Alright. So, the other day I finally sat down with my mommy (aka accountability partner for life) and went over my monthly budget. I know, yikes. I had been putting it off for months because, well, let's face it - nobody wants to sit down and stare at a piece of paper that tells you just how broke you are and how many bills you have to pay with all the money you don't have. BUT. It had to be done. I've decided that all the stress and sleepless nights I have been causing myself, hoping and praying that I make my payment deadlines, are so not worth that cute cardigan that was 30% off or the multiple trips to the coffee shop that I make each week. I mean, I have coffee at home. Pretty sure I'm capable of making myself a cup of coffee, am I not? And I'm not exactly lacking in the wardrobe locale either. After all, once I have that degree, and that degree gets me a career, then I can go shopping for the latest and greatest fashion finds and not have to worry about whether or not I'm also sacrificing my dinner in the process.

Now, after my mom and I finished going through my finances, I was surprised to find that it actually wasn't as bad as I thought it would be. Which is exactly what she told me - shocker - cause every one of us knows mom is always right. I still don't have much of an income, but I definitely have what I need - this just means sacrificing some of my "wants." And since I finally got the nerve to sit down and face my fears, I thought I would share with you guys some of the tips I found helpful for getting my money under control. Here goes...

#1. Stop using credit cards!

Seriously, these have been my absolute worst enemies. I used to tell myself I would NEVER get into debt and I didn't understand why people couldn't just exercise a little self control - ironic, right? I'm telling you right now, though - whatever you're wanting right now that you just cannot wait for is so not worth the debt it will cost you later. Because it will become a habit, trust me. I've never met a person who managed to just spend $50 on their credit card and that was it for them...just sayin'. I'm sure there's someone out there who's done it, but I still think it's best not to get yourself started. And if you've already started (like me), now is the time for both of us to get a grip and break the habit. So hard, but so worth it.

#2. Sit down and look at EVERYTHING

I know it sounds intimidating, but I can almost guarantee it really won't be as bad as you think. Grab a sheet of paper and your calculator and look at literally everything. I mean it. Income, bills, how much you need for food, clothing, toiletries, credit card payments, pet needs - EVERYTHING. Putting a budget together is so ridiculously easy these days with all the resources we have available all over the internet. Just look around, we really have no excuse.

#3. Limit yourself to needs first

I'm sure you're thinking it's gonna be a pretty dull life from now on, but you'd be surprised to find what you end up with once you organize everything. But first, figure out all the things you absolutely need right now. Then, if you have some extra, you can add in a few of those wants. Try to set aside at least a small amount for savings too - it's always a good idea to have something to fall back on when life throws those unexpected twists your way.

#4. Try out the "envelope system"

My parents and I decided to follow the Financial Peace University program by Dave Ramsey and it is BRILLIANT, I tell you. There are so many great tips and valuable lessons to gain from it and one of the things he suggests is using the "envelope system". This is seriously one of the best ways to keep yourself financially accountable. You label each envelope for different purposes (i.e. restaurant money, clothes, makeup, etc.) and put a set amount of cash in each week to take out when needed. That way, you don't just hand your card over each time you pay and just end up wondering what happened to all your money at the end of the month. Give it a shot, you won't regret it. It's such an simple change to make but it makes all the difference.

#5. Stick to it!!!

I don't think I really need to say much else for this one. It's that simple - stick to your budget. I am the queen of figuring out a plan and pretending to be organized then throwing that plan out the window as soon as I lose motivation. We can't do that anymore, you and I. We've got to stop giving ourselves the option of going back, just draw the line, and refuse to cross it.

Now, once again, this is all coming from a broke college student who is, herself, trying to get her act together. I am, absolutely, the last person in the world who should be giving advice on financial discipline, but I wanted to share what has worked for me, at least, and boost anyone else who may be struggling - we're in the same boat! That being said, I heartily welcome any other tips and tricks anyone has to offer in regards to handling our funds more responsibly. Feel free to comment with your ideas, success stories, encouragement, or whatever! Good luck, now - WE CAN DO THIS!

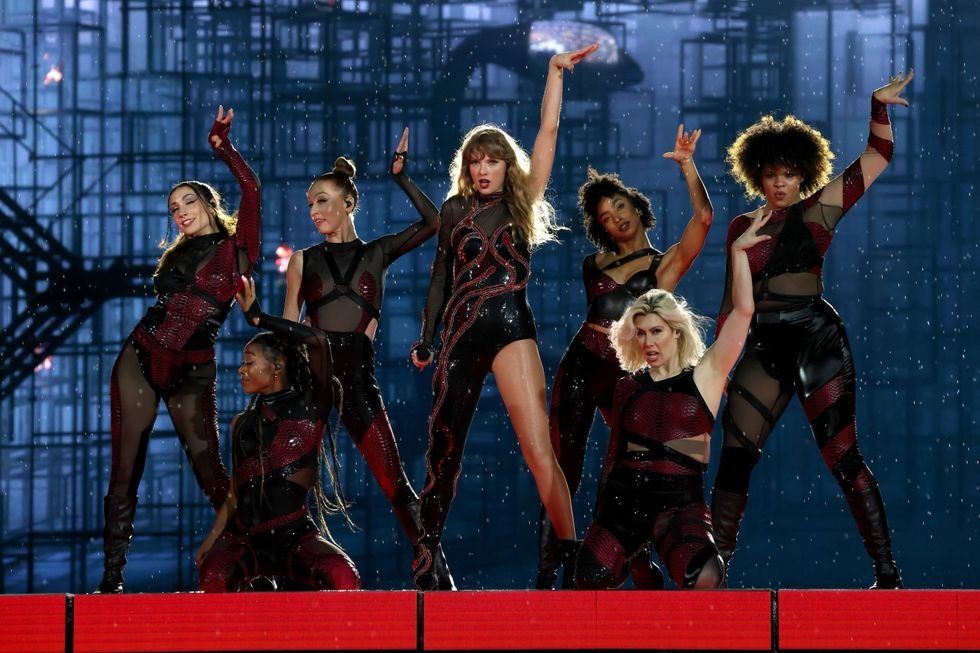

Energetic dance performance under the spotlight.

Energetic dance performance under the spotlight. Taylor Swift in a purple coat, captivating the crowd on stage.

Taylor Swift in a purple coat, captivating the crowd on stage. Taylor Swift shines on stage in a sparkling outfit and boots.

Taylor Swift shines on stage in a sparkling outfit and boots. Taylor Swift and Phoebe Bridgers sharing a joyful duet on stage.

Taylor Swift and Phoebe Bridgers sharing a joyful duet on stage.