If you are a young adult like me, then you are probably entering the "real world" for the first time and, like me, you might be worried about finances. College-aged people are usually at a time in their life when they have their first real source of income and their first bills and loans to pay off. Additionally, young adults are great at unknowingly blowing through their money on things such as food and going out. In this article, I will show you a few (mostly free!) online tools that can help show you how to create a simple budget that will allow you to take control of your finances and be better aware of your spending habits.

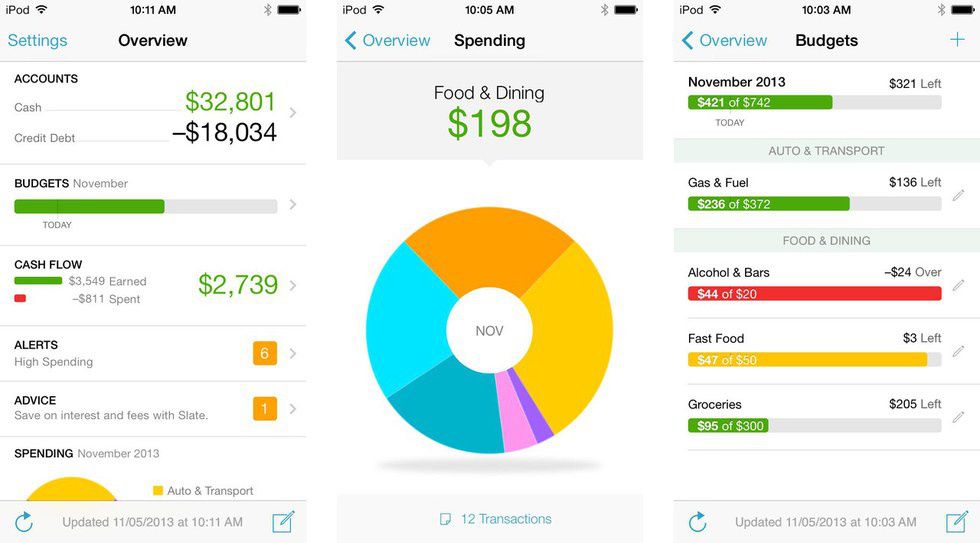

1. Mint.com : The Mint.com app is super easy to use. Just put in your bank account information and the program sorts everything for you and creates a budget for you based on your monthly spending. You can change your budget if you want. The app is simple to understand yet complex enough that you can see everything you need to know. Personally, I really love the Mint app because I like being able to have a clear visual on where my expenses are for the month. If I used up half of my dining money for the month, it's very clear to see that the bar for "dining" will be halfway full. The app also gives you a warning when you are about to go over your budget in a certain area. Mint is extremely secure and the most-used finance app. However, if you don't like the idea of linking your bank account to something, check out the next tool.

Image source:http://www.iclarified.com/38692/mint-personal-fina...

2. Wally (App) : Wally is a similar app to Mint, but you don't have to connect to a bank account; you upload the transactions yourself. Wally has more mixed reviews than Mint, but it's still free, and worth a try.

Image source: http://indianexpress.com/article/technology/tech-r...

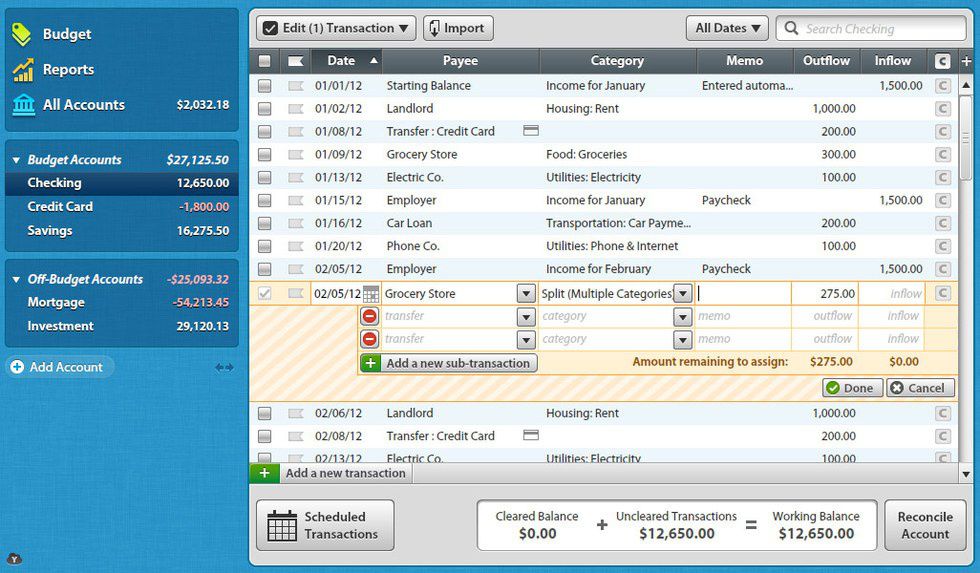

3. YouNeedABudget.com : YNAB is a budgeting software for your computer that allows you to connect to your bank account, or enter your transactions manually. It is very thorough, and more in-depth than the other tools I've mentioned. Best of all, it's free for college students, and $5 monthly for everyone else. You can also try YNAB for 34 for free. Not a bad deal for for such a powerful tool.

Image source: http://classic.youneedabudget.com/features

4. Tools available through banks: Many banks are now offering free online tools to help their users with budgeting. Regions has "My Green Insights" which allow you to set up a budget, and to set up "goals," such as saving for a vacation, wedding, or first house. Bank of America similarly offers "My Portfolio." In my opinion, using these kinds of tools is the easiest and most hassle-free of all the options I have mentioned, since your bank account information will already be connected to the budgeting tools. Check out the free, useful online tools and resources that your bank may offer and get started being smart with your money.