It's probably best to assume that you’re reading this because you’re not great with money. Honestly, who is? There’s no shame in being clueless about it. Trying to understand how to be good with money is really hard. Heck, even some of the world’s biggest billionaires aren’t good with it. And all of them have enough money to buy your house 500 times (probably). In any case, don’t feel too bad about it. The best thing that you can do is try to improve your skills so you don’t cringe every time you think about opening your banking app! Here are some small, but super effective ways to do just that:

Curb your enthusiasm (when it comes to impulse buys)

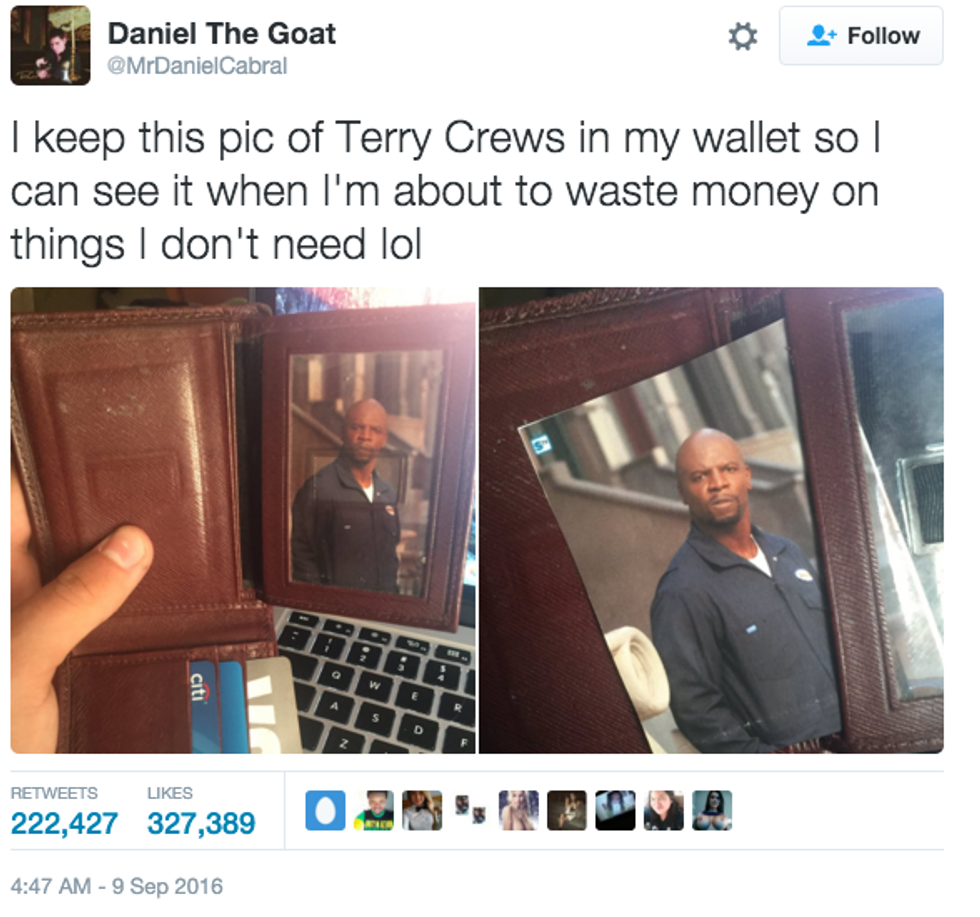

Ever heard that phrase, “It’s the little things that count?" - That’s definitely true when it comes to money. Most of the time, it’s the little purchases that build up and are the cause of all the pain and agony when you think about money. And those “small” purchases? I guarantee you that at least 90% of those were food, drinks, snacks or impulse buys that you made. It’s always so tempting to walk into a store for the sake of getting something to “treat yo self." You’ve probably thought to yourself, “It’s not a big deal, it’s only $3 bucks!” But let’s face the facts: you can’t always “treat yo self.” What are you gonna do if there’s no more money to treat yourself with? If this happens every day in a year, you’re really spending $1,095 on money you could be using for things that are cooler and way more important (ex. A plane ticket to somewhere exotic, an entire vacation, tuition [not very cool, but super important], etc.). Instead of spending so much on those little things, do little things that will save you a lot in the long run. For example, start making lunch or coffee at home. Avoid going to places like coffee shops or bookstores to study. Don’t go to any stores unless you know you need something. Small things like that will save you a lot of time, money, and most importantly, pain.

Make a list of things you’d rather be saving for

We all have a bunch of dreams and goals that we’d like to achieve. Unfortunately, a lot of those dreams have a literal price tag on them. The best that you can is to turn them into your goals and motivation for not spending excess money. For a lot of people, those goals could be traveling the world, going to grad school, moving to a new part of the country, and more. Think about it this way: without money, some of those dreams can’t exist. It’s a harsh reality, but the world truly runs on the fact that having more money equates to more possibilities in the future. It’s definitely a lot of hard work to be cautious with money since it’s really hard to come by when you’re in college. Thankfully, it isn’t impossible.

Create a monthly budget

You have money for a reason: to spend it on things you need. You can’t be unreasonable and say that you’ll never spend money on anything ever again. What’s the point of working for it? Instead of completely restricting yourself, try your hardest to make a budget that fits your needs. If you make a regular income, take a look at how much you make on a monthly and weekly basis (or however often you get your paycheck). If not, look at how much money you currently have and try to stretch it for a month. On a sheet of paper, make three columns. One column is designated for needs, one for wants, and the last for your goals/things you want to save up for. In each column, list down the things that fit those categories (ex. Groceries/food go under the “needs” column, coffee go under the “wants” column, a trip to Australia under the “goals” column). Give each of those categories a set number for the whole month (ex. Groceries - $250, gas - $150, etc.). Whatever you have leftover, put it in a savings account or designate that money for unpredictable things that could come up in your life. By having a set of numbers that you can restrict yourself to, it makes controlling your spending habits insanely easy to follow.

If all else fails, just do this: