Okay, maybe millennials aren't that bad at saving money. We're even saving more than any generation before us. With student loans, credit cards, and just having fun, money gets tight. Low wages, little work experience, and very little time contributes to your lack of money. That's why I exist. I tried – and sometimes failed miserably– to save money using these apps. The ones mentioned have ultimately saved my social life (and credit score) by helping me save more than I ever could alone. All of the apps are available for free on android and iPhone.

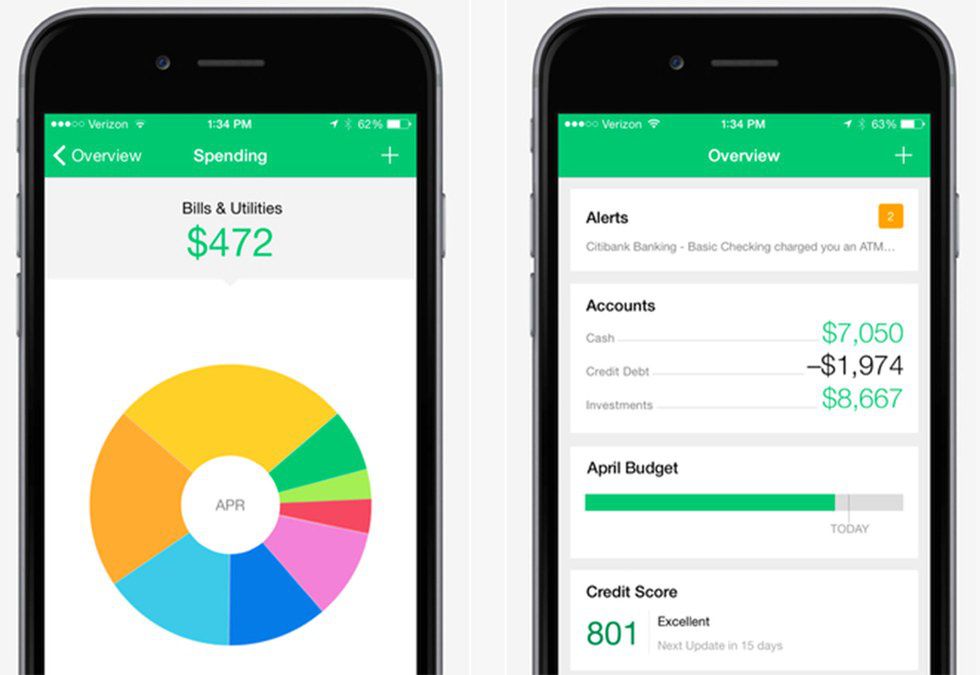

1. Mint

Mint first connects with your bank account or credit card. Don't worry, it's legit. Just choose your bank, enter your info, done. Mint can even link with your loan providers to track your crippling student debt. After you put in your information, Mint can notify you when a bill is due, tell you how much you owe, and even how much money is in your bank account. This helps you avoid late fees and overdraft charges.

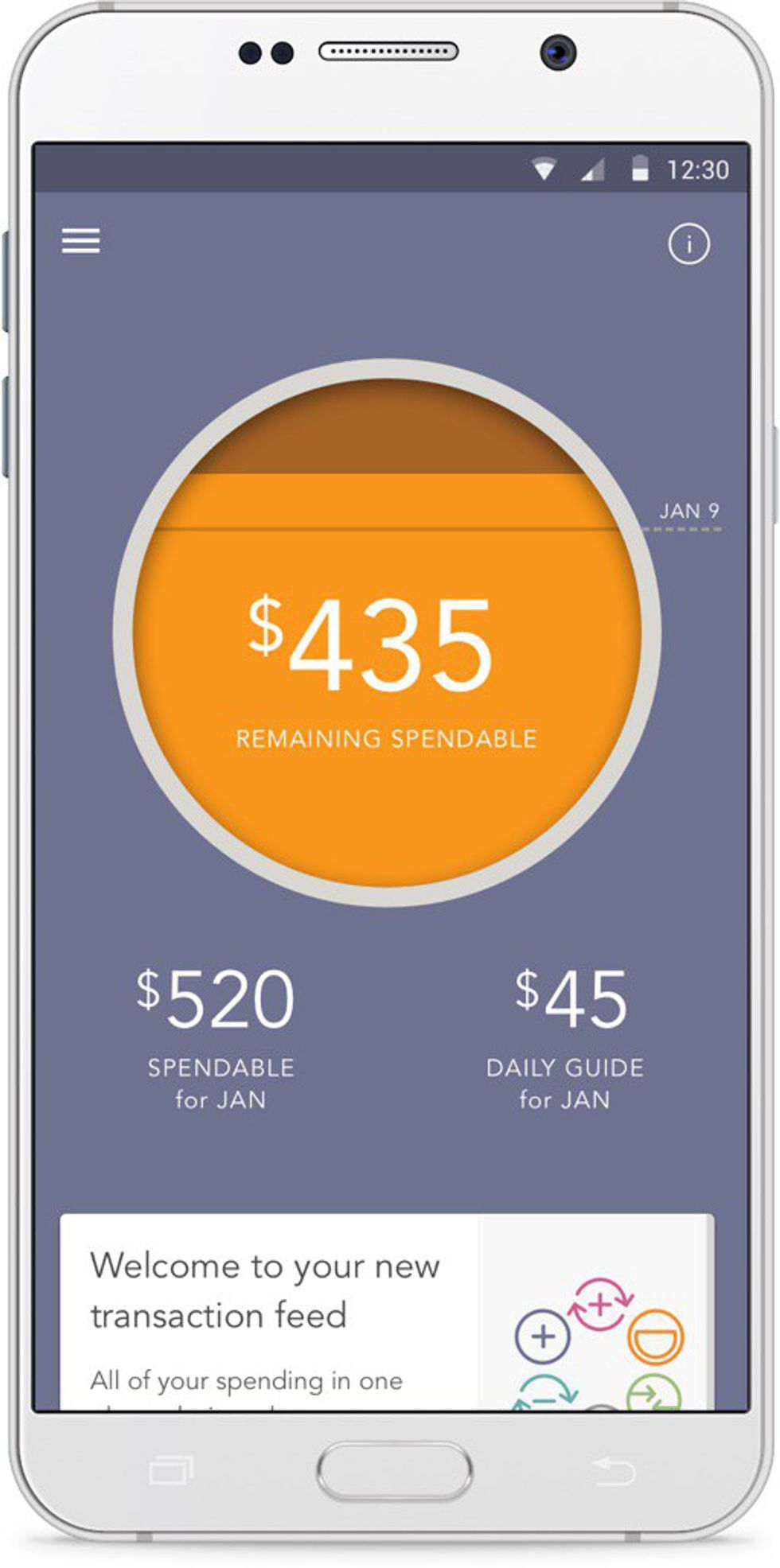

2. Level Money

Level Money is powered by Capital One, so I was surprised it's free to use. Just enter username and password for your primary checking account (or credit card, since you probably use that more). After you put in your banking information, just input your income, monthly bills, and how much you plan to save each month. The app does the hard work for you and gives you a daily spending amount based on your financial stability. Mine is usually $0.57, but that's not the apps fault. This app is handy for people trying to maintain a budget, so everyone. Although, it does help to have a steady monthly income.

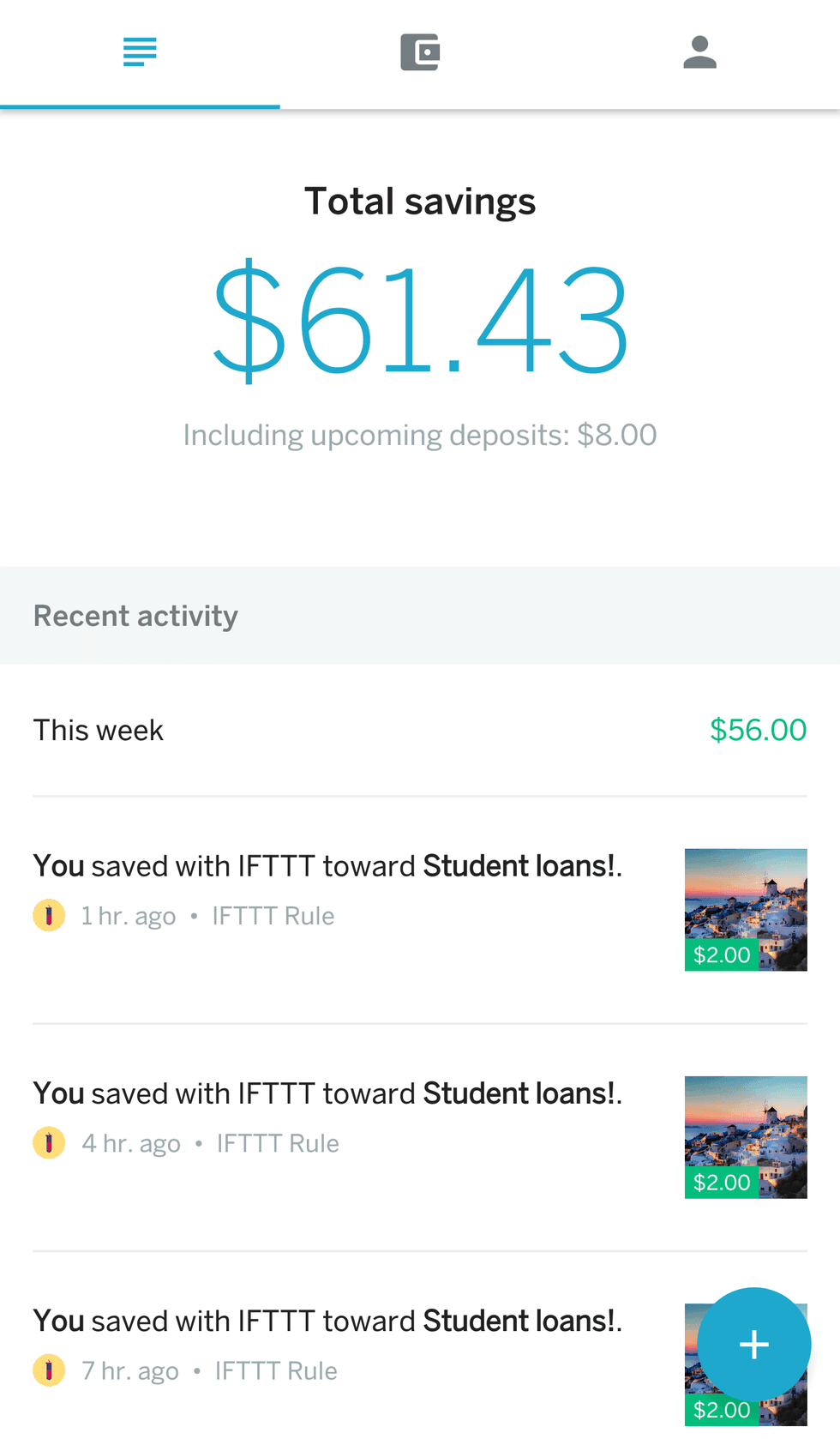

3. Qapital

This one is my favorite. I use it daily without doing *anything. You link your bank account to the app and customize how much you would like to save. They have remade rules, like round up (Every time you swipe your card, it rounds up and adds the difference to your Qapital account) or Spend less. Spend less is the sweetest, it lets you pick a store (mine is starbucks), and an amount of money ($15). Since I typically spend $15 at starbucks a week, if I avoid the coffee mogul like I avoid my ex, Qapital deposits what the difference in my savings account. The best feature of this app is the customization. You can set virtually any rule you want. One crazy saving rule i have is every time I post on Facebook, $3 is withdrawn from my checking account. Capital isn't going to overdraft from you either. It is very easy to set goals and reach them. You can withdraw your money from the app at any time. This is the best, seriously. Get it.

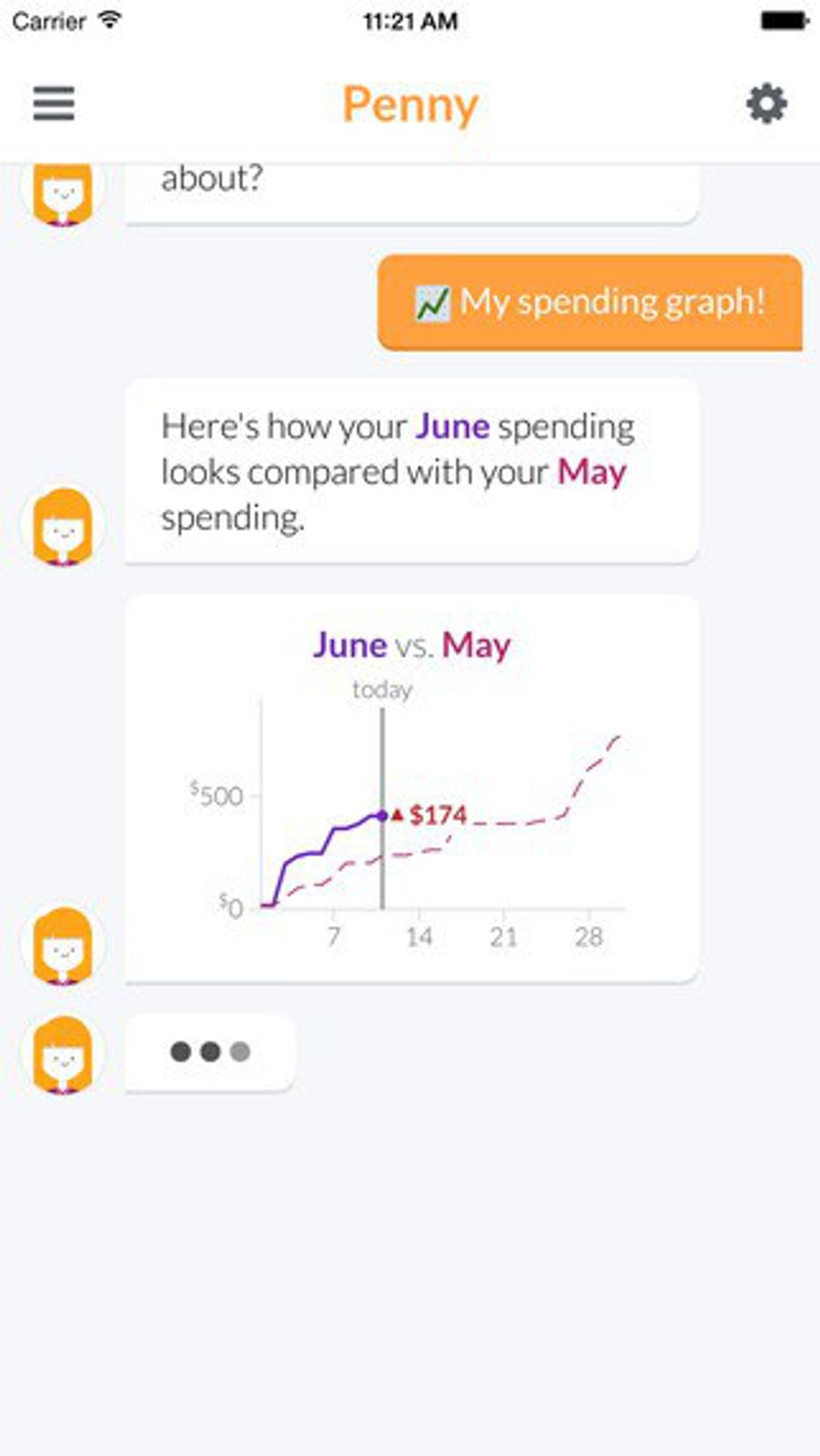

4. Penny

This app is cool as hell. This chick talks to you about your spending habits. It's like your mum texting you about your balance, but you don't have to feel guilty. She alerts you when your bills are due, when your paycheck comes in, tracks your monthly spending habits, and even gives your personalized advice on how to better save (ya' know, totally not for that nice bottle of Tequila you've been wanting). This app is great for someone wanting to keep track of their spending habits.

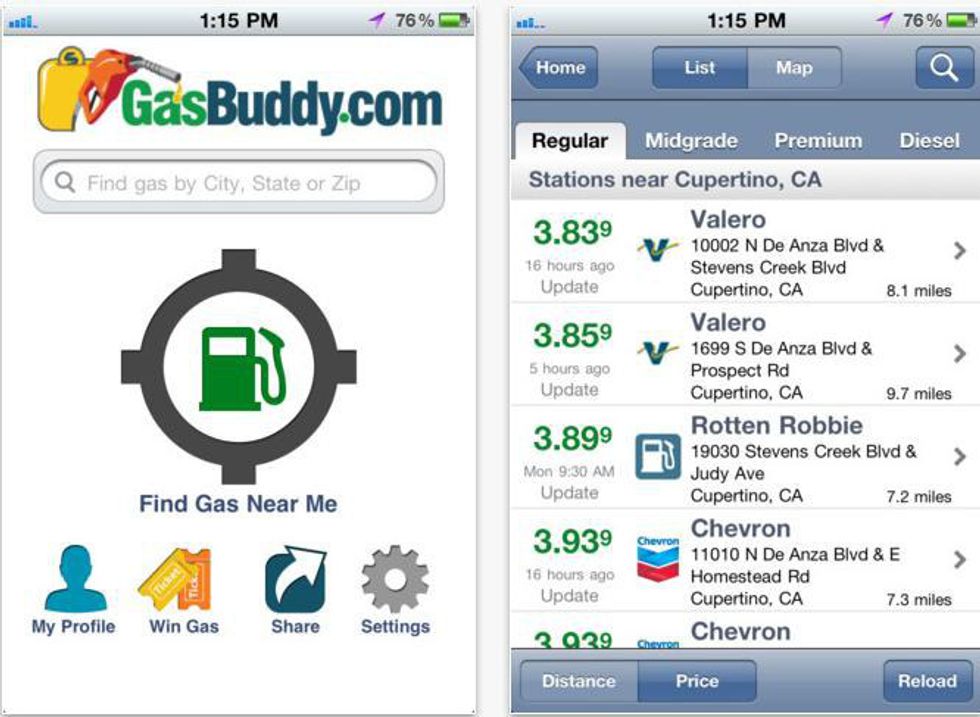

5. GasBuddy

We've all heard of this magical app. Download it. Now. Even if you don't drive, you know someone who does. Send the link to your friends, they'll thank you. This app helps you find the cheapest gas prices around. Just have your location on, tap the large middle button, and drive. You're welcome.

6. Circle Pay

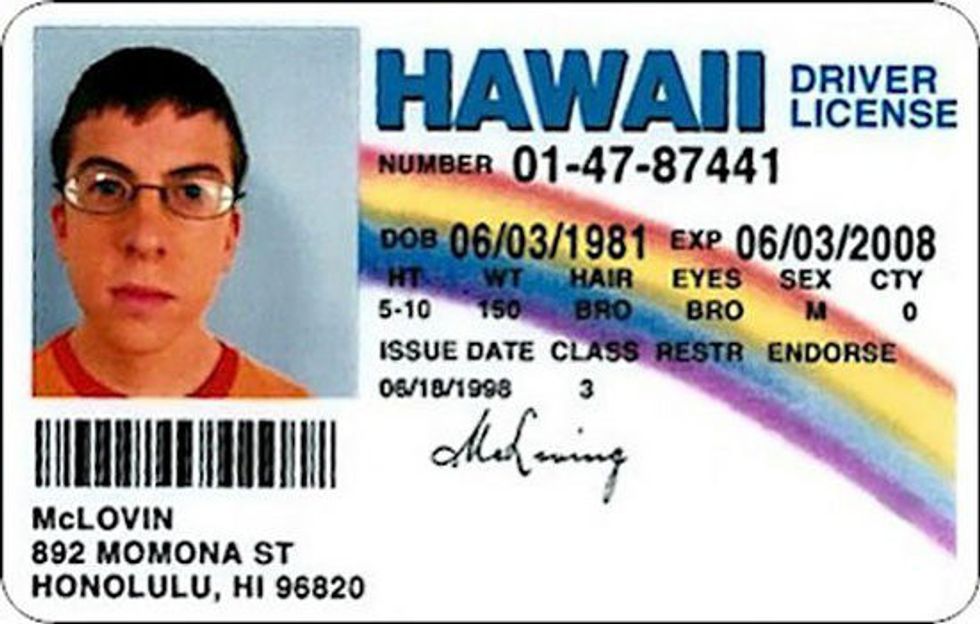

Circle pay is the oddball. This app won't necessarily save you money. But we all know that annoying friend that asks you to buy them food because they forgot their wallet, which is fine the first *few times. After a while, you both end up broke. Here comes circle pay! Circle pay is like PayPal, but more functional. You instantly send monies and even text with it. It's also a handy way to convert USD into Bitcoin, so you can get that fake you've been saving diligently for.

Saving is a necessary evil, you don't have to do it alone.