Auto insurance was recently described to me by my dad as a “necessary evil.” Everyone has to have it to drive their car, and everyone needs a car to get around or to work here in Michigan. It sucks to pay hundreds each month, but it’s the law.

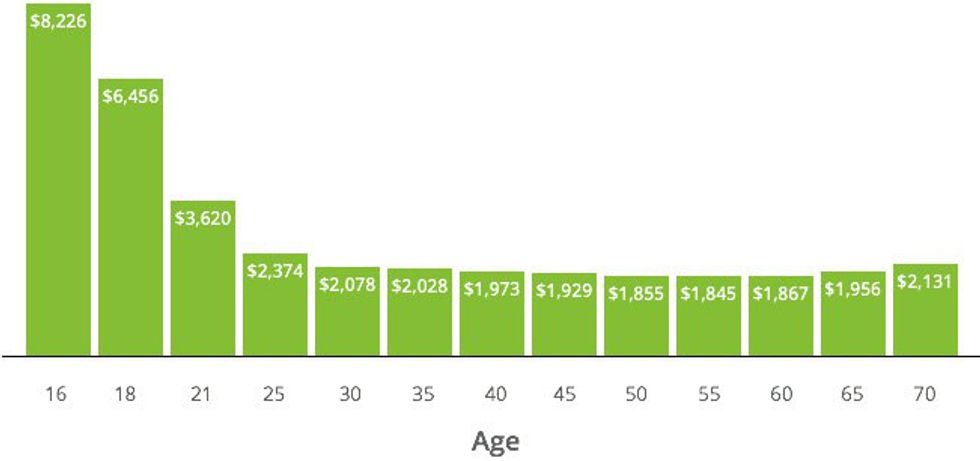

What makes car insurance so “necessary?” What benefits does it bring? It seems to cost so much more than it’s worth. Michigan drivers pay $213 a month on average, totaling $2,551 a year. That could buy you a used car, pay your rent for three months or your groceries for nine. The amount you pay can be dependent on frequency of claims in your area, your credit, the type of car you drive, and others factors. For instance, if you live in Detroit or the immediate metro area like me, annual costs can reach $5,109. If you’re a young driver, say 16, the national average for your insurance stretches to $8,226 a year. That’s almost an entire semester of college or a down payment on a house!

These numbers are pretty intimidating. It’s also said that Michigan has some of the worst rates in the country, and if we take a look at what you’re actually putting your money toward, it’s easy to see why. The way it works is fairly simple; Michigan requires that everyone have no fault insurance, which provides three different coverages:

--medical expenses, payment of lost wages due to injury, and replacement services

--payment for damage your car does to someone’s property, not including their car (unless properly parked)

--payment in case you are sued

Collision coverage isn’t even required. This means what you legally pay in at minimum doesn’t even cover the cars in the car accident, which is exactly what you’d expect to be doing here. You have to pay extra for that.

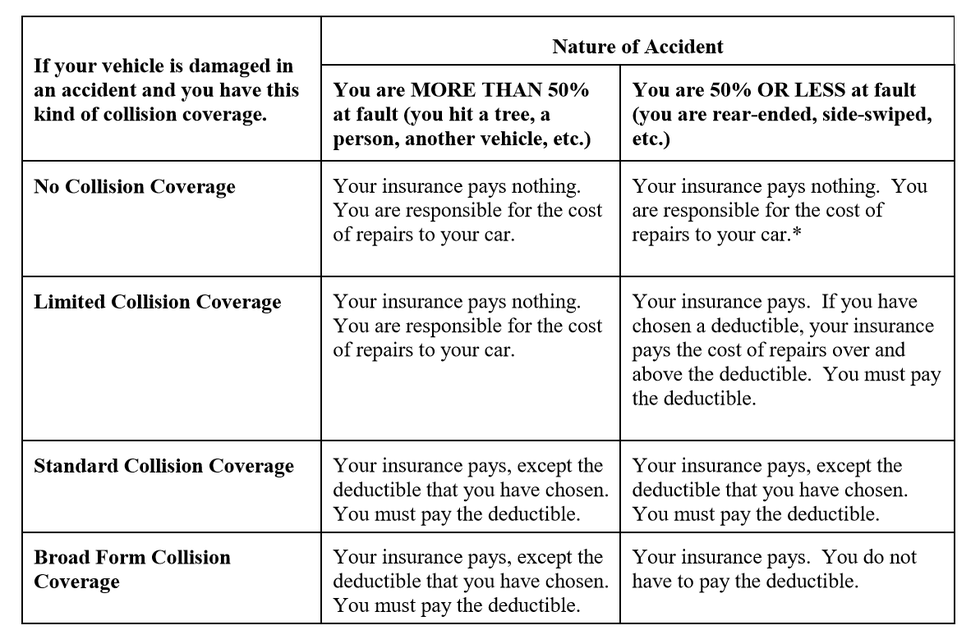

If you decide to protect your actual car, you have three types of collision coverage to choose from: Limited, Standard, and Broad Form. That chart below outlines the type of coverage you’ll get with each.

The only instance in which you don’t have to pay a fee (in addition to the thousands paid each year) is when you have the Broad Form coverage AND it’s not your fault. Otherwise, you’re charged $50-$250 as a deductible and you’ll most likely see a bump in your rates for using the service you’ve been paying for in advance (makes sense right?). In fact, drivers who make a claim of $2,000 or more will see a 44 percent increase in their premium. So if you pay $300 a month, after an accident you’d pay about $432.

There are tons of loopholes insurance agencies legally practice in order to line their pockets with your cash. If I total my vehicle, my insurance company (if I have full coverage) will replace it. However, they calculate the amount of money to give me by the depreciated value of my car, not by how much it would cost to rebuy the same make and model. Therefore I will not have enough money to buy the same car, although they advertise this deal as a replacement. They can also enforce policies like settlement caps or policy limits. Let’s say the cap is $20,000. Even if you’ve been paying $4,000 each year for eight years without an accident, totaling $32,000, and your confirmed damages equal out to be $30,000, the company will still only provide you with the $20,000 cap. If you want the other $10,000, you’ll have to sue the other driver involved to get it. Even without a cap, some companies can deny you full claim amounts if they don’t feel the damages warrant that much money or believe you made a false claim.

So we pay in every month, we pay extra for what should be the basic minimum coverage, and we pay more for using the service we paid for already. What do we get in return? I guess you could say we earn the privilege of being able to drive, although without extensive public transportation it’s less of an option to have a vehicle or not. Coverage is a nice safety net, but although we pay thousands each year we will only get a fraction of that back. I haven’t gotten into an accident in three years; all that was paid in that time was for nothing. And even if I were to get into a wreck, I may not even report it for fear of raising my rates.

I don’t know about you guys, but the more I research auto insurance, the more it sounds like someone charging me extensively for a service they are not fully required to provide. I may never use it, but I’m legally required to have it by the state.

Think of if I just put $300 into a jar in my bedroom each month instead. I could pay for any repairs, crashes, or car troubles on my own without asking permission from a company looking to turn a profit off my “just in case” mentality. And If I don’t get into an accident, it’s still my money to keep for the future.

Auto insurance was created to make sure disputes after car accidents could be settled fairly between the two drivers. I agree this is a problem that needed a solution, but a government mandated cost to drivers functioning through private corporate companies is NOT the answer. How are we not creative enough to have come up with a better solution since the one we thought of in 1897? Or are we just blinded by insurance lobbyists fighting to prevent a change or improvement in our current process? I can personally come up with three malleable and totally possible alternatives right now:

-Create government mandated bank accounts which collect a percentage of parents’ taxes when they have a child; by the time the child is of age to drive they could have $10,000 (or whatever minimum amount) to use in case they get into an accident. When it is used, the driver’s taxes would replenish it. When you’re elderly and unable to drive (or other qualifying circumstances), you could get your money back as a return.

-We could just not have insurance. When I buy a laptop or a new pair of shoes I don’t have to get coverage for them. When I take them out of my house I run the risk of them breaking or getting ruined, but I still do it. If the difference is in the danger, I can point to that we can all have health insurance instead. Why are cars treated differently than our other material possessions?

-Car repair could be a public service, sort of like firemen or police officers. Just like when police come to de-escalate a situation then make a court appointment to settle it legally at a later point, these government workers could show up to the crash to tow your car and make an appointment to repair it for you later. Of course it would be a service funded by taxpayers like the others.

Maybe these alternatives aren’t perfect, but they’re surely better than the atrocious system we’ve got going on currently. We have to throw our earnings away to private companies who pocket our money and give us half-empty services. If I’m going to pay too much for something, at least let the overflow of money go into my government who might actually use the profits for something else that will help me, not buy a new pool for John Doe at the office. Or let me keep my own money, and use it as disposable income to further the economy. Anything but what we’ve got now. What d’you say?