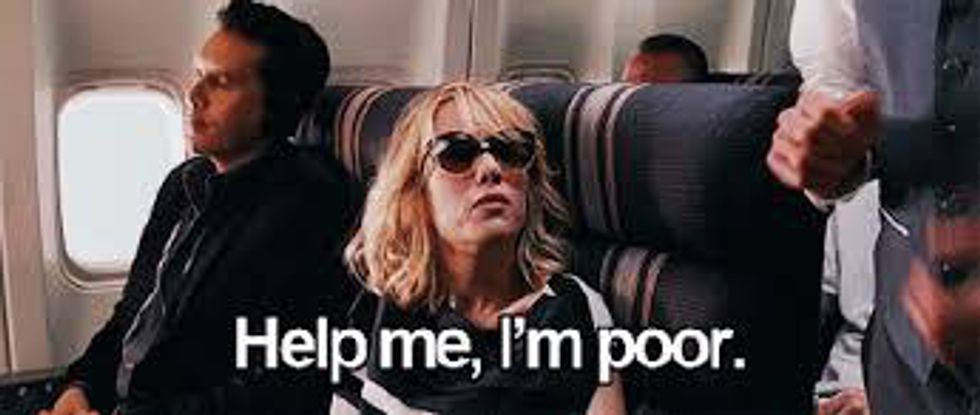

Grandma and Grandpa were living the life! Too bad that everything has changed.

1. College was actually affordable!

In 1960, the average cost per semester to attend a four year university was $1,939.

In 2008, the cost to attend a university jumped to $8,843 a semester. With this huge increase, it is easy to understand why student debt has increased over the years as well. In 2014, 69 percent of students graduated with student loan debt with an average of $28,950 per borrower.

2. Transportation cost less!

In 1960, transportation was not as necessary as it is today. However, for one of our grandparents to buy a brand new car, it would have been about $20,827.

Today, cars are almost a necessity for anyone living in a semi-rural area, especially if we want to get an education or a job to afford a new whip, which would cost one of us about $31,252.

3. New houses were cheaper!

In 1960, the price tag on an average new home would cost someone about $101,733.44

In 2013, the average cost of a new home was $289,500, which is why many students go back home after they graduate college to save up enough money to get their own place. While a house is usually a good investment, it takes a while to build up the money for a down payment. These statistics wouldn’t be as hard on us if we made more money than our grandparent’s generation. However, we make about the same.

4. While prices increased, our wages did not!

In 1964, the average hourly wage in the U.S. was around $19.18, for a typical worker.

In 2014, the average pay hardly increased to about $20.67, meaning to accommodate the rising costs of nearly everything, the average worker has to work more hours a week. This means that while we spend more time away from our families to make a living wage, we still won't make enough to pay for everything we need.

5. Annual salary is nearly the same!

In 1960, the average annual income for a household was $42,576 a year.

In 2013, the average annual income barely increased to $44,321 a year.

In today's distorted economy, there is a huge disparity between the rich and the poor. There is more competition for jobs, forcing more kids to have to go to college to have a job where they can make enough money to support a family. There is also more competition for jobs that require education, forcing many students to obtain a master's degree or Ph.D. to get a good job. Where does that leave us, the millennials, that are struggling in college right now?

These statistics are based on today's inflation rates. They are shocking, and one might wonder what has caused such high inflation. Is it a by-product of the growing consumer-focused economy, or is it a consequence of the incompetence of bureaucracy in Washington? Can these trends be reversed? Only time will tell.

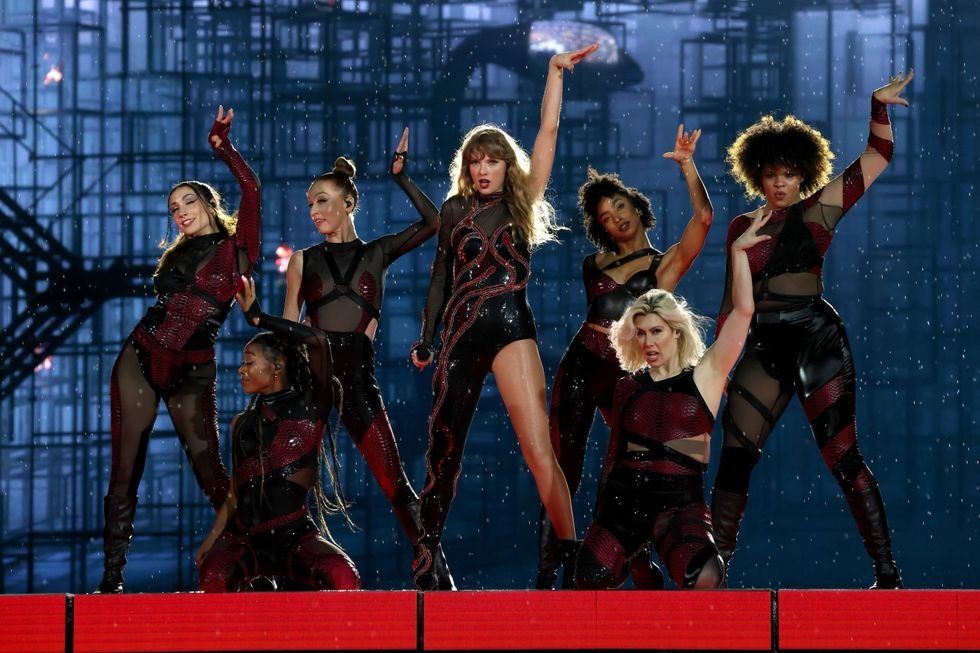

Energetic dance performance under the spotlight.

Energetic dance performance under the spotlight. Taylor Swift in a purple coat, captivating the crowd on stage.

Taylor Swift in a purple coat, captivating the crowd on stage. Taylor Swift shines on stage in a sparkling outfit and boots.

Taylor Swift shines on stage in a sparkling outfit and boots. Taylor Swift and Phoebe Bridgers sharing a joyful duet on stage.

Taylor Swift and Phoebe Bridgers sharing a joyful duet on stage.