College: a time period where even if you’re working a part time or full time job, you’re still in student debt, paying above-average amounts of money in rent (even with roommates) and unable to look at your bank account out of fear that it’s below $0. But one thing that you can do is eat a decent, well-balanced meal by making minimal adjustments to your college lifestyle, maintaining a routine and following these 11 tips:

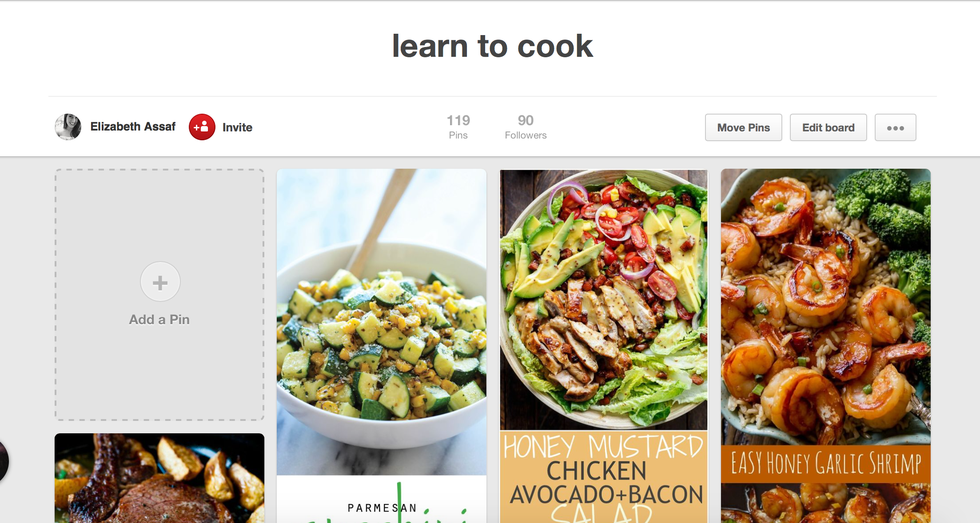

1. Utilize websites like Pinterest or Yummly.

As a college student, you’re more than likely unable to come up with meal ideas or recipes off the top of your head; but by doing a few quick searches such as “easy dinners” or “quick meals” on sites like Pinterest or Yummly, you’ll find someone else has already done it for you. These sites also allow you to track the recipes you’re interested in either eating or making yourself, as well as provide the ability to save and share the ones you like.

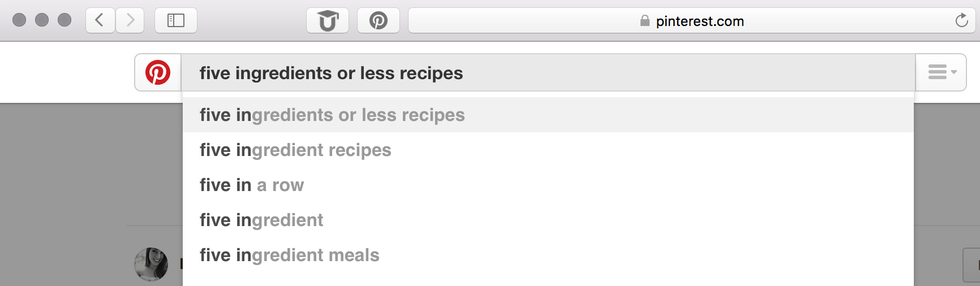

2. Search for recipes with minimal ingredients.

In the world of cooking, the phrase “five ingredients or less” is a common and acceptable recipe type; and as you would guess, these recipes call for exactly what you’d expect: five ingredients or less. By leveraging recipes with minimal ingredients, you’ll save yourself time, energy and most importantly, money.

3. Build a library of spices, ingredients, etc.

I won’t lie and tell you that food is cheap: it’s not. But one way to make it more affordable is to little by little add spices and ingredients to your collection. These small additions, such as garlic powder, cornstarch and brown sugar, will save you money each time you’re at the grocery store because you know you already have them.

4. Use the ingredients that you already have.

Did you buy a five-pound bag of rice last week? Great, grab some fresh veggies and make stir fry. By using what you already have, you’ll not only save money but you’ll also waste less food.

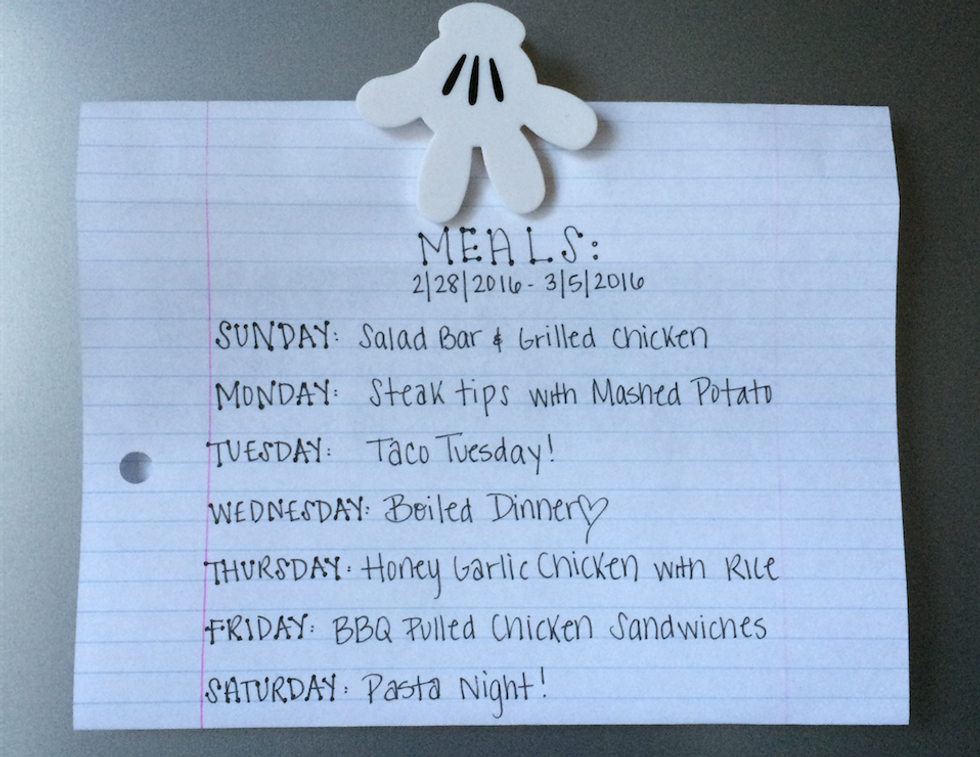

5. Plan your meals once a week and make a list!

6. Get into a habit of shopping once a week.

Instead of running to the grocery store every time you’re low on something, make a routine out of shopping for your food. If you’ve followed Tips 1-5, you most likely already have a plan as to what you’ll be eating for the week and what ingredients you’ll need. Make a list, check it twice and get going!

7. Compare the prices of fruits and vegetables to that of junk food.

The average price of potato chips? $4.51 per 16 oz. as of June 2013. The average price of actual potatoes? $0.65 per pound.

8. Utilize less expensive ingredients in your meal choices.

9. If you can, buy in bulk and freeze meat when it's on sale.

This relates back to Tip #4: you already have the meat, just take it out of the freezer and defrost it. Just remember to package the excess meat in a freezer-safe bag and mark the date on the outside.

10. If you have roommates, ask if they’d like to make it a team effort (Split the cost!)

11. If you’re financially responsible, find a credit card that gives rewards for groceries.

If you’re interested in building your credit while embarking on this cost-saving, grocery tip adventure, find a credit card that gives rewards specifically for groceries. You’ll earn something back for the money you’re already spending. But remember: always pay it off in the full. Who wants to pay interest on fruits and veggies?