came out as winners in the game of money.

For example, Mr. Smith has made over $25,000,000 dollars by playing around with the volatility of Bitcoin. He has been so fortuitous in his investing that Forbes magazine recognized his accomplishments and taken the time out to publish a mini-autobiography on him. Take a look at the article on your own to see what you can potentially turn yourself into with a computer, faith, and a few investment dollars.