The United States for years allowed large banks and corporations to reach a status of “too big to fail” or “too big to jail.” This means that the government imposed such little regulation on banking and lending practices that these companies were able to reach a level whereupon their failure in 2008 they could blackmail the entire global economic system into bailing them out.

Big financial institutions have built their business models around cheating people and gambling other people’s money with hopes of short-term gains. Banks and other financial institutions convince the courts and the world that there are inevitable boom and bust cycles in the market, while this may be true to a certain extent, the frequency of which it happens is not inevitable. There can be safeguards in place that do limit these boom and bust cycles and move them from every 15-years to every 50-years or so.

The reason that these banks convince the courts and regulators of such is so that they can continue to operate with no regulation and continue to grow immensely rich. To put this idea of safeguards into perspective, from 1797 to 1933 the American Banking System crashed about every 15 years. In 1933 the Government placed regulations into the banking world and subsequently there were zero crashes for 50 years (Elizabeth Warren). These regulations made it so that banks could not gamble money and grow to the point of having so many assets that they could put the global market at risk.

Once the government started to slightly deregulate the banks in 1980 the market hit a crash. How did regulators answer this crash? We deregulated a little more, that led to the SNL crisis. To combat the SNL the U.S. hit the largest and most radical deregulation, repeal of the Glass-Steagall Act. Subsequently, just eight years after that the U.S. has one of the largest crashes in history. To put the history in a more tangible way, the reason banking system did not crash for 50-years was because there was an oversight, Big Brother was watching. The minute Big Brother goes into the other room, though, all hell breaks loose.

Table 1

The growth of financial institutions immediately after the repeal of regulation which led to banking systems that were large enough to blackmail the world market.

Source: Haldane, Andrew. “Thompson Reuters Data Stream.”

It does not take a genius to see that the Glass-Steagall Act was the backbone for the 50-year stable period. It was repealed because financial institutions had the money to keep congressman and pivotal politicians in their pocket. The act was not repealed for better governing or a better economy, it was repealed so that banks could grow rich with short-term gains and no regard for future America. There are a lot of bits and pieces that make up The Glass-Steagall Act but in plain English,

“The law prevented banks like JPMorgan and Bank of America from dealing with both Main Street and Wall Street. Banks either had to cater to Main Street by taking deposits and doing mortgages and small business type loans or they could cater to Wall Street by buying and selling stocks and bonds or helping big companies merge.The thinking was that the Wall Street component of banking was too risky and would put regular Americans' savings and loans at risk. The law came into being after the stock market crash of 1929 and the Depression that followed. The official name of the law was the Banking Act of 1933, but it became known as Glass-Steagall because it was championed by Senator Carter Glass, a Virginia Democrat, and Congressman Henry Steagall, an Alabama Democrat and former Treasury secretary.” (Long)

Immediately after the act was repealed banks realized they no longer had to operate in the interest of Main Street, they could operate to please their wallets instead, and they did. Banks from then on began using predatory lending tactics in order to cheat people and make as much money as possible. There was no oversight so they could practice subprime mortgage lending with zero backlashes for the time being. Even with the TARP bailout for the “big four” banks and the continuously suggested regulation on the size of these banks, years after 2008 they are more than 30-percent larger. What happened to “too big to fail?”

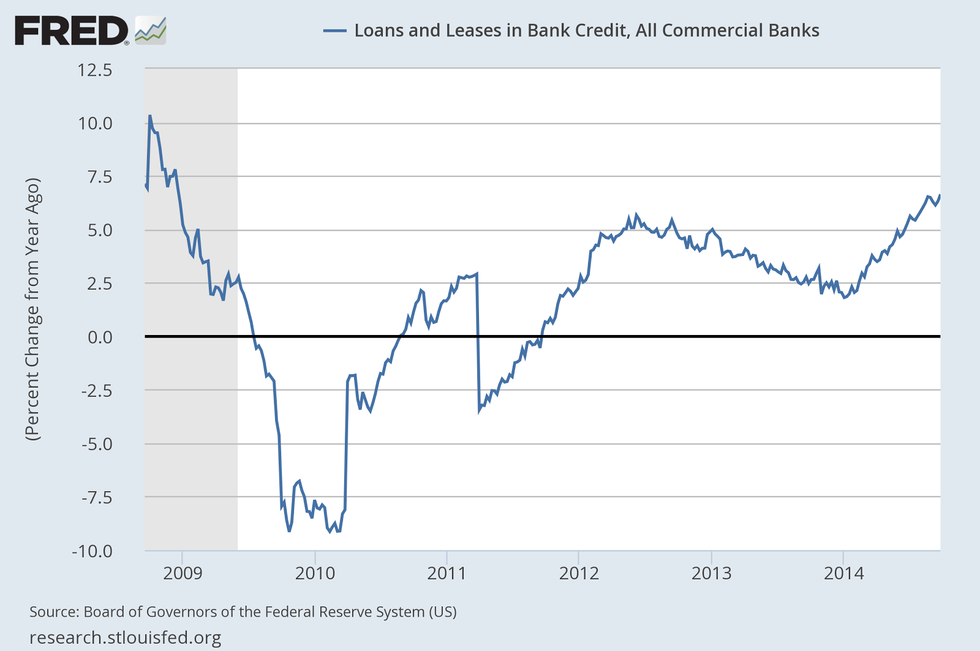

Table 2

Banks continue the same practices even after the 2008 financial crisis with little regulation.

Source: Board of Governors of the Federal Reserve System (US)

The only solution to avoiding the upcoming repeat of 2008 is very strict regulation on the financial institutions that now have arguably more power than the U.S. Government. Given the increase in the size of the banks, it is certain that when unregulated practices lead to another market bust, it will be much worse and cost much more than the $700 billion dollar bailout.

The Dodd-Frank act takes over thousands of pages and is scheduled to be carried out over a period of years so that it can regulate in a fashion that is not too aggressive nor too light. It is designed to decrease risks in the U.S. financial system. The Dodd-Frank act alone has established a number of agencies tasked with overseeing various components of the act. These agencies are in place to liquidate and enforce the regulation in the financial world to keep them in scale and investing dangerously; and as Greenspan said, “If They’re too big to fail, they’re too big”(Greenspan). However the act was edited many times to the point where its initial precedents weren’t as strong as its final format, “The basic goal of the Dodd-Frank Act was to make the financial system safer and fairer than it had been in the past, to reduce the risk of financial crises and to protect the economy from the kind of devastating costs that the financial crisis imposed on all of us” (Soergel). Even with the weaker intentions, it evolved to obtain, it still has carried out some positives: it has a stronger ability-to-pay requirement (This means that banks can no longer trick home buyers into mortgages that they really cannot afford) , it minimizes loopholes of the financial system and shadow banking. Although the problem in the economic system still remains and shadow banking still exists, it has been decreased.

Even with the beginning of the Dodd-Frank act, though, the banks have found loopholes to go back to business as usual. Banks sold Collateralized Debt Obligations or CDOs in the years leading up to 2008 which is essentially thousands of bad mortgages piled together and sold off with a false AAA rating. Since 2008 regulators have put regulations on banks selling CDOs but that did not stop them, they now sell Bespoke Tranche Opportunities (Yang). These are the same thing as the previous CDOs. Being that banks are now 30-percent larger and playing by the same set of rules, this is very bad. In short, the Dodd-Frank has good intentions, however, it will not work. The act has already become far too watered down and hardly imposes regulation.

Given the very clear dilemma the economy faces with the large fraudulent financial institutions there is only one solution: very strong regulation. The banks cannot operate with zero oversight any longer and as long as they stay as large as they are they will continue to destroy any regulations with their countless politicians who work for them. The solution to this dilemma is to reinstate the Glass-Steagall Act and break up the large banks. With the reinstatement of the Glass-Steagall Act the U.S. economy can begin to head in the direction of the stable period it was once in and inflation and housing bubbles will not appear as frequently. However, the only way that the Glass-Steagall act can be put back into place is if the banks and financial institutions are broken up. These monstrous institutions have spent millions in ensuring that their private interests are protected and their corrupt fashions can carry on.

The businessmen would tell you that there is nothing to be done about the 15-year boom and bust cycles of the economy but history tells us a different story. With heavy regulation there was a 50-year stable period. But every time the government has taken away regulation, it has lead the economy directly into a bust cycle. Greed overrides everything in this economy, with corrupt politicians to blame, allowing it to happen. The way to solve these cyclic economic periods of slowdown is to put a choke-chain on the big banks.